Milan Cacic

July 21, 2023

Financial literacy Social media Economy Weekly update Weekly commentarySHOULD WE BE BUYING OIL STOCKS?

Over the last few weeks we've had lots of questions regarding the price of oil and oil stocks. The most common question is “Should we be buying oil stocks?”. The simple answer is: oil companies are very cheap, however, there is still a lot of negative sentiment around oil and gas and these companies will not go up unless the oil price goes up.

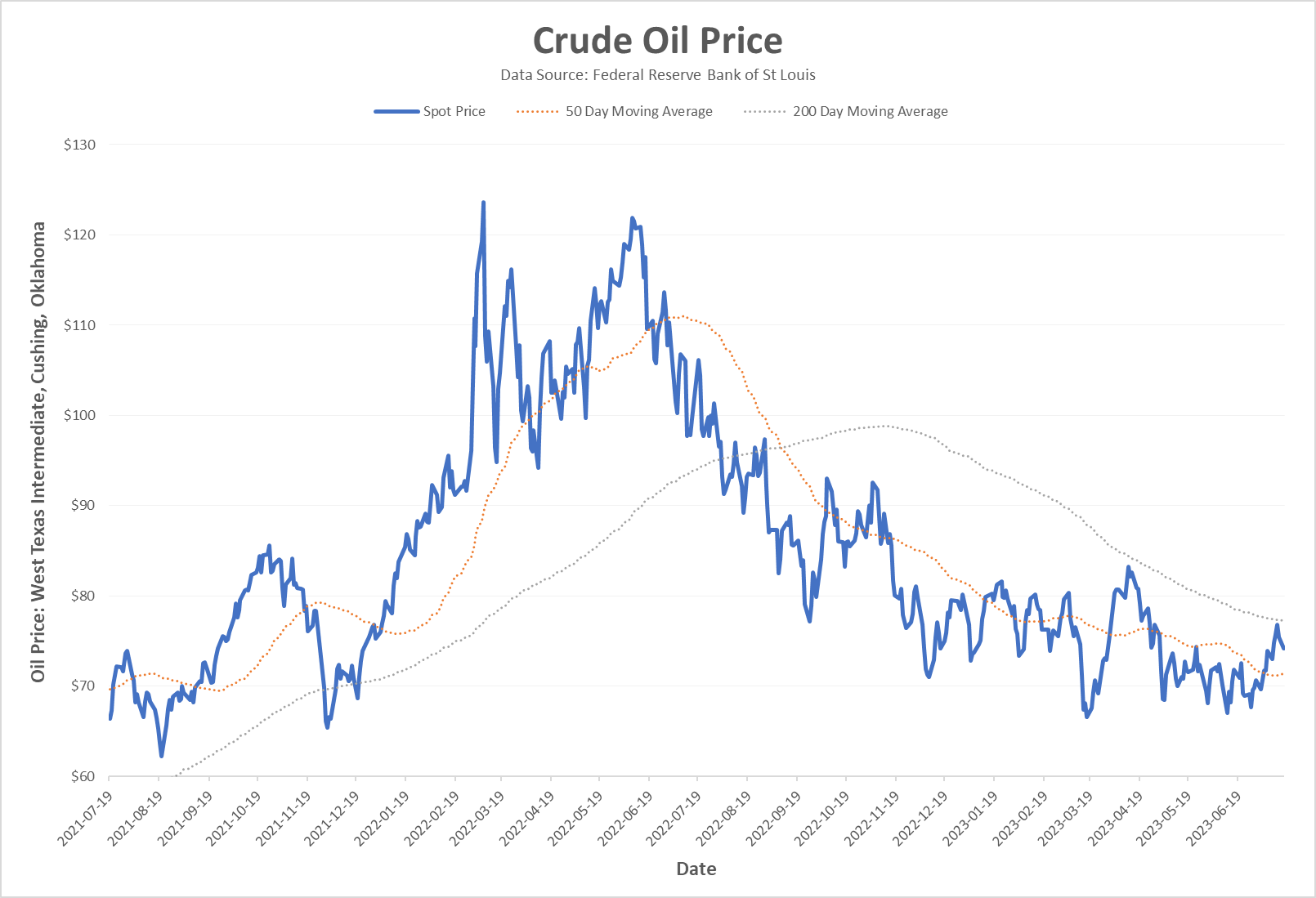

As you can see from the chart below, the price of oil has been trending downward for the last 12 months. Obviously, if this trend continues, there is not much value in buying oil companies. We should also note that over the last few weeks, the price of oil has broken through its 50-day moving average [$72.62] and is now approaching its 200-day moving average [$77.06]. Technically speaking, if oil breaks above its 200-day moving average and holds, oil may be off to the races!

Newton's first law

Newton stated "an object in motion will stay in motion until acted upon". We believe Newton's first law applies to both stocks and commodities. The oil price has been trending down for a year and will continue to trend down until something significant acts upon it to make it move in a different direction. Below are some factors that may change oil’s trajectory:

- Global gasoline and diesel demand is now above its 2019 level.

- Passenger jet fuel is up 1.3 million barrels per day year-over-year.

- The United States is done selling their strategic petroleum reserves and inventories are at 40 year lows.

- World oil consumption is now back above 2019 levels.

- China's is in an economic slump and world consumption levels are at record highs. What happens when China starts firing on all cylinders again?

All of these fundamental reasons could trigger traders to start buying oil again. I think it's also important to point out that the United States drained 290 million barrels of oil from their strategic reserves. At first, this was done to offset the decline in Russian sales from the sanctions, however, Russian oil sales never declined. Now we have drained oil inventories to the lowest level in 40 years and Russian production is starting to decline because it hasn't been spending on oil and gas development. Maybe this will be big enough to change the trend in oil prices.

For those that like to use history, the chart below speaks for itself. Commodities compared with the Dow Jones industrial average are at the cheapest level in more than 100 years. The chart is trying to tell us to buy commodities!

I've also included a piece from our CIBC Economics team entitled "A biased bank".

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan