Milan Cacic

December 15, 2023

Money Financial literacy Economy Commentary Quarterly commentary Weekly update Weekly commentaryFED UP! CANADIAN BANKS RESPOND AS THE FED TAKES A PAUSE.

Earnings for most of the Canadian banks were quite good this quarter. They commented that they had manageable credit exposure and felt that the Canadian economy was going to have a soft landing, which would bode well for Canadian bank earnings.

BMO, Royal, TD, CIBC, and National Bank all raised dividends which are now at a 3-year annualized growth rate of 8%. While the banks reported, the Federal Reserve made it official that we have seen the last rate hike. The next move for the fed will be a cut, with most economists predicting 4 rate cuts next year. This is very good for banks for two reasons: 1) mortgages will get cheaper, which is the chief driver of bank earnings, and 2) bank balance sheets will get better because bonds go up when rates go down, which takes pressure off the banks’ capital ratios.

One last point – as interest rates go down, people require a lower dividend % to buy/hold bank stocks. If you can get 5% on a GIC, then you may want 6% on a bank stock dividend. However, if the GIC rates come down from 5% to 4%, then you may only require a 5% dividend on a bank stock. For a bank stock to go from 6% dividend to a 5% dividend, it would require the stock price to go up 20% without any change in their actual total dividend amount ($/share). This is why interest rate direction has such a big effect on the stock market.

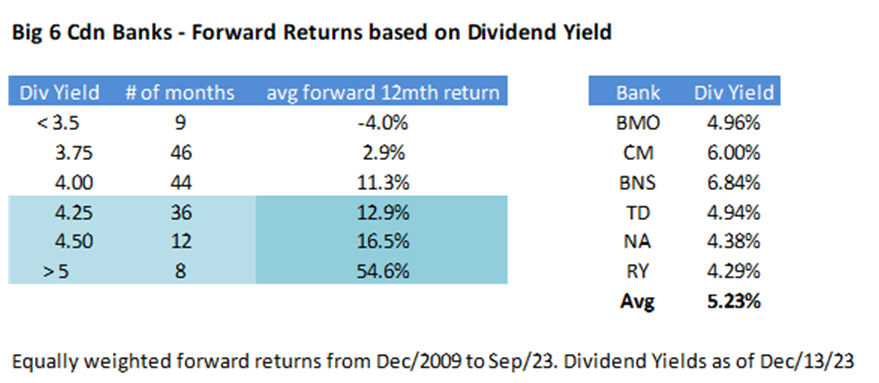

As you can see from the chart below, when banks have high dividend yields, the future returns are usually very good. Most banks are in the 4.25% to >5% Div Yield, which historically means the next 12 month returns for banks should be between 12.9% and 54.6%. I guess we will find out as we increased our bank exposure and added some REIT’s in the models this week.

Source; BMO GAM via Bloomberg

I've also included a piece from our CIBC Economics team entitled "Our two song parodies for two generations”.

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan