Milan Cacic

March 15, 2024

Money Financial literacy Economy Commentary Monthly update Weekly update Weekly commentaryIS IT TIME TO INVEST IN EMERGING MARKETS? JUST ASK THE US DOLLAR…

We have had a few questions about emerging markets and whether this would be a good time to invest there. There is no doubt that emerging markets are considerably cheaper than US markets right now. Currently, the US market trades at approximately 20 times next year’s earnings while emerging markets’ price-to-earnings are much lower (around 12 times next year’s earnings). This spread is significantly larger than it has been in the past. So, should we be buying emerging markets now?

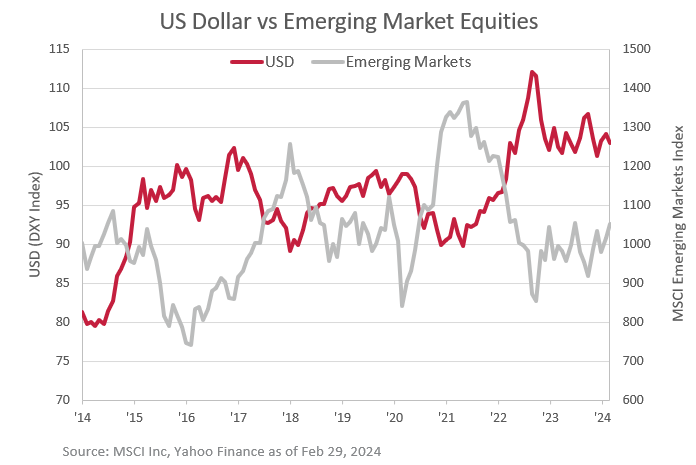

Historically, the most reliable entity to tell us whether now is the right time to buy emerging markets is the US dollar. The graph below shows the relationship between the US dollar and emerging market equities. As you can see, emerging markets have a negative correlation to the US dollar. When the US dollar goes up, emerging markets are likely to go down or sideways; when the US dollar goes down, emerging markets are likely to go up.

I guess this means that, when the US dollar starts to fall, there will either be some substantial upward moves in emerging markets, or US markets will fall considerably to reduce the significant price-to-earnings spread (most likely a combination of the two). Either way, let’s keep a close eye on the US dollar over the course of the next 6 months!

I've also included a piece from our CIBC Economics team entitled "Why so Sad?”.

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan