Milan Cacic

April 19, 2024

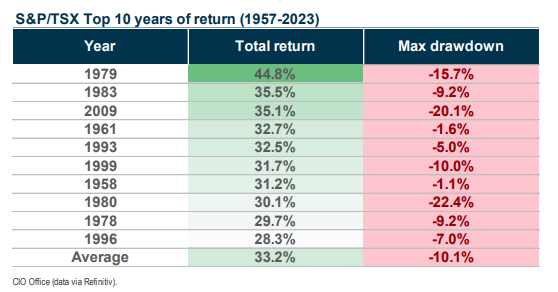

Money Financial literacy Economy Commentary News Trending Weekly update Weekly commentary Annual commentaryEVEN THE BEST YEARS HAVE CORRECTIONS…

The chart below shows the top 10 total calendar year returns for the S&P/TSX since 1957. The chart also shows the maximum drawdown that took place during that calendar year. As you can see, even during these years of exceptional returns, the corresponding drawdowns still averaged over 10%.

I mention this for two reasons. Firstly, corrections in the market are normal (even during good years!). Secondly, time in the market is significantly more important than timing the market. Sometimes when markets go up, we get anxious and feel like we should sell. Sometimes when markets go down, we get anxious and feel like we should sell. The right thing to do is rebalance the portfolio so that you are properly diversified and stick with your long-term financial plan. Sometimes it's our job to remind people!

Source: NBI Inc. as of March 29, 2024

I guess I should also comment on the recent Canadian federal government budget. Spending is up! There's not much else to say. For those who are interested please click on the link as Jamie Golombek, Managing Director, Tax and Estate Planning, CIBC Private Wealth outlines some of the key tax measures that may affect you and your family. 2024 Federal Budget report.

I've also included a piece from our CIBC Economics team entitled "6…5…5…3…2…?”.

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan