Milan Cacic

July 11, 2025

Money Financial literacy Economy In the news News Trending Weekly update Weekly commentaryCHAPS, CHARTS, AND CHARGING BULLS

While I was out stampeding this last week I've had a few conversations with people concerned about the market valuations. People were also commenting on the strange market action with regard to the US bombing Iran and oil prices actually going down instead of up. The simple explanation behind both of these concerns is all the market cares about is “artificial intelligence”.

Let's dig a little deeper.

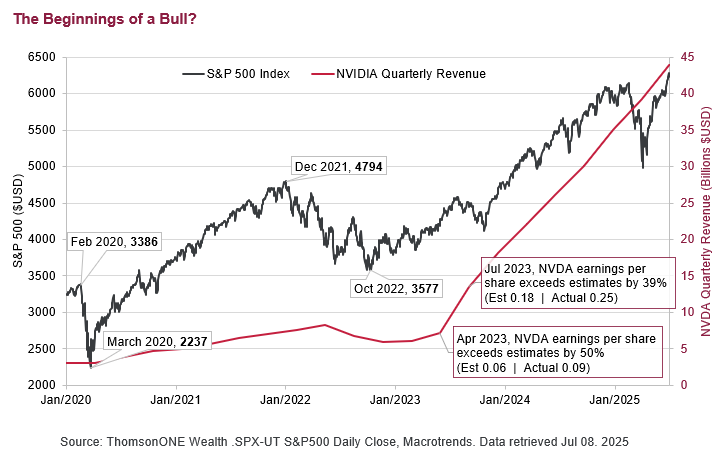

For those concerned about market valuations and a steep market crash, let me remind you that the market has had two corrections in the past 5 years, in March 2020 and October 2022. Both of these were more significant than you might think. As you can see from the chart below, the S&P dropped over 1100 points (34%) in 2020 and 25% in 2022. We also just had a 17% drawdown in 2025. The correction has already happened!

For investors wondering why the market didn't react more significantly to the bombing in Iran, I would suggest that all the market cares about is artificial intelligence. Everything else is just a side note. For those old enough to remember the Internet craze from 1995 to 2001, it is very familiar. However, artificial intelligence has the potential to be 10 times bigger than anything we saw with the Internet. It's also going to come at us faster than anything we've seen before. It's important to note that it's not just affecting technology stocks. Everything from energy consumption/production, logistics, client services, and the computer or phone that you're reading this on is affected by artificial intelligence. It is all-encompassing and is affecting every part of our lives.

How do we participate?

We believe we may now be in the next leg of a bull market that likely started after the Oct 2022 correction, and just before Nvidia surprised to the upside on their May 2023 quarterly earnings. As you can see in the previous chart, NVIDIA’s quarterly earnings massively surpassed estimates (by 50%!) which was likely the beginning of this artificial intelligence Bull Run. They surprised to the upside again in the following quarter, beating estimates by almost 40%, as AI has continued its infiltration of our everyday lives.

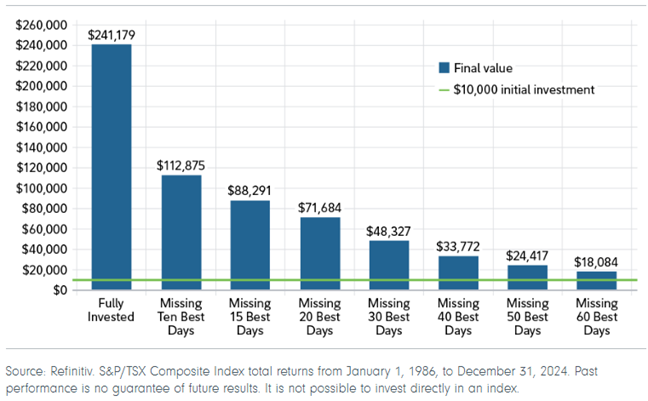

As this bull market gets its legs, driven by the powerful force of AI, we want again to highlight the importance of being invested the market. It’s impossible to predict the future, but we can extrapolate based on what history has told us over time. As you can see from the chart below, history tells us that you are much better off staying invested than letting your emotions push you into trying to time the ebbs and flows of the market. Waiting for the right opportunity might mean missing out on some of the best days on the market, and missing out on any of market’s best days could have a lasting impact on your portfolio.

I have also attached some commentary from our CIBC Economics team entitled “Know when to hold ‘em, when to fold ‘em”.

As always, if you have any questions, please feel free to give us a call.

Have a great weekend.

Milan