Milan Cacic

July 18, 2025

Money Economy In the news News Trending Weekly update Weekly commentaryCOULD THE TARIFFS ACTUALLY BE WORKING?

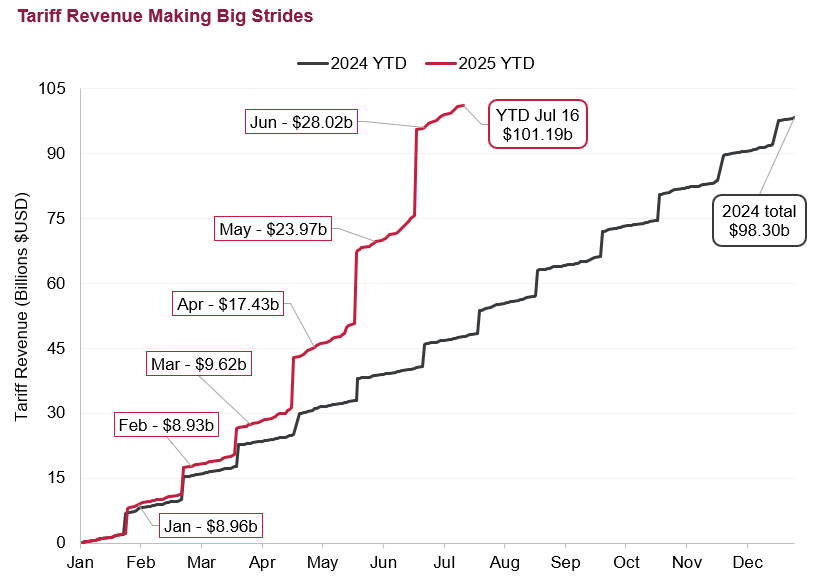

As you can see from the chart below, US government tariff revenue came in at $17 billion in April and $24 billion in May. This number is continuing to increase and will likely annualize at $300 billion to $400 billion. Without a doubt, this is a meaningful source of new receipts for the US government. Having said that, it's still a long way to go to cover the $2 trillion deficit that the Trump administration plans to run in 2025.

Source: Cacic Wealth Management, U.S. Department of the Treasury, Daily Treasury Statements. DHS – Customs and Certain Excise Taxes. Data retrieved Jul 18, 2025

The real question is "Who is paying for these tariffs?". So far, US companies’ profit margins have not eroded, and consumer price inflation has actually gone down since the start of the tariffs. This implies that the companies are not paying for the increased tariff costs, nor are the consumers. How can this be possible?

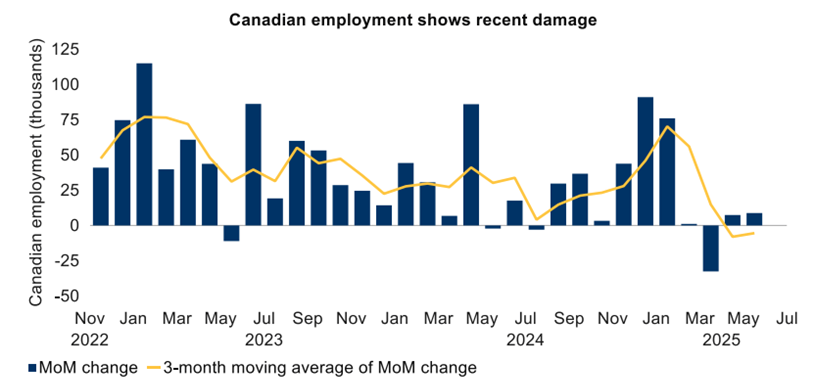

One possibility is that the foreign sellers are making some price concessions. As you can see from the chart below, there has definitely been some economic damage to Canada. Since the tariffs were implemented, Canadian employment data has dropped off a cliff. Another possibility is that the US companies built up inventory and stocked their shelves in anticipation of the tariffs, so they are not drawing from their higher-cost inventory yet. Regardless of what the answer is, we should find out within the next 3 to 6 months who is paying for the tariffs. In the meantime, Canada is definitely paying part of the price. Hopefully, we can strike a deal soon!

Source: Statistics Canada, Macrobond, RBC GAM. Data as of May, 2025

I have also attached some commentary from our CIBC Economics team entitled “The Dangers of Jay Walking”.

As always, if you have any questions, please feel free to give us a call.

Have a great weekend.

Milan