Milan Cacic

August 01, 2025

Money Financial literacy Economy Commentary In the news News Trending Weekly update Weekly commentaryTHINGS WE ARE WATCHING!

While we navigate the current market landscape, which seems to be roiling with uncertainty around tariffs, the economy, and the president of the United States, we remain focused on quality companies with strong earnings visibility. Maintaining this focus helps anchor portfolios amid evolving conditions. Here are the key themes we’re watching:

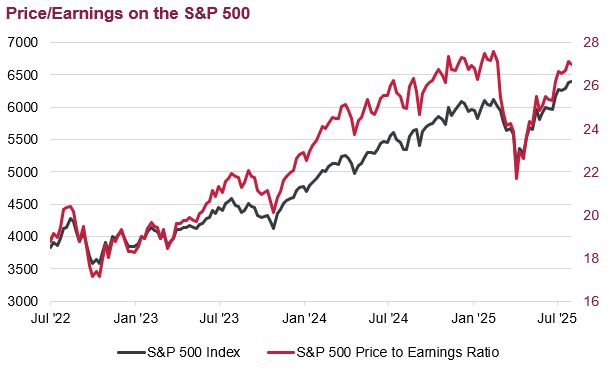

Market Strength and Stretched Valuations:

Equities continue to perform robustly, supported by rebounding earnings and GDP growth. However, elevated valuations are prompting caution. We prioritize companies with resilient fundamentals and predictable earnings to deal with the volatility.

Source: Bloomberg. Data as of Jul 30, 2025

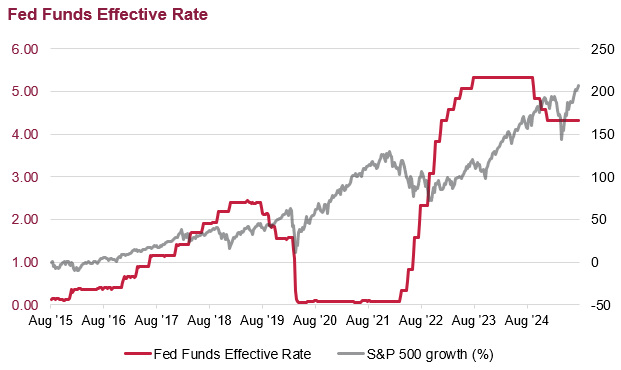

Federal Reserve Policy Outlook:

The Fed may pivot to rate cuts in 2026, potentially fueling a final equity market surge. However, an early rate cut could weaken the US dollar and/or elevate inflation, introducing risks to the market. We’re closely monitoring Fed signals to adjust positioning.

Source: Federal Reserve Bank of St. Louis [Fed Funds Effective Rate, weekly avg]. ThomsonONE. Data as of July 30, 2025

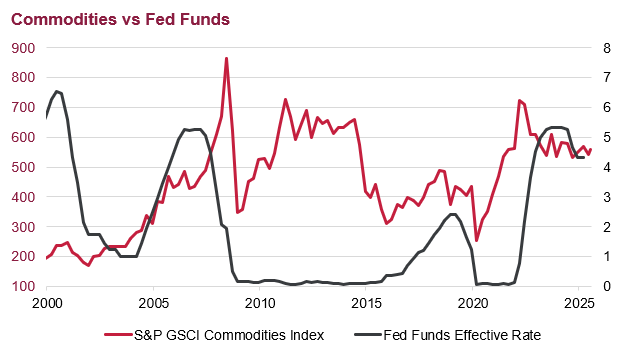

Rotation Toward Real Assets:

If the Federal Reserve starts cutting rates, we will rotate toward real assets – gold, commodities, and infrastructure – as a hedge against inflationary pressures and potential currency fluctuations. These assets offer stability and value preservation in uncertain environments.

Source: Bloomberg. Federal Reserve Bank of St. Louis [Fed Funds Effective Rate, quarterly avg]. Data as of Jul 30, 2025

Growing Risks:

While optimism persists, risks such as inflation, geopolitical tensions, and overextended valuations are on our radar. Our disciplined approach emphasizes quality and diversification to mitigate these challenges.

We remain committed to proactively managing your portfolio, focusing on high-quality investments and ready to make dynamic adjustments as we navigate this environment.

I have also attached a note from our CIBC Economics team entitled “Is Canada getting off lightly?”.

As always, if you have any questions, please feel free to give us a call.

Have a great weekend.

Milan