Milan Cacic

August 22, 2025

Money Economy Commentary In the news News Trending Weekly update Weekly commentary Year In reviewNAVIGATING STAGFLATION RISKS

A central banker’s job may sound easy because they only need to prioritize two competing issues: stable prices (inflation) and stable growth (the economy). During "normal” times, when the economy starts to slow down, the Fed would cut interest rates – making it easier for firms to access credit, which they would then invest and hire more people, stimulating the economy. In periods of high inflation, the Fed would raise interest rates to slow the economy – firms would lower their spending and pay down their debt, serving to slow down price increases and mitigate inflation. We just experienced both of these scenarios: in 2020 we had a slowing of the economy, and the Federal Reserve cut interest rates to zero, which drove increased spending. Then again in 2022 we had the opposite, where the Federal Reserve had to raise interest rates significantly to try and slow down inflation.

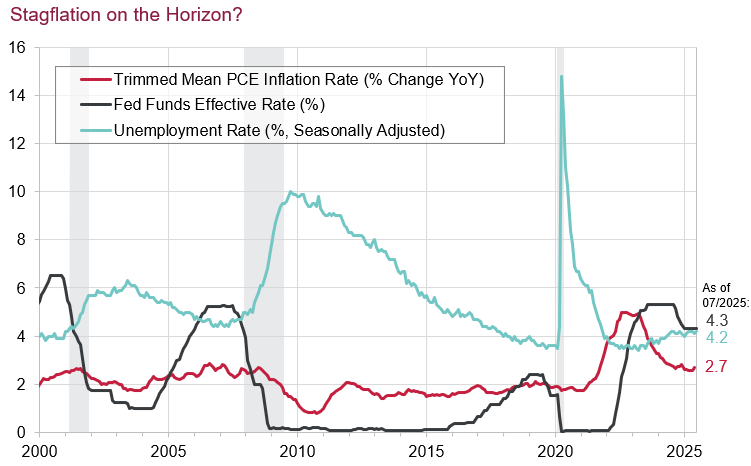

For a central banker, the worst-case scenario is when the economy is slowing, unemployment is rising, and inflation is increasing – all at the same time. We call this "stagflation". Stagflation is difficult for central bankers because if they try to stimulate the economy by cutting interest rates, they will likely drive inflation higher. And if they try and curb inflation by raising interest rates, they will drive the economy deeper into recession. “Stagflation" puts the central bank in a precarious situation.

Note: Shaded areas indicate recession. Data retrieved Aug 21, 2025.

Source: Federal Reserve Bank of St. Louis – Trimmed Mean PCE Inflation Rate (YoY percent change, seasonally adjusted), Federal Funds Effective Rate (not seasonally adjusted), Unemployment rate (seasonally adjusted).

Why are we talking about this?

We are talking about this because it appears that inflation is starting to rise again. This makes sense on the surface because of the U.S. tariffs. While the U.S. might be bringing in $30 to $50 billion per month in tariff revenue, that $30 to $50 billion is also increasing costs for consumers. At the same time, the economy is showing early signs of weakness (US non-farm payroll number was not very good). Combine this with the market predicting three more rate cuts from the Federal Reserve in 2025, and a few more cuts in 2026, which will also be inflationary. All of the sudden, there's a lot of data pointing in different directions that all seem to lead to potential stagflation. While the interest rate cuts will be good for the market in the short term, they could cause significant inflation if the tariffs continue – or worse yet, increase. The next six months should be interesting. And over the next few months, it should be obvious which direction both inflation and the economy are going. We will keep you posted!

I've also included a piece from our CIBC Economics team entitled "A lot of uncertainty? Not in the US market’s eyes".

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan