Milan Cacic

August 28, 2025

Money Education Financial literacy Social media Economy Women & wealth Commentary Trending Weekly update Weekly commentaryPERSPECTIVE IS KEY: AVOIDING THE "HAMMER" APPROACH TO MARKET PREDICTIONS

Historically speaking, September is not a great month for investing. I am sure some of you will read headlines over the weekend talking about Donald Trump, wars, a slowing economy, and the potential for a drop in the market. While reading, I would like you to consider the importance of a balanced market analysis – especially when evaluating predictions from well-known figures. The saying "To a man with a hammer, everything looks like a nail" applies to financial markets as well.

I say this because I was recently listening to Michael Burry talk about the overheated stock market. Burry is known for accurately forecasting the 2008 housing market collapse, a storyline featured in the movie "The Big Short". This prediction gave him fame, made him some money, and also allowed him to raise a significant amount in his hedge fund. Having said that, since his stock market crash call in 2008, he and many other pundits have consistently tried to predict market crashes without success:

- In December 2015, Burry predicted a crash, but the S&P 500 saw an 11% gain over the next year.

- A prediction of a new financial collapse in May 2017 was followed by a 19% increase in the S&P 500 over 12 months.

- His September 2019 forecast of a crash from an "indexed ETF bubble" preceded a 15% gain in the S&P 500 in the following year.

- Following his February 2021 prediction of significant declines due to a speculative bubble, the S&P 500 rose by 16%.

- And in January 2023, he again predicted an upcoming recession, but we now find the S&P 500 at an all-time high.

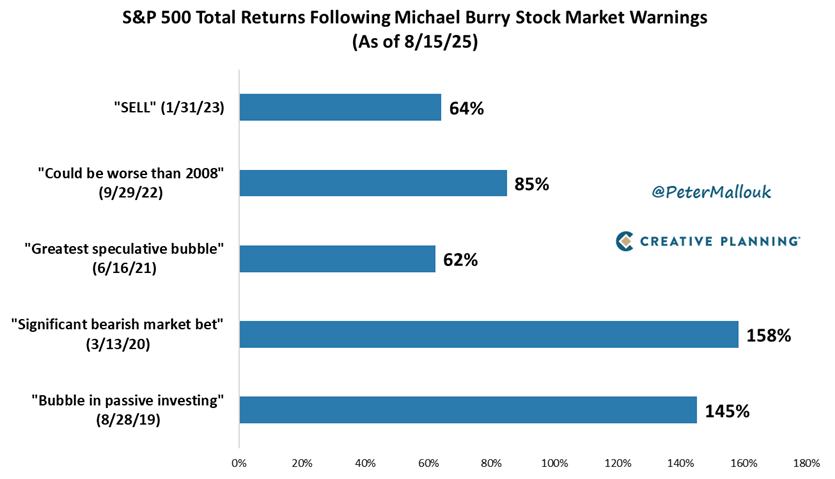

As a matter of fact, if you look at the chart below, you will see that had you listened to the so-called "market experts", you would have missed out on significant returns. This illustrates the danger of trying to time the market. A person who became famous from predicting the decline of the market will naturally see every stock market rise as an opportunity to predict the next market crash. No different than the man with a hammer seeing everything as a nail.

Source: Peter Mallouk, Creative Planning.

Our data-driven approach allows us to get rid of emotions and analyze a range of data points and economic indicators to focus on long-term value creation. The goal is to build low-volatility portfolios that can perform well in various market conditions. The right tool for the right market!

I've also included a piece from our CIBC Economics team entitled "No to being young again; The struggles of Canadian youth employment".

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan