Milan Cacic

September 19, 2025

Money Financial literacy Economy Commentary In the news News Trending Weekly update Weekly commentarySNIP SNIP! WHAT THE FED’S CUT MEANS FOR MARKETS

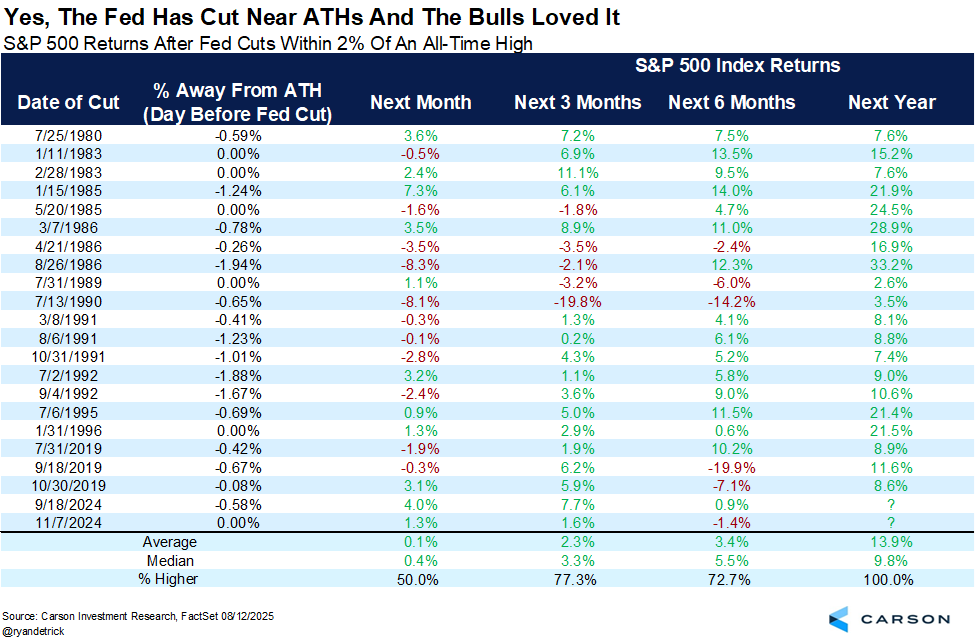

Markets are sitting near all time highs, and with the Fed beginning to cut rates, it’s natural to wonder if we’re “too high” and due for trouble. But history offers some encouraging perspective – as the chart below shows, in all instances where the Fed has cut rates near market highs, the S&P 500 was higher 12 months later.

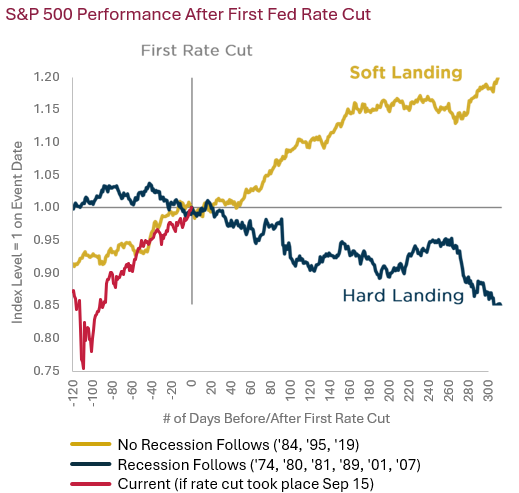

Another encouraging sign is when rate cuts coincide with a “soft landing” (slowing inflation without a recession), the market has historically done very well for the next two years. As Mark Twain once said, “History doesn’t repeat itself, but it often rhymes”. While no two cycles are the same, today’s environment has a unique twist: the AI-driven productivity boom could help keep inflation in check, giving the Fed room to cut rates further.

The next few years will be interesting! The only certainty is change and we are positioned to help you navigate it with discipline and expertise.

Source: Piper Sandler. ThomsonONE. 2019 episode excludes period of COVID selloff & recovery. 1980 period goes through the first rate hike. Data from 3/14/1974 – 09/15/2025. Past performance should not be taken as a guarantee of future results.

I've also included a piece from our CIBC Economics team entitled "Sooner or later".

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan