Milan Cacic

September 26, 2025

Money Financial literacy Economy Commentary In the news News Trending Weekly update Weekly commentaryIS A.I. LIKE THE DOTCOM BUBBLE? NO, BUT HOLD ON TO YOUR HAT!

As we wrap up another volatile week in the markets, discussions around potential "bubbles" have become increasingly prevalent. We've received several inquiries lately about whether we're on the cusp of a market crash, and it's understandable. Prices do appear a bit elevated, and President Trump's distinctive communication style hasn't exactly soothed investor nerves.

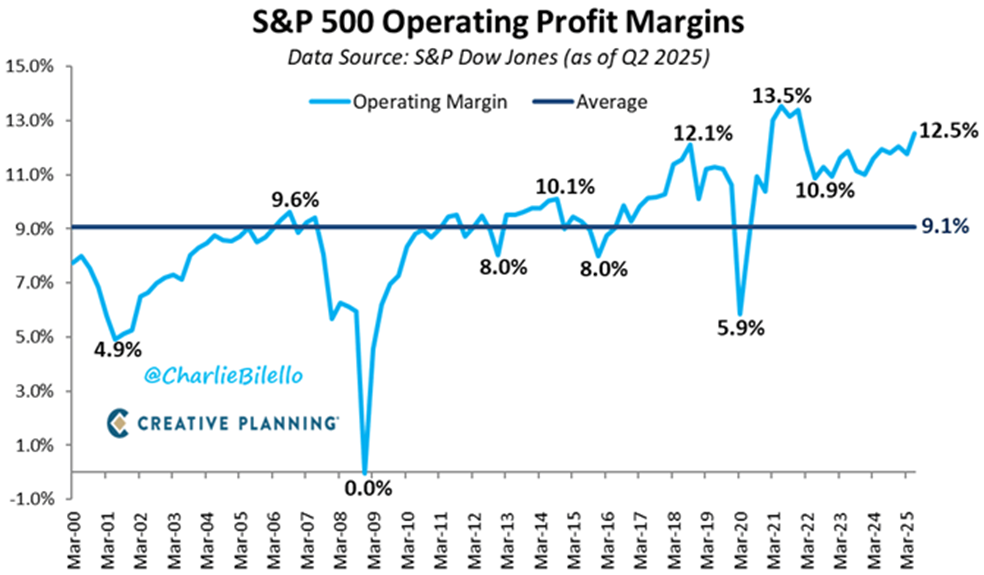

As you know during times like these, we like to draw some historical parallels to provide context. The current AI-driven era bears striking similarities to the internet boom from 1995 to 2000 (note; I started in the business in 1995). Back then, Alan Greenspan's famous "Irrational Exuberance" speech in 1996 was followed by a staggering 500% surge in the Nasdaq before the peak in early 2000. Today, with AI adoption hovering at just 25% in corporate America, we're more akin to the early stages of the internet in 1996, far from the exuberant extremes that signal a true bubble top. Today’s companies are also much more profitable than they were back in 2000. If you look at the chart below, you can see that the S&P 500 profit margins have almost doubled since the 2000 dotcom bubble, and I would argue that the large tech companies are considerably more profitable today than they were back in 2000.

Source: Creative Planning. [@CharlieBilello]. Aug, 2025. X https://x.com/charliebilello/status/1956460905215984050

Source: Creative Planning. [@CharlieBilello]. Aug, 2025. X https://x.com/charliebilello/status/1956460905215984050

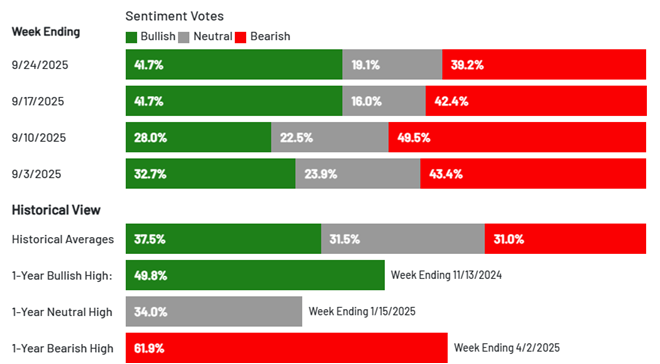

Another indicator we follow is sentiment, and sentiment indicators aren't flashing red (yet). Combine this with the fact there is a mountain of sidelined cash ($7.2 trillion), and you begin to feel like this could have much more room to run. Moreover, the year-to-date rallies in today's AI leaders pale in comparison to the magnitudes seen in dotcom giants during the internet boom.

Source: American Association of Individual Investors. AAII Investor Sentiment Survey. Sep 25, 2025.

In short, this cycle likely has further to run. Of course, that doesn't mean smooth sailing ahead. The Nasdaq 100 experienced numerous 10%+ pullbacks throughout the dotcom bull market, so expect volatility to persist. We're monitoring developments closely and remain positioned to navigate any turbulence.

I've also included a piece from our CIBC Economics team entitled "Fiscal Physics".

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan