Milan Cacic

October 10, 2025

Money Education Financial literacy Economy Commentary In the news News Trending Weekly update Weekly commentaryGOVERNMENT SHUTDOWNS... WHAT THEY MEAN FOR THE MARKET

There has been some concern from clients about the US government shutdown and how it affects the markets. As the shutdown stretches into its ninth day, it appears that equities have shrugged off the noise. As you know during times like these, we like to use history as a guide to what might happen.

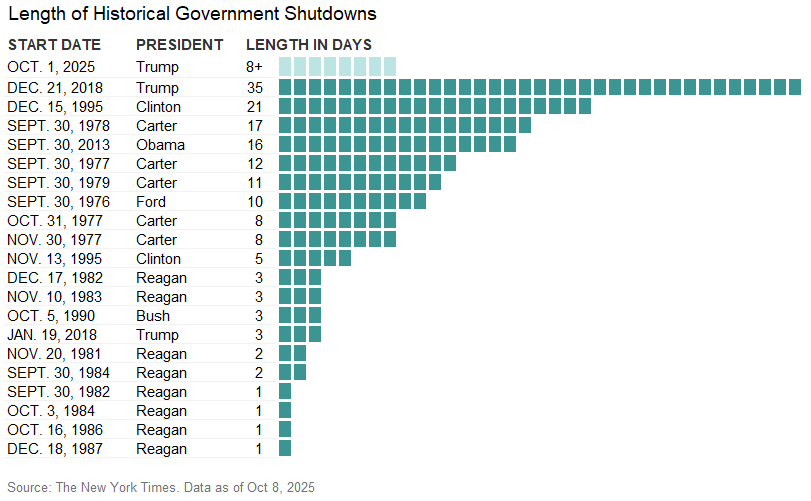

As you can see from the below chart, government shutdowns are typically brief with an average of just eight days. However, the longest shutdown in history was in 2018 under the same president that is in power today. This precedent certainly sets up the possibility of yet another record-length shutdown. So what does this mean for the markets?

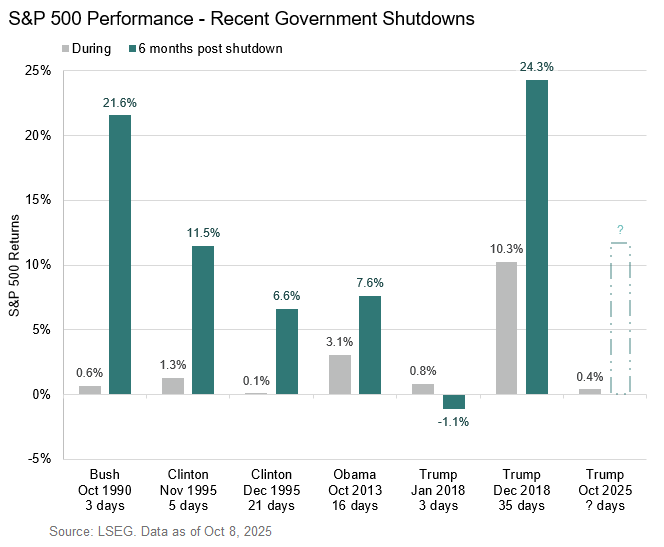

If we look at the chart below, we see that markets tend to do well during government shutdowns. What is even more impressive is that the markets tend to do very well once the government resumes after a shutdown.

Why the resilience? Our belief is that shutdowns rarely occur unless the economy is on solid footing. Policymakers steer clear of shutting the government down when risks loom large. It is our opinion that this administration believes the economy is strong, helped along by the price of oil dropping more than 10% just before the shutdown. Coincidence? Probably not.

The bottom line is that volatility may tick up, but history tells us that the path of least resistance still favours an upward market trend. As always, we would like to emphasize the importance of staying diversified and focusing on the long-term.

I've also included a piece from our CIBC Economics team entitled "What Professor Gold is teaching us".

As always, if you have any questions, please feel free to give us a call at any time.

Have a great long weekend.

Milan