Akshat Shukla

October 17, 2025

Money Economy In the news News Trending Weekly update Weekly commentaryRARE EARTH MINERALS, NOT SO RARE RESPONSE – BREAKING DOWN TRUMP’S NEW CHINA PLAN

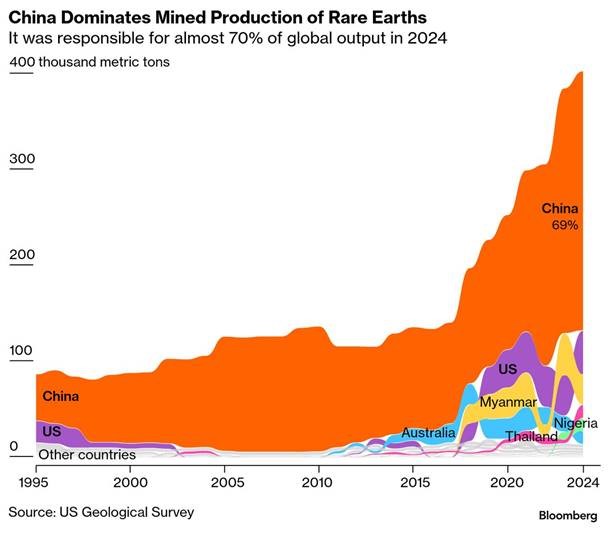

After a tense few days, the Trump administration is working to calm things down with China. Treasury Secretary Scott Bessent weighed in on Wednesday, reassuring markets that Trumps is pursuing “competition, not decoupling” with Beijing.

Bessent’s media tactics helped calm the markets. He laid out a series of steps the administration is preparing in order to shield American companies from what he calls “nonmarket manipulation” by the Chinese government:

- Price floors across key sectors to prevent China from undercutting US competitors

- A national mineral reserve to ensure access for defense, energy, and other critical industries

- Partial government ownership in key corporations, including the Pentagon-MP Materials deal

- Reducing reliance on China’s rare earths with other trade partners

Bessent is convinced the plan puts Washington in a position of strength ahead of the next round of trade talks.

Where Things Stand

Despite all the name-calling, Bessent stressed that bilateral talks are ongoing, and Trump will meet Chinese President Xi Jinping at the APEC summit in South Korea later this month. He also hinted that the current 90-day tariff pause could still be extended, on condition that Beijing refrains from implementing new export restrictions. That was enough to lift the S&P 500 and Nasdaq indexes, helping both close the day fractionally higher after a volatile midweek session.

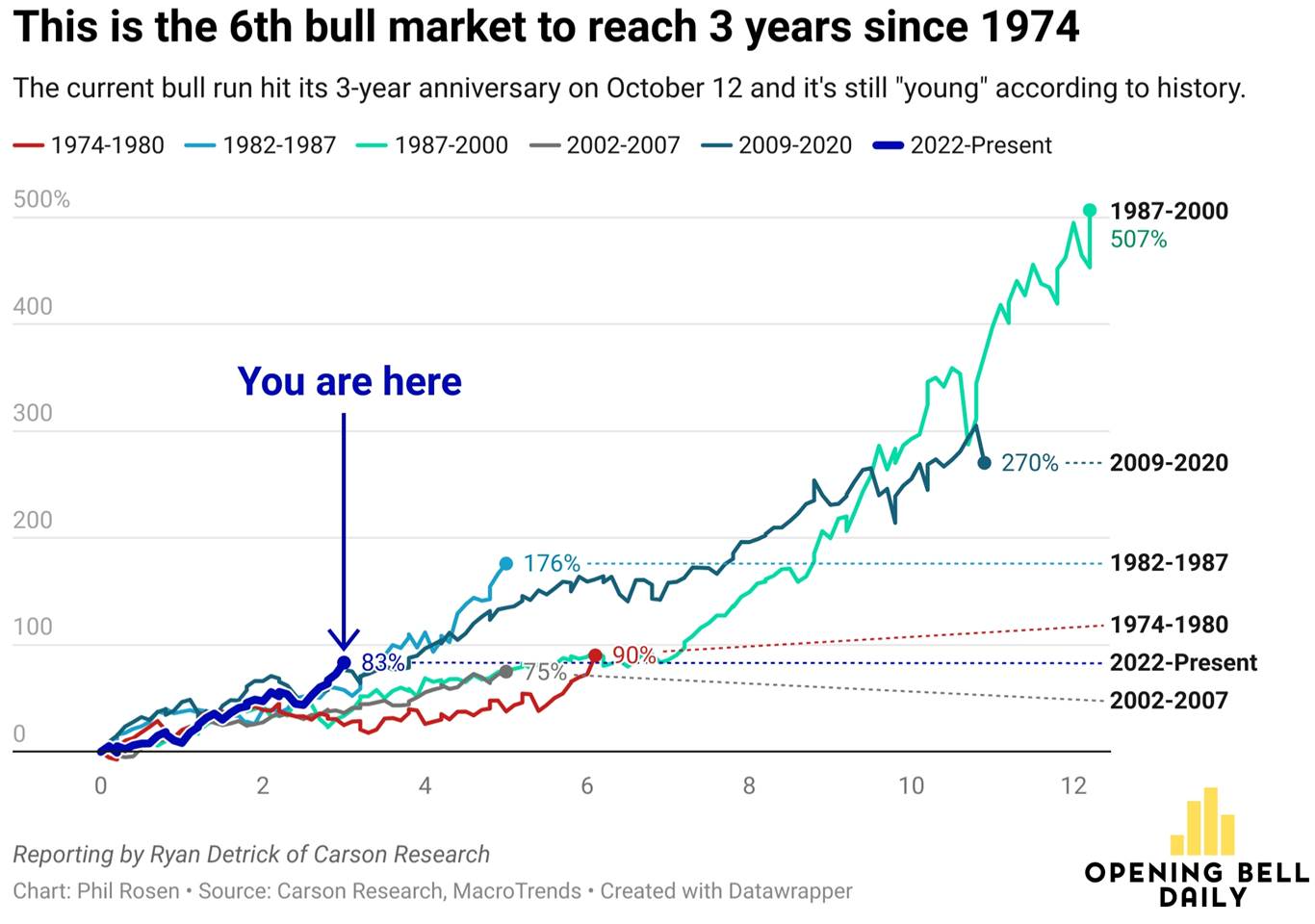

Everyone is worried about an AI bubble, but this is still a "young" bull market compared to history

We have received numerous queries from clients worried about a tech bubble and we thought it would be prudent to visualize our response with the below chart, because a picture is worth a thousand words.

I've also included a piece from our CIBC Economics team entitled "Will AI boost productivity? Which one?".

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Akshat