Milan Cacic

December 05, 2025

Money Economy Commentary In the news News TrendingPIPELINES, POLICY, AND PROGRESS

After years of gridlock, Ottawa and Alberta have finally landed on a deal that gives the province regulatory breathing room and a real shot at building a pipeline to the West Coast. It’s not perfect, but it’s the most constructive step forward for Canada’s energy sector in nearly a decade.

At its core, the agreement gives Alberta something it has long sought: regulatory relief in exchange for cooperation on emissions policy. Alberta will be exempt from several federal rules that have weighed on the sector, including the oil and gas emissions cap and the Clean Electricity Regulations. Importantly, both governments will also prioritize creating a pathway for a new pipeline to the B.C. coast, which is critical for accessing fast-growing Asian markets. It’s not a guarantee, but it’s the clearest signal of support we’ve seen in years. The tanker ban on the West Coast may even be adjusted to allow limited oil exports.

In return, Alberta has agreed to tighter industrial carbon pricing, support for electricity transmission infrastructure, and backing for large-scale carbon capture projects. Both of these measures will raise costs for producers (which creates an uneven cost to Albertan producers relative to other jurisdictions), and the carbon capture targets in-particular come with execution risk. However, in exchange, they buy regulatory stability – a valuable commodity in an environment where uncertainty has often delayed major projects.

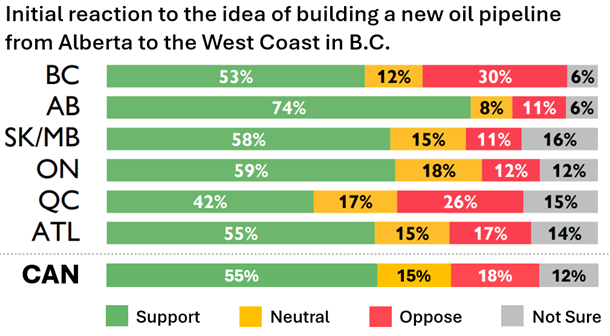

As you can see from the chart below, initial polling has the proposed pipeline favoured across the nation (55% support), with only 18% in opposition.

Source: Abacus Data. (Dec 1, 2025). Canadian Public Affairs

Overall, this MOU is not the ideal scenario (true regulatory reform would have been more efficient and less costly), but it does move the ball forward. The agreement removes several roadblocks and opens the door to long-term export capacity at a time when global demand for reliable energy remains strong. For Alberta’s producers and for Canada’s broader economy, this is a step forward. Let’s hope we see follow through...

I've also included a piece from our CIBC Economics team entitled "Revisionist history and Canadian economic slack".

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan