Milan Cacic

January 23, 2026

Money Economy Commentary Weekly update Weekly commentaryDON’T CONFUSE A SPEED BUMP WITH A WALL

Every bull market needs a little drama to stay interesting. We just got ours. The recent drop tested the market’s confidence, shook out some nervous hands, and most importantly found its footing right where it should. That’s not a warning sign; that’s a green light.

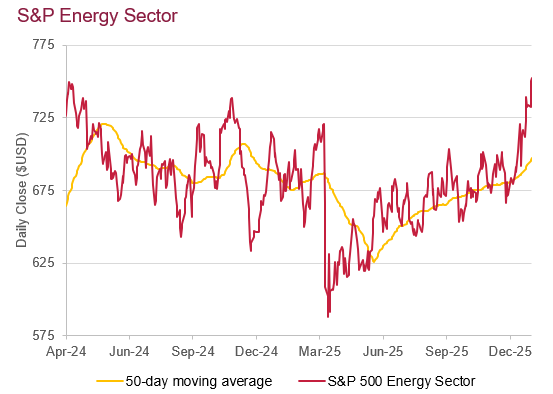

Energy in particular is one spot where the headlines and the market are giving conflicting stories of warning signs and green lights. Oil looks terrible, everyone hates it. And yet, Exxon, representing nearly a quarter of the energy index, just hit an all-time high, while oil services stocks are up sharply. When stocks are acting better than the commodity they’re tied to, it usually means the market sees something improving ahead.

Source: LSEG. Data as of Jan 22, 2026

Markets have a way of looking forward while we’re still looking at yesterday’s news. Or put differently: reflation without inflation produces elation.

Bottom line: the market passed its test, and energy stocks may be quietly setting up for better days, long before the mood improves. Things are setting up for an interesting next few months!

I have also included a piece from our CIBC Economic team entitled “Is No K OK For Canada?”.

As always, if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan