Milan Cacic

October 08, 2021

Money Economy Commentary Trending Weekly updateINFLATION..

We have had quite a few questions regarding inflation. So how could inflation affect your portfolio?

When the lock down began, we saw inflation in products that were in high demand because of our new adjusted lifestyles. For example, there was a surge in purchases of exercise equipment, outdoor activity equipment and electronics used to work from home. Now that we are starting to normalize again, we are seeing inflation on products that are used when in an open economy. In both of these cases, the supply chains were not prepared for the increase in demand. However, as time goes on, the supply chains will react and supply and demand will equalize. This is why most economists think that inflation will be temporary until supply and demand get into balance.

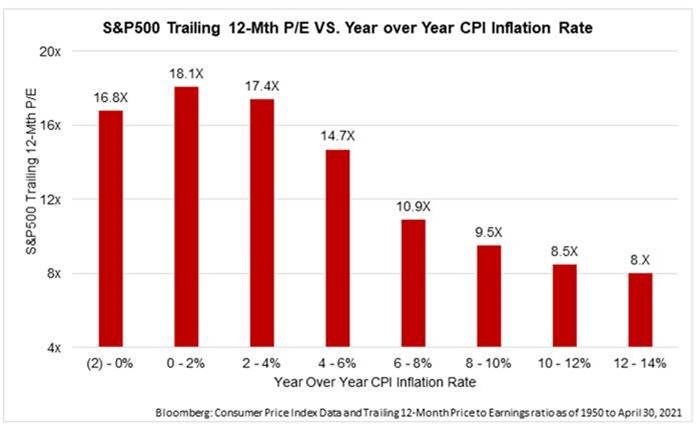

What if we are wrong and inflation does continue to go up? As the chart above illustrates, the sweet spot for the market, as it pertains to the price-to-earnings relative to inflation, is between zero and 2%. Even if inflation gets up to between 2% and 4%, market multiples do not drop much. The real damage to market multiples begins if inflation gets above 4%. Needless to say, we will keep a close eye on the change of inflation for the next few quarters.

What if we are wrong and inflation does continue to go up? As the chart above illustrates, the sweet spot for the market, as it pertains to the price-to-earnings relative to inflation, is between zero and 2%. Even if inflation gets up to between 2% and 4%, market multiples do not drop much. The real damage to market multiples begins if inflation gets above 4%. Needless to say, we will keep a close eye on the change of inflation for the next few quarters.

I have also included a piece from our CIBC economics team entitled "The truth about Canadian inflation".

As always please feel free to give us a call anytime if you have any questions.

Have a great long weekend!

Milan