Nick Polychronopoulos

December 29, 2025

Good reads Commentary Year In reviewWhy Quality Stocks Are Mispriced: Insights for Investors

Recently, I came across a timely article that resonates with the challenges we face as portfolio managers and disciplined investors, particularly those who follow the G.A.R.P. (Growth At a Reasonable Price) philosophy. I wanted to share some key takeaways and my perspective on why quality stocks appear mispriced in today’s market environment.

The Case for Quality Stocks

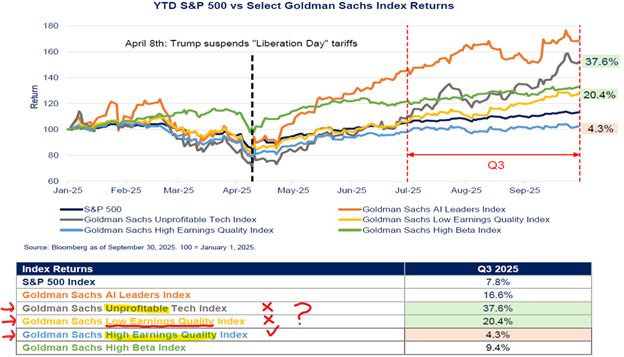

Quality stocks—companies with robust earnings, resilient balance sheets, and sustainable margins—have surprisingly underperformed in 2025. In contrast, unprofitable small-cap firms have outperformed their profitable peers by about 20% since "Liberation Day." This trend highlights a market driven more by sentiment and risk appetite than by fundamentals.

Why Is Quality Mispriced?

Structural Mispricing: The undervaluation of quality stocks isn’t just a short-term anomaly. It’s a structural issue, where market biases favor short-term excitement over durable business models.

The Quality Paradox: Despite their strong fundamentals, quality stocks are often ignored during risk-on rallies, as investors chase high-volatility, speculative names.

Amplified by Passive Flows: Passive investment and momentum-driven strategies have made this effect more pronounced, especially in under-researched market segments.

Misunderstood Role: Quality is frequently seen as defensive, but historically, it has been a persistent driver of long-term returns. Markets tend to underprice the enduring advantages of quality companies during periods of exuberance.

Investment Implications

Investors who maintain a patient, disciplined approach focusing on durable profitability and prudent capital allocation are well-positioned to capture long-term outperformance as the market eventually revalues these attributes.

Source: Russell Investments, December 3, 2025

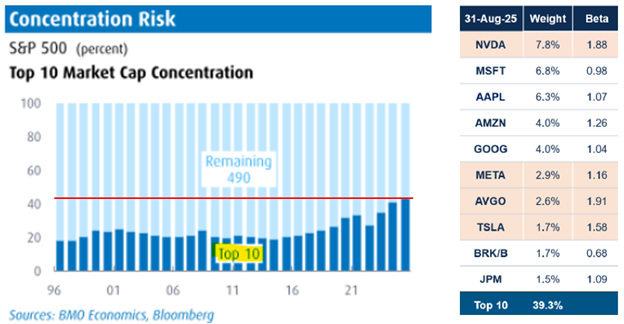

Concentration Risk

U.S. equity concentration has reached levels not seen since the late 1990s tech bubble. The top 10 names now represent 40% of the S&P 500 Index weighting—a significant risk for diversified investors.

For further reading: BMO Economics Publications

Are We in a Bubble?

Short Answer: Not yet.

According to BMO Economics, we may be in the 7th inning of an asset bubble. While valuations are high and monetary policy remains supportive, signs of underlying asset quality erosion are beginning to appear, but not at crisis levels.

Style Headwinds

The largest drag on performance this year has been style. Quality Growth has lagged in a speculative environment dominated by momentum and high-beta stocks, increasing risk and amplifying volatility.

Performance Disconnect

Recent data shows that indices tracking unprofitable technology firms and low earnings quality have outperformed those tracking high earnings quality—a clear disconnect from fundamentals.

Source: Bloomberg as of September 30, 2025

The Opportunity

When market excitement fades, the value of quality stocks is likely to be recognized again. History tells us that low-quality rallies do not last. This environment presents an opportunity for disciplined investors to benefit from the eventual revaluation of quality.

If you have any questions or would like to discuss these insights further, feel free to call or email me directly.