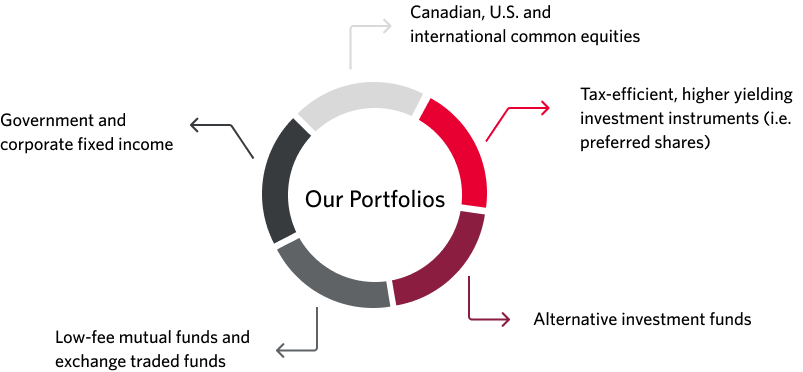

Rowan-Legg Wealth Management invests in well diversified portfolios that are tailored to the client. Our portfolios are managed on a discretionary basis which allows for more timely investment and execution.

Our equity portfolios focus on sustainable dividend growth common equities. This is a proven approach that has outperformed the market since 2009 and does so with less volatility and better downside in most market environments. In addition, these portfolios generate a stable and growing cash flow that can be used as an income source in retirement.

Our Discretionary Investment Management Portfolios succeed because:

We employ a highly disciplined quantitative and qualitative based investment process

We generate very low turnover for greater tax-efficiency, but trade around positions to enhance value over time

We target a long-term dividend growth rate of 8-10%

We invest alongside our clients in the same portfolios