Aaron Sherlock

September 12, 2025

Earnings Exceed Expectations but Tariffs Loom Large - Q2 2025

Q2 2025 has been a chaotic quarter, to say the least, with trade war effects beginning to bite, geopolitical tensions remaining high and companies publicly battling choices made in the Oval Office. Earnings results continue to be strong despite this environment but the outlook for the future continues to matter more than the results in the rearview mirror.

Company Valuations Matter

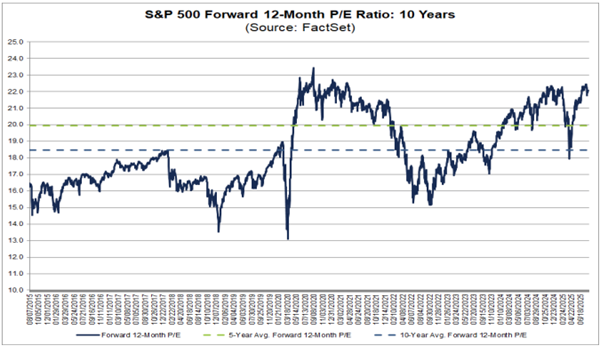

Understanding the relationship between company fundamentals and share prices is essential in today’s market environment. While both current performance and future growth potential influence valuations, it is the outlook for future growth that investors weigh most heavily. Recent data on price-to-earnings (P/E) ratios provides valuable insights into how the market is currently assessing these prospects.

Here are key things to note:

- P/E multiples vary significantly across sectors, with some notable outliers, including IT at 30.0x, Consumer Discretionary at 28.0x and Energy at 14.5x.

- Under-promise and over-deliver is the name of the game as suggested by the Q2 2024 “earnings beat” ratio, which came in at 81%, exceeding the five- and ten-year averages of 78% and 75%, respectively.

The figures mentioned above point to the premium investors are placing on sectors with higher growth expectations, while more defensive or cyclical sectors continue to trade at lower multiples. As always, understanding these dynamics is crucial for informed investment decisions.

S&P 500 Forward 12-Month P/E Ratio (as of Aug 8, 2025)

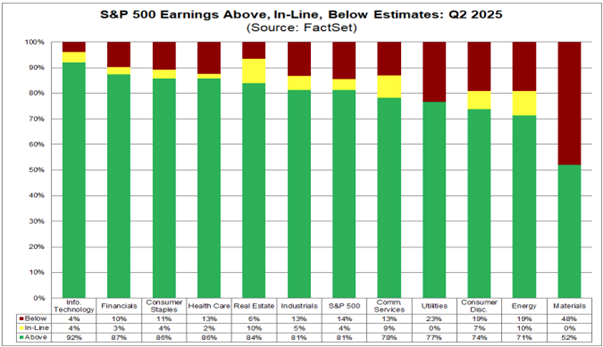

Earnings Exceed Expectations

A closer look at recent earnings results reveals continued strength in corporate performance, with most sectors participating in the expansion. While headline growth remains robust, the nuances in sector performance and corporate guidance provide important context for interpreting these results.

Here are a few things to take note of:

- Blended S&P 500 earnings for the quarter rose by 11.8% year-over-year. If this pace is maintained, it will represent the third consecutive quarter of double-digit earnings growth.

- Year-over-year earnings growth was reported by nine sectors, while two sectors experienced contractions, indicating a generally positive trend across the majority of the index.

- Guidance remains mixed, with 78 companies issuing forecasts for the upcoming period: 38 companies issued negative guidance, while 40 provided a positive outlook. However, the proportion of negative guidance (49%) is below the five-year average of 57% and the ten-year average of 61%. Given the many unknown variables in the current environment, it is only normal for companies to remain cautious in issuing guidance. Providing accurate forecasts is challenging, as markets tend to penalize misses more than they reward beats.

Overall, the combination of strong earnings growth and relatively balanced guidance highlights both the resilience and the caution present among S&P 500 companies. Monitoring these trends will be critical as market conditions continue to evolve.

S&P 500 Q2 2025 Earnings Surprises by Sector (as of Aug 8, 2025)

If you are interested in receiving investment and economics insights right to your inbox, I invite you to subscribe to my monthly Sherlock's Clues e-newsletter. Simply send me an email at aaron.sherlock@cibc.com to be added to the distribution list. I'm also available to answer your questions and help you navigate your investment journey. Contact me anytime to discuss how I can assist with your investment needs.

Disclaimer: This commentary is for informational purposes only and is not being provided in the context of an offering of any security, sector, or financial instrument, and is not a recommendation, an endorsement, or solicitation to buy, hold or sell any security.