Smith Falconer Financial Group

June 18, 2023

Patience is a Virtue

Of the few things that are certain in life, stock market volatility ranks high. Periods of short-term uncertainty captivate investors, clouding judgement on long-term financial goals.

Last summer, Lois shared The Psychology of Money by Morgan Housel with clients as her summer reading recommendation, to be enjoyed by the recent graduate and seasoned investor, alike. This book offers every investor a fantastic perspective on maintaining a long-term outlook.

In Chapter Four, Housel compares Warren Buffett, the richest investor of all time, to Jim Simons, the greatest investor of all time. He shares that Buffett has realized one-third of the annual returns that Simons has, yet Simons’ net worth of tens of billions of dollars, is one-fourth of the size of Buffett’s fortune. Why? Simons had half the amount of time to build it.

The lesson that Housel draws from this is that “good investing isn’t necessarily about earning the highest returns, because the highest returns tend to be one-off hits that can’t be repeated. It’s about earning pretty good returns that you can stick with and which can be repeated for the longest period of time.”(1)

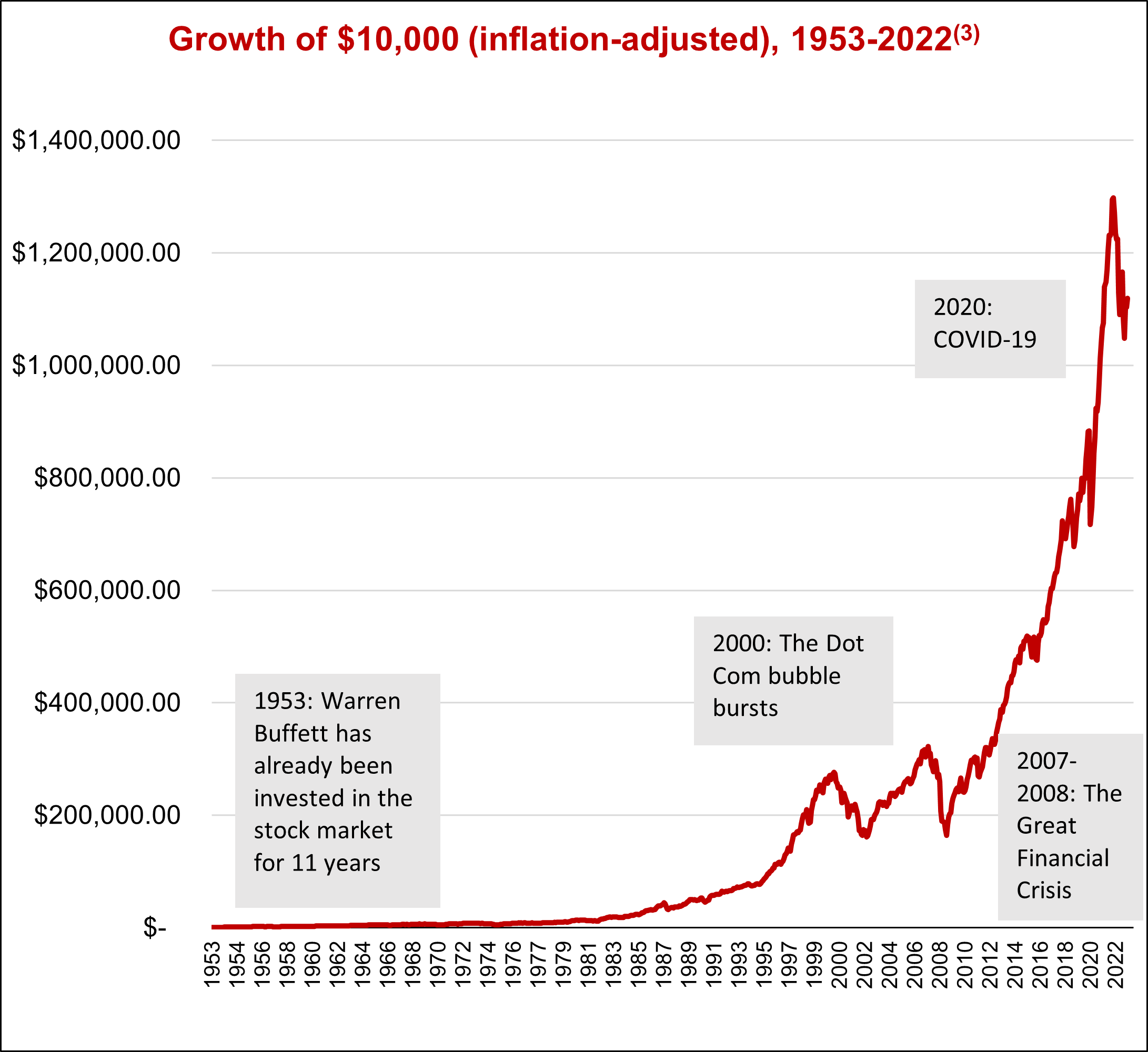

Warren Buffett has been investing since the mid-1900s. To put this timeframe into perspective, it is important to understand how many declines and periods of volatility he has lived and invested through.

Consider just the period of 1953-2022, beginning 11 years since he purchased his first stock, and not including the 20% decline of 2022; Warren Buffett saw the S&P 500 fall by 5% around 207 times, and by 20% almost 12 times. On average, the 5% declines lasted for 43 days, and the 20% declines lasted 354 days, measuring the market high to market low.(2)

However, during the same amount of time, adjusted for inflation and assuming that all dividends were reinvested, the S&P 500 grew by approximately 11,000%, averaging 6.96% a year.

To us, this means that with inevitable volatility, major crashes, recessions, and business failures, a long-term investor in a portfolio of quality businesses such as those found in the S&P 500 has historically recovered, and seen significant growth, despite these declines.

Warren Buffett, substantiated by this historical evidence, has taught us that “the stock market serves as a relocation center – at which money is moved from the active to the patient."(4)

When it comes to investing, patience is the most powerful virtue.

Sources:

(1) Housel, M. (2020). The Psychology of Money. Harriman House Ltd.

(2) Capital Group. (2023). (rep.). Keys to Prevailing Through Stock Market Declines. Capital Group. Retrieved from Keys-to-Prevailing-Market-Declines-4Q21-Stats-Update (capitalgroup.com)

(3) Webster, I. (2023). Stock Market Returns Since 1945. Official Data Foundation. Retrieved from https://www.officialdata.org/us/stocks/s-p-500/1945

(4) Buffett, W., & Bratton, W. W. (1997a). The essays of Warren Buffett: Lessons for Corporate America. Cardozo Law Review.