Smith Falconer Financial Group

July 02, 2023

Our Intelligence on Artificial Intelligence

In 2023, the conversation around Artificial Intelligence (AI) has accelerated rapidly and remarkably. Bill Gates has written that the development of the technology is “as fundamental as the creation of the microprocessor, the personal computer, the Internet, and the mobile phone”. Is this a new “industrial revolution”?

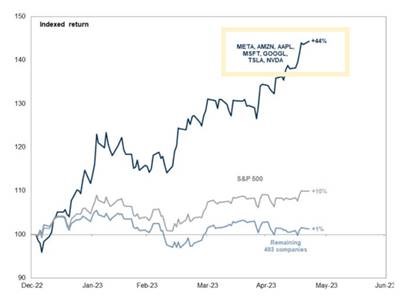

By the end of May, the 7 largest technology companies in the United States accounted for 90% of the S&P 500’s return, a gap that has persisted and widened, reminiscent of past technology bubbles. Is this a new cause for concern, or will AI only have a larger impact on share price performance?

Source: AGF Investments Inc.

To provide perspective, we want to answer two fundamental questions: what is AI, and how are these companies leveraging it?

Artificial Intelligence: explained

Simply put, AI simulates human intelligence with machines. It is powered by data, and the more quality data it is provided, the more efficiently it can provide output. This output is based on it’s understanding of the situation - it’s perception, reasoning, problem-solving and creative abilities. The ideal form of AI is meant to draw conclusions equivalent to those of a rational human.

The type of AI that is dominating headlines right now is Generative AI, the most famous example being ChatGPT. Generative AI does not only use the data it has been provided, but it can also use it to produce its own.

Major technology companies are making AI accessible

The “Big Tech” companies in the graph above are making AI accessible for their consumers. Today, we will discuss businesses and individuals.

AI platforms designed by these companies can be leveraged in many ways by businesses and their employees. For those who use Google Workspace, Bard is a virtual assistant that can summarize meetings, create action plans, and compose and reply to emails, amongst many other capabilities.

Businesses can also build their operational capabilities through platforms such as Microsoft’s Azure AI, on which they will be able to leverage and develop AI “securely, responsibly, and with confidence”.

When interacting with consumers, businesses will be able leverage generative AI using companies such as Meta (parent company of Facebook) and Amazon’s machine-powered advertising and chat functions that are tailored to the consumer interacting with them.

For the individual consumer, these large technology companies also have products to sell, and AI makes their most compelling features possible. For example, Apple integrates AI into their products with a focus on convenience, through add-ons such as facial recognition, predictive text and actions.

There are also AI innovations that are and will be available for individuals to use with a larger “shock factor”. These include Virtual Reality, Tesla’s autonomous driving, and plans for robots and the “Metaverse”.

With this accelerating accessibility, made possible by companies such as Nvidia, who produce the hardware and software that power AI, it's regulation is a critical topic. Companies including Microsoft, OpenAI and Google have been aggressively lobbying governments around the world, pressing for approval on AI regulations. They advocate for greater transparency and the responsible uses of such technology.

Takeaways

Our inspiration for this blog came from the opportunity Maddie Hubbard (our new team member), had to hear takeaways from Yann LeCun, VP and Chief AI Scientist at Meta, at the Toronto Munk Debate on AI.

He suggests that, even with everything we just listed, we still have very far to go as a society, as the growth potential for AI is huge and rapidly evolving. He shared that in 5 years, “we won’t be using ChatGPT anymore”, as it is one of the inaugural iterations of much that is to come.

In the Age of AI, The Smith Falconer Financial Group (SFFG) continues to value active management of portfolios. Global growth managers we employ have high conviction in fundamental analysis and valuation, in order to invest for long term outcomes. These portfolio managers buy businesses where they see improving shareholder value. After all, change is here to stay, and it will continue happening at an increasing rate.