Smith Falconer Financial Group

August 27, 2023

Tax-advantaged donations

Each year, Smith Falconer Financial Group is delighted to support important charitable initiatives, through CIBC Run for the Cure, and CIBC Miracle Day. This month, we began our fundraising for the CIBC Run for the Cure Wonder Women of Wealth (WWoW) team, which Lois proudly leads. The WWoW mission is two-fold: to raise $1-million dollars for breast cancer research; and to spotlight the role of women in wealth management and encourage women across Canada to pursue the career.

Throughout this fundraising, the concept of Gifts of Securities has been top of mind for our team and we have been actively working to ensure that donations can be seamlessly made to the WWoW in this capacity.

Because of this, we felt it was timely to discuss the benefits of gifting publicly traded securities to charitable initiatives that are important to you.

The two main benefits are: capital gains tax savings, and the donation tax credit. To encourage donations of securities to registered Canadian charities, the government eliminates the capital gains tax that Canadians are required to pay on dispositions of securities that have appreciated in value, and offers a varying tax credit based on the province you live in1.

To illustrate these benefits, we share an example from Ontario, created by Jamie Golombek, Managing Director, Tax and Estate Planning, and Kate Lazier, Director of Philanthropy and Legacy Planning, of CIBC Private Wealth.

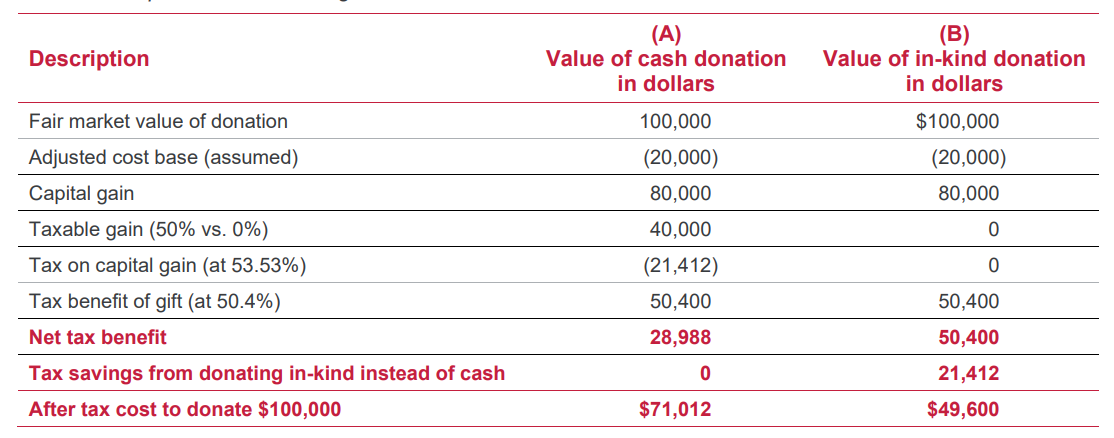

The below chart depicts the difference in tax savings from a cash donation vs. a Gift of Securities (in-kind) donation.

In this example, the donor has securities worth $100,000 that have an adjusted cost base of $20,000. The donor is in the top tax bracket in Ontario, with a marginal tax rate of 53.53% and a donation tax credit rate of 50.4%.

Source: The tax incentive to gift securities

As outlined above, by donating securities as opposed to cash, the donor saved $21,412, and just over 50% of the donation was therefore “covered” by the net tax benefit.

It is also worth noting that if these securities had depreciated in value, while the donor would not be saving on capital gains tax, they would still have the benefit of claiming a capital loss, similar to routine dispositions of securities.

If you have any questions, know that Smith Falconer Financial Group is passionate about supporting clients in making extraordinary contributions to society through philanthropy and are always here to provide guidance in doing so. We are pleased to serve national charitable institutions – Centre for Addiction and Mental Health Foundation, The Princess Margaret Cancer Foundation and The Children’s Aid Foundation of Canada, with their stock donation programs led by our valued team member Lira Lamaca.

1We write this is 2023, with it in mind that there is a possibility of a reduction in the capital gains tax savings in 2024, as the 2023 Federal Budget proposes.