Smith Falconer Financial Group

April 08, 2024

Financial Literacy with Mimi Hijleh, CIM®

In March, Smith Falconer Financial Group was proud to host Mimi Hijleh, Partner, EdgePoint Wealth Management, for a session focused on financial literacy.

Her presentation highlighted our commitment to delivering information that is relevant to our valued clients of all generations. We strongly believe that these topics are just as applicable to the veteran investor as they are to the novice investor.

Mimi discussed inflation, the power of compounding, understanding volatility in the stock market and the importance of having a long-term outlook.

Similar to Morgan Housel’s style of writing in The Psychology of Money, a book we routinely recommend to clients, Mimi explains concepts through the use of relevant, effective examples. We wanted to share a couple of them today.

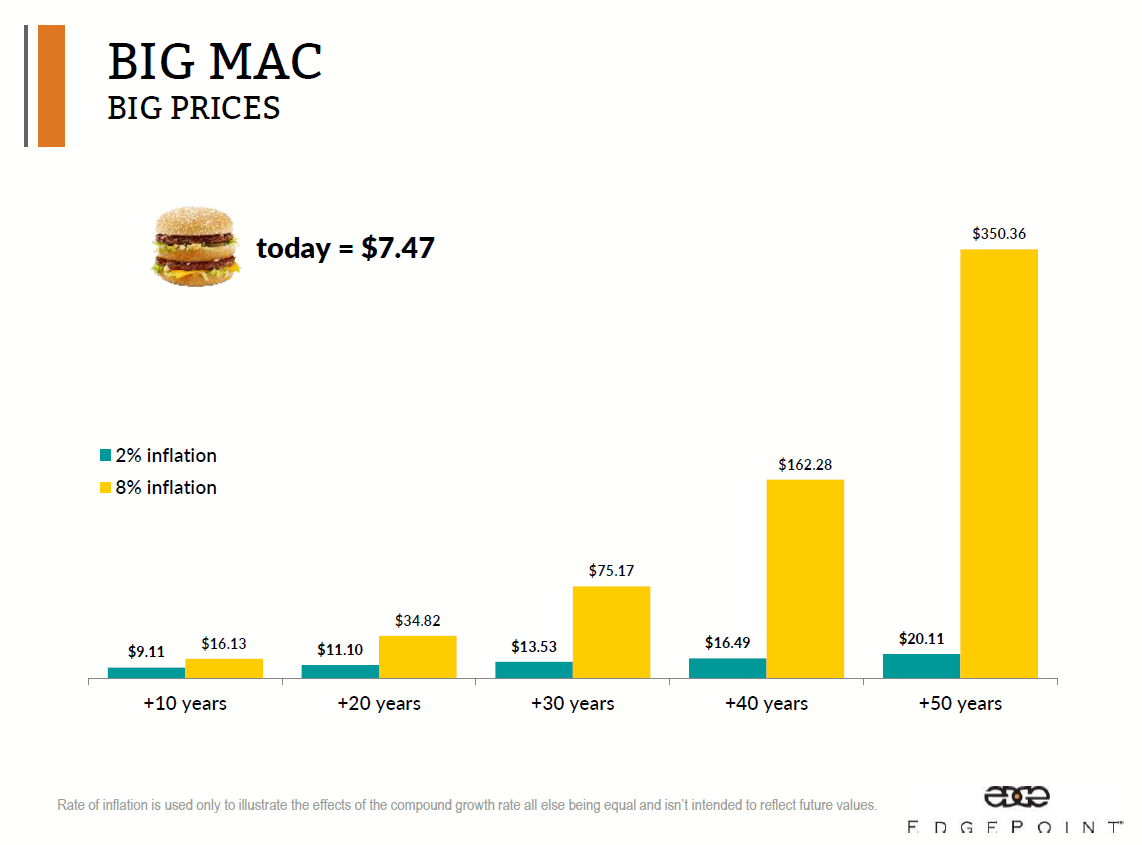

Inflation

Inflation is defined as the overall rise of prices of goods and services in the economy. In 2000, the average price of a Big Mac was $2.85, today it is $7.47. This equates to a 4% annual inflation rate over the past 23 years.

We often discuss the importance of bringing inflation down to 2% and this graph emphasizes just how significant that is. In comparing 2% inflation (green bar) to 8% inflation (yellow bar), it is illustrated just how dramatically the price of the Big Mac could rise if inflation were to stay high over the long-term.

This is why investing is so important, to maintain and increase purchasing power, despite inflation. Keeping money in your hypothetical “piggy bank” simply erodes it’s value over time.

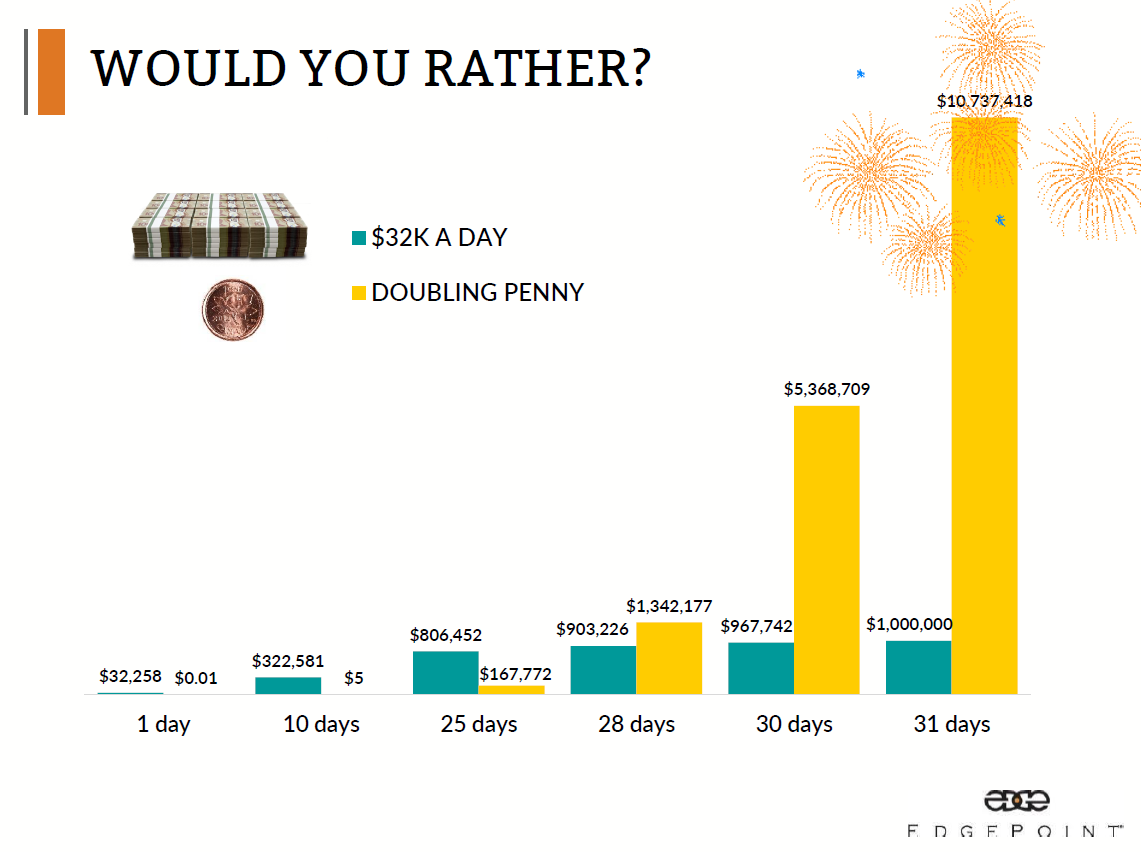

The power of compounding

A powerful example of the power of compounding, is the question – would you rather receive $32,258.06 a day for the next 31 days, or a penny that doubles every day for the next 31 days?

Chose the penny? You would end up with over 10x the amount in 31 days. However, the real benefit is not seen until day 28, when the compounding effect on the penny, surpasses the option of taking the $32,258.06 a day.

Mimi explains that this is the difference between exponential and linear growth. This goes hand in hand with having a long-term outlook. With time, you not only experience a return on your original investment, but also a return on your investment return. Time is the greatest advantage for compounding growth.

Mimi referenced a quote from The Psychology of Money multiple times throughout the presentation, reinforced by each of her examples.

“If you understand the math behind compounding, you realize the most important question is not, “How can I earn the highest returns?”. It’s, “What are the best returns I can sustain for the longest period of time?”

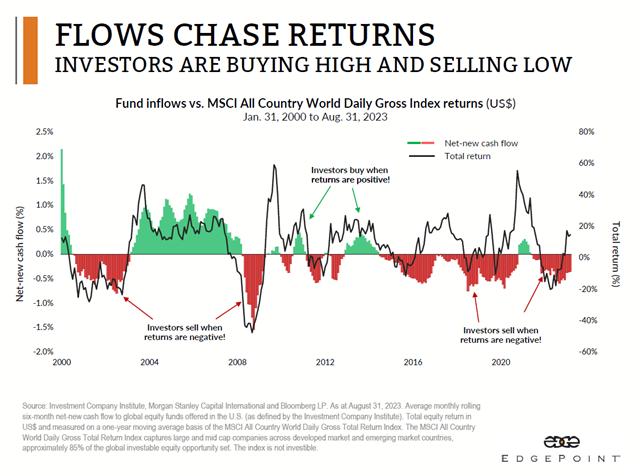

Volatility and emotions in the stock market

“If making money was anything but brutally difficult, we would all be rich. Volatility and emotions often get in the way of great investment returns”.

Mimi considered the mentality of “buying low and selling high”. The below graph’s black line depicts the return of the global equity market over the past 23 years. The green area shows when investors have bought, and the red area shows when investors have sold.

The conclusion is that investors are buying when markets are up, and selling when markets are down.

When markets are up, investors have a fear of missing out. When markets are down, fear of losing capital permanently kicks in.

In conclusion

Mimi’s presentation re-enforces that patience and time are the most important attributes in investing. With confidence, experience, and a long-term strategy, investors are best positioned to achieve their long-term goals.

This is why her presentation is of importance to all generations. The earlier an investor understands these concepts, the greater the benefit derived from years of compounded growth.