Bram Houghton

June 18, 2022

Commentary Weekly update Weekly commentaryWeekly Market Update - June 17th, 2022

At the risk of being repetitive, markets were again challenged this week by the current landscape of battling inflation with rate hikes and how both will impact economic development moving forward.

US Fed raised interest rates on Wednesday by 0.75%, its biggest rate hike in almost three decades.

The Bank of England raised interest rates by 25 bps to 1.25% as the Bank tries to curb inflation. New data has shown that U.K. inflation soared to a 40-year high of 9% annually in April as food and energy prices rose.

The Swiss National Bank surprised markets with a 50 bps hike, the first rate rise since 2007.

Eurozone confirmed inflation for May at 8.1% year-over-year and 0.8% month-over-month. The European Central Bank has indicated that several 50 basis point rate hikes are possible if inflation worsens in the Eurozone.

U.S. weekly jobless claims fell versus expectations. They remained close to a five-month high, possibly a sign that layoffs have increased slightly from record-low levels.

U.S. housing starts fell in May and U.S. retail sales fell unexpectedly by 0.3% in May from April, below the forecasted increase of 0.2%.

The Bank of Japan has kept its short and long term rate targets unchanged, as expected, to support the economy's recovery from the COVID-19 pandemic.

The city of Beijing has declared that its latest Covid outbreak is under control, while Shanghai will conduct mass testing every weekend through end of July.

West Texas Intermediate crude oil prices slipped on Friday driven by interest rate hikes, while new sanctions on Iran limited losses.

Weekly change: TSX: 2.7% ; DOW: 5.9%; S&P 500: 4.0%; NASDAQ: 6.4%; GOLD: 0.1% WTI:

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

MacroMemo - June 14 – June 27, 2022 by Eric Lascelles Link to Article

Rapidly rising prices – As evidenced by the latest U.S. Consumer Price Index (CPI) report, inflation continues to rise and to exceed consensus expectations. Food inflation has also not yet cracked, however Base metal and lumber prices have begun to fall as well as used car and dwelling costs appearing to have peaked.

Falling economic forecasts – Economic forecasts continue to sour with the World Bank and the OECD both slashed their global growth outlook for 2022. RBC Economics also significantly downgraded forecasts for both 2022 and 2023 – just from a weaker starting point and to a weaker end point.

Rising recession risk – A recent poll by the Financial Times finds that 70% of a poll of leading academic economists anticipate a U.S. recession next year. This does not mean there is a 70% chance however - those 70% of the economists could have a recession as their base case scenario, but with a mere 51% probability, while the other 30% of the economists might assign a 0% chance to a recession.

Slightly improving supply chains – Supply chains are getting slightly better. At the global level, port congestion is still problematic, but it does appear to be significantly less intense than last fall, and is perhaps beginning to improve again. Shipping costs are beginning to contact and supplier delivery times have improved.

COVID-19 whiplash in China - Just weeks after reopening, a significant swath of Shanghai has now been shuttered again. Despite any expedient resolution, it appears that China’s zero-tolerance policy toward the pandemic is just barely manageable given the highly infectious variants now circulating.

JUNE 16TH POST-HIKE UPDATE by CIBC Asset Management Link to Article

CIBC Asset Management portfolio managers and analysts share their reaction to the U.S. Federal Reserve Board (Fed) raised its benchmark interest rate by 75 basis points.

Equities

"The Fed is showing they are committed to get ahead of the curve with respect to inflation. They are orchestrating a necessary slowdown by raising rates, but they are re-establishing credibility and the possibility of a soft landing." — Craig Jerusalim, Senior Portfolio Manager, CIBC Asset Management

Positioning

Canada: In many of our Canadian portfolios, we've an overweight to energy, financials, etc. These are areas that tend to outperform in higher-rate environments.

Global: We always operate with a capital-preservation mindset and aim to be more conservative in our approach to valuation and forecasting than the market. We continue to focus on investing in high-quality businesses with strong management teams, trading at attractive valuations that will outperform over the long-term.

Fixed Income

"What would have been a surprise as little as a week ago, came as no shock to investors today as the Fed hiked its rate by 0.75%. The Fed took the opportunity to move quicker to bring the Fed Funds rate closer to its neutral target, given the futures market had already priced in the more aggressive action. A similar move remains priced into the futures market for the Fed’s September meeting, which would take the Fed Funds rate to 2.25%-2.50%." — Pat O'Toole, Vice President, Global Fixed Income, CIBC Asset Management

Positioning

We're focused on adding to lower beta shorter-dated corporates where valuations are attractive but credit risk is lower—improving portfolio yield in a defensive manner. As yields move up, we’re looking to leg-into a longer portfolio duration.

Is The Bond Market Finally Signaling A Bottom? Link to Article

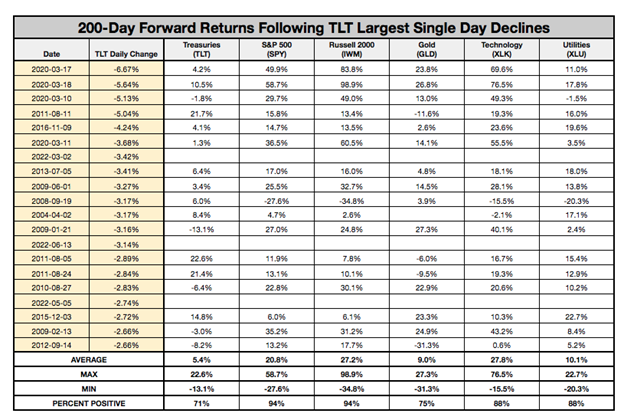

Treasuries had one of their worst days in the past 20 years. Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy, government bonds had their 13th biggest decline since the fund’s inception back in 2002.

After 200 days, we can say pretty confidently that risk asset prices are headed in the right direction again. Large-caps have delivered solid returns on average. Small-caps and tech have outperformed. Utilities have underperformed. Treasuries and gold have delivered surprisingly good and consistent returns. All of this is pretty consistent with what we’d expect to see in a generalized risk-on environment. It definitely feels like there’s a bit of a small sample size fallacy that must be considered when accounting for those 20%+ return figures, but I do also feel that they’re directionally correct.

So what can we conclude here?

Yield spikes like the one we saw earlier this week don’t necessarily indicate a bottom in the markets, but they do seem to suggest that some type of inflection point is nearing. During COVID, for example, the yield spike marked the swift return of risk assets. In that case, it did indeed signal a bottom. Other instances are much less clear.

Global Insights

The structure of the world’s supply chains is changing – Networks of aircraft, email and container ships not to mention railways and pipelines, have tied together businesses across the globe. Over the past five years the tensions pulling at this fabric have been growing stronger.

Explainer: What are the consequences of yen's fall to a 24-year low? The yen has long been the currency of choice for investors undertaking so-called carry trades, which involve borrowing in a low-yielding currency like the yen to invest in higher yielding currencies like U.S. or Canadian dollars. The yen's decline also boosts the attractiveness of its stock market among foreign investors who consider it undervalued versus European and U.S. markets.

Household debt burden eases in Canada ahead of steep rate hikes – Household credit market debt as a proportion of disposable income dropped to 182.5 per cent, from a record 185 per cent in the final quarter of 2021, Statistics Canada reported Monday. Household debt grew 2 per cent, compared with a 3.3 per cent gain in disposable income in the first three months of the year.

Half a million passengers faced delays on international flights at Pearson in May – Scenes of endless security and customs queues at large Canadian airports -- and Pearson in particular -- have played out all spring, with peak travel season weeks away.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.