Bram Houghton

January 13, 2025

Commentary Weekly update Weekly commentaryMarket Update - December 23rd - January 10, 2025

In a Nutshell: Markets have been volatile to begin 2025 with the most recent U.S. jobs data causing bond yields to spike and sending ripples through equity markets. The jobs data showed strength that further validated the FED’s pause on rate cuts and sticky inflation.

U.S. Labour Markets

The U.S. economy unexpectedly added more jobs in December, an increase that will factor into how the Federal Reserve approaches possible future interest rate cuts. Nonfarm payrolls increased by 256,000 jobs last month after rising by a downwardly revised 212,000 in November, well above forecasts of 164,000. U.S. private payrolls growth slowed in December, but the labour market showed more than enough strength through Nonfarm payrolls and the latest JOLTs Job Openings reports to show considerable strength that caused bond markets to react.

Initial jobless claims in the U.S. have decreased to 201,000, significantly lower than the forecasted 214,000 and the previous figure. The decline suggests improved employment conditions and potentially increased consumer spending. As a leading economic indicator, this lower-than-expected reading is likely to boost market confidence and strengthen the USD against other currencies, reflecting economic resilience and growth potential.

The latest JOLTs Job Openings reports a significant rise in job vacancies, reaching 8.1 million. This figure exceeds forecasts and marks a significant increase from the previous 7.8 million. The rise in job openings indicates active recruitment by businesses, which supports economic growth and could boost consumer spending. This positive labour market development is seen as bullish for the USD, reflecting economic resilience and increased opportunities for job seekers.

U.S. Economy

The ISM Manufacturing Purchasing Managers Index (PMI) revealed an unexpected upturn in the manufacturing sector with the actual figure coming in at 49.3, indicating an improvement in the manufacturing industry. This was above the expected 48.2 and is seen as positive or bullish for the USD, indicating potential strength in the currency.

U.S. Wholesale Inventories unexpectedly declined by 0.2% in the latest economic data, contrasting sharply with the forecasted 0.1% increase and the previous month's 0.2% growth. This decrease suggests a faster turnover of goods at the wholesale level, potentially signaling increased consumer demand. Wholesale inventories are a key economic indicator of market health and consumer activity. While higher inventories often reflect weaker demand and are bearish for the USD, a lower-than-expected reading, like this one, is typically seen as bullish for the currency.

Canadian Economy

Canada's economy gained a net 90,900 jobs in December, largely in full-time work, and the jobless rate edged down to 6.7%. While the report was strong and favourable for the Canadian economy, it is still widely expected that the Bank of Canada (BoC) may lower rates again in January.

Canadian manufacturing activity increased at the fastest pace in nearly two years as inventory accumulation in anticipation of trade tariffs by U.S. buyers provided a measure of support for export sales. The Canada Manufacturing Purchasing Managers' Index (PMI) rose to 52.2 in December up from 52.0, its highest level since February 2023 and the fourth straight month above the 50.0 mark indicating expansion.

Eurozone and UK Economy

Euro area inflation rose as expected in December, with a 2.44% year-over-year increase and a 0.1% month-over-month gain. Core inflation excluding food and energy, also matched forecasts at 2.7% year-over-year. These figures are slightly higher than the previous month's rates. Energy prices significantly influenced the inflation rise, but the European Central Bank (ECB) is unlikely to be alarmed.

Germany reported higher-than-expected inflation of 2.9% year-over-year, while Italy and the Netherlands fell short of expectations, balancing the overall euro area figures.

Germany's unemployment rate remained stable at 6.1% in December, according to data, slightly lower than the 6.2% predicted by economists. While the jobless rate has held steady, there are signs of a potential slowdown in the labour market. The number of jobless claims increased by 10,000 on an adjusted basis in December, a significant rise from the 6,000 reported in November.

Asian Economy

The People’s Bank of China (PBOC) plans to cut interest rates further in 2025, as it brings monetary policy in line with traditional policies in the U.S. and Europe. The PBOC said it will cut interest rates from the current level of 1.5% “at an appropriate time”.

China’s services sector expanded in December at the fastest pace in seven months supported by higher domestic demand despite export businesses declining. The Caixin services PMI came in at 52.2 in December, compared to expectations for a print of 51.4. The reading was higher than the 51.5 seen in November. This indicates that Chinese manufacturing has continued to expand to end 2024.

Energy

The latest report from the Energy Information Administration (EIA) indicated a smaller than expected decline in U.S. crude oil inventories, pointing to weak market demand. Commercial crude inventories dropped, significantly less than the projected and a slower decline compared to the previous which suggests a diminishing pace of demand. Despite this, cold weather in the U.S. and Europe, and potential supply disruptions from more sanctions on Russia pushed Brent Crude Oil prices past $80 for the first time since October.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| Last Week | 1.1% | -0.5% | -0.6% | -0.5% | 0.2% | 4.8% | 0.9% |

| This Week | -1.2% | -1.9% | -1.9% | -2.3% | 1.5% | 3.5% | 2.4% |

Market data taken from https://www.marketwatch.com/

10 investing themes for 2025 by Larry Adam, CIO, Raymond James Link to Article

The outlook for 2025 builds on a strong 2024, with continued economic growth and healthy financial markets, but also introduces challenges that may temper expectations. Here 6 of the 10 most notable trends for 2025 according to Larry Adam, Chief Investment Officer for Raymond James:

Cautious Optimism: While confidence surged in 2024, high valuations and policy uncertainties (e.g., taxes, tariffs) leave little room for error. Inflation surprises or limited Fed action on rates could increase market volatility.

Continued Economic Growth: The U.S. economy is expected to grow by 2.4% in 2025, driven by a resilient consumer, steady job growth, fiscal spending (e.g., Inflation Reduction Act, CHIPs Act), and investments in AI and other transformative sectors.

Moderated Equity Performance: Equity fundamentals remain strong, but gains are likely to be more muted than in 2024 due to high valuations and cautious investor sentiment. The S&P 500 target for 2025 is 6,375.

International Markets Lag: U.S. equities are expected to outperform globally, though Japan shows promise with economic improvements and a shift away from deflation.

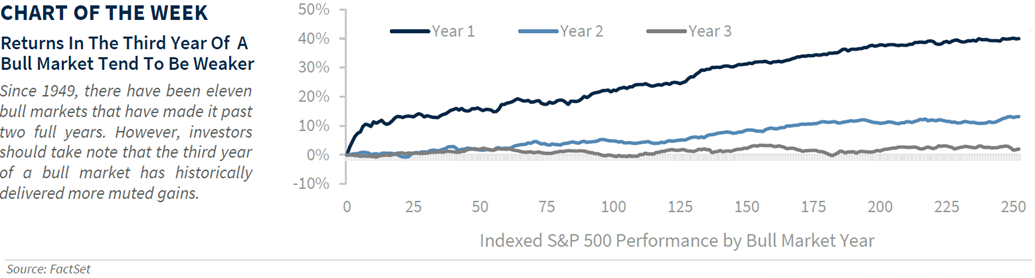

Challenging segment of the Bull Market: The next phase of the bull market will likely bring more volatility and lower returns, requiring a focus on quality, fundamentals, and active management.

Diversified Asset Allocation: Elevated uncertainties underscore the importance of a balanced and resilient portfolio. A long-term strategy and diversification are crucial to managing risk and sustaining wealth growth amid potential volatility.

Chart: Returns in the 3rd Year of a Bull Market

Investors should remain prudent, adapt to changing conditions, and prioritize quality and strategic asset allocation.

MacroMemo - January 7-27, 2025 by Eric Lascelles Link to Article

2025 outlook recap

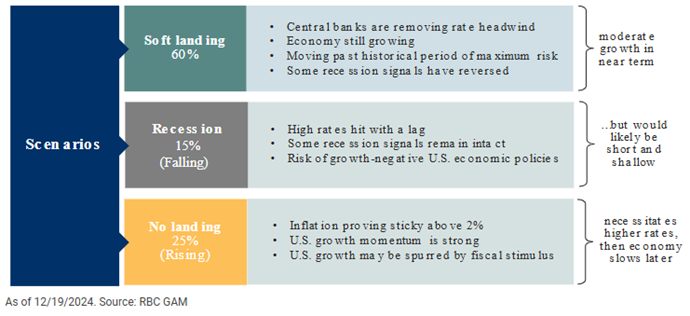

Further to previous reporting on key themes for 2025, RBC GAM places weightings on all the potential outcomes for 2025:

Soft landing still most likely, but recession no longer next most likely

Tariffs

The Trump administration is using tariffs as a negotiation tool for trade and defense policies. It is expected that Tariffs will be implemented, but negotiated down from where they currently stand:

Tariffs as Leverage

- A proposed 25% tariff on Canada and Mexico is tied to border control policies.

- Trump has linked UK tariff reductions to increased fossil fuel investments in the North Sea.

Defense Spending Pressure

- Trump has pushed NATO allies to increase defense spending from the 2% GDP target to 5%, a number that far exceeds current levels. Even the U.S. spends only 3.4%.

- Increased defense spending by allies could boost arms manufacturers and defense-related jobs, lead to U.S. military adjustments as allies strengthen their forces, though geopolitical pressures may sustain high U.S. defense spending and redirect government resources away from social programs or private-sector productivity due to higher military budgets.

China’s Trade Resilience

- China’s economy is less dependent on U.S. trade than assumed, with only 2.5% of its output consumed by the U.S.

- Most Chinese exports go to Asia, Europe, and other regions, limiting the impact of U.S. tariffs.

- Broader challenges lie in limiting China’s access to American technologies, though China could reciprocate.

Overall, tariffs and defense spending are tools for negotiation and geopolitical strategy but carry economic trade-offs and implications for global military and trade dynamics.

Canadian political change underway

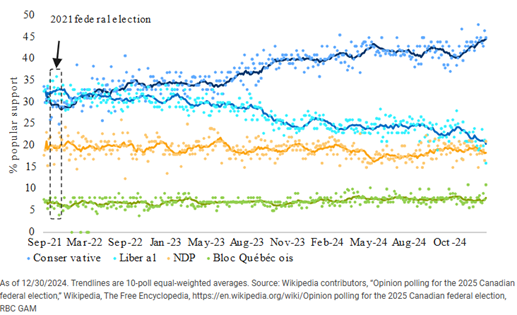

Canada's political landscape is undergoing significant changes as the country prepares for a federal election by October 2025.

Leadership Transition in the Liberal Party

Prime Minister Justin Trudeau announced his resignation on January 6 but will remain in office until a new Liberal leader is chosen. The leadership vote must typically occur within five months, though urgency may expedite the process given the upcoming election and pressing policy negotiations, including tariffs with Trump.

Election Timing and Political Dynamics

Parliament has been postponed until March 24, eliminating the possibility of a winter election. A spring election is most likely, though a Liberal-NDP deal could push it to the fall. Current polls show the opposition Conservative Party maintaining a strong lead, with the Liberals potentially falling behind the NDP. A majority Conservative government seems likely unless voter sentiment shifts dramatically.

The Conservative Party’s lead widens

Policy Implications

The Conservative Party’s economic platform is seen as more supportive of productivity, economic growth, and business interests compared to current Liberal policies. The prorogation halts all pending legislation, adding pressure for political and policy decisions once Parliament resumes.

In this shifting landscape, the Liberal Party faces an urgent need to stabilize its leadership and policy direction to remain competitive in the election.