Bram Houghton

July 05, 2022

Economy Weekly update Weekly commentaryWeekly Market Update - June 30th, 2022

Stocks sank on Friday to extend what is the worst first half of a year for global share prices on record, as investors fret that the latest show of central bank determination to tame inflation will slow economies rapidly.

Central bank chiefs from the U.S. Federal Reserve, the European Central Bank and the Bank of England met in Portugal this week and voiced their renewed commitment to control inflation no matter what pain it caused.

Real gross domestic product (GDP) in Canada rose 0.3% in April, led by growth in goods-producing industries while advanced data suggest that real GDP decreased 0.2% in May.

U.S. consumer spending rose less than expected in May as motor vehicles remained scarce while higher prices forced cutbacks on purchases of other goods, another sign that the rebound in economic growth early in the second quarter was losing steam.

U.S. first-quarter GDP shrank at a 1.6% annual pace against expectations. It is the first contraction since the start of Covid-19 and the second-quarter GDP is expected to grow less than 1%.

The U.S. trade deficit in goods fell in May. The decline could give a lift to the U.S. gross domestic product in the second quarter. An advanced estimate of wholesale inventories showed an increase in May. Retail inventories rose for the month, according to an early estimate.

U.S. durable goods orders rose month-over-month in May ahead of the consensus; the third straight monthly gain as orders for transportation equipment led the increase.

German state inflation posted a surprise decline, falling 0.1% month-over-month in June and was up by 7.5% year-over-year.

Spain, however, showed that 12-month inflation rose to 10.2% in June, the first time it surpassed 10% since April 1985.

The People’s Bank of China pledged to keep monetary policy supportive to help the nation’s economy by boosting credit rather than lowering interest rates. Chinese stocks also marked their best month in nearly two years supported by signs of an economic recovery after the easing of COVID-19 restrictions

Oil is heading for the first monthly decline since November as OPEC+ completed the return of output that it halted during the pandemic.

Weekly change: TSX: -1.1%; DOW: -2.3%; S&P 500: -3.2%; NASDAQ: -5.0%; GOLD: -1.2% WTI: -1.0%

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

We’re Not Already in a Recession Brian S. Wesbury & First Trust Economic Research Department Link to Article

The Atlanta FED model projections, superficially place the odds of having two consecutive quarters of negative growth are close to 50%. That’s important, because two consecutive quarters of negative growth is considered a recession by the strictest definition.

National Bureau of Economic Research, however, uses a mosaic of factors to determine whether we are in a recession, such as jobs, manufacturing and real incomes. In the first five months of the year, manufacturing production is up at a 6.6% annual rate, nonfarm payrolls are up at an average monthly pace of 488,000, and the unemployment rate has dropped to 3.6% from 3.9%. Meanwhile, in April, both “real” (inflation adjusted) consumer spending and real personal income (excluding transfers) were at record highs.

First Trust Economic Research team do expect a recession, with a lag, after monetary policy gets tight which, it must continue to do to steer current inflation back towards the Federal Reserve’s 2.0% target. But that means a recession starting in late 2023 or in 2024, not now.

Please note that this is not a prediction being made by the Wicks Houghton Group

MacroMemo - June 28 – July 11, 2022 by Eric Lascelles Link to Article

Ukraine war grinds on. Economic restrictions remain more likely to rise than fall. Lithuania has begun to block Russian rail shipments to the isolated Russian outpost of Kaliningrad on the Baltic. The EU recently announced it will greatly limit its imports of Russian oil, with G7 likely to follow. Meanwhile, Russia blocked its natural gas from flowing to several European countries. Germany is now receiving 40% less natural gas than normal from Russia via its main pipeline, albeit for what Russia says are maintenance-related reasons.

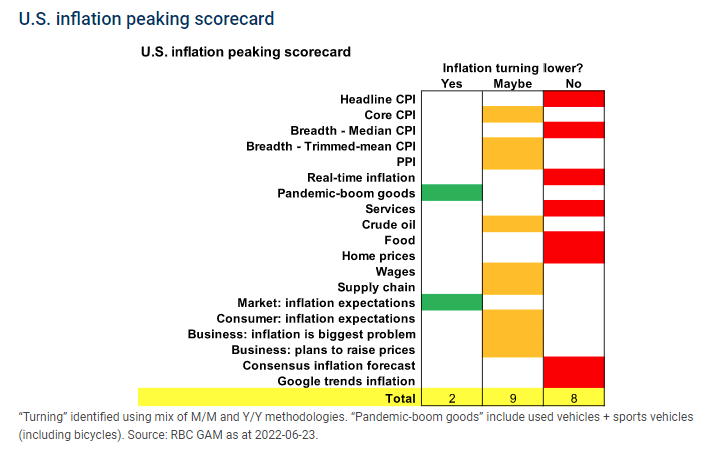

Inflation peaks? RBC GAM have put together an inflation scorecard using 19 different inputs to determine if inflation will turn a corner (pictured below). Of the 19 inputs, 8 presently say “no”, 9 say “maybe” and 2 say “yes.” This may not sound like much, but two months ago all 19 said “no”. There is progress occurring, even if very few are firmly in the “yes” column.

What should turn first? Transport, Housing and Food are still the primary drivers of inflation. Some notable trends we’ve seen that supports Inflation peak include used car market and housing markets weakening, Copper prices fell recently on global growth concerns and Lumber prices have fallen sharply. Supply chain have also continued to improve and Shipping costs eased further. Crude oil prices, on the other hand, remain elevated as Russia’s invasion drags on.

Economic signals hold steady. Consumer and business confidence have fallen significantly in the face of many simultaneous headwinds. Despite this drop in sentiment, corporations are not yet significantly scaling investment and hiring plans. There are hints of diminished activity, but nothing major, and nothing in line with the material drop in business confidence recently observed. From the consumer standpoint, the inflation-adjusted amount of spending in 2022 has definitely weakened, but it has not seen a sudden collapse as one might expect if a recession were beginning right now.

The Monetary Surge Continues to Ebb Brian S. Wesbury & First Trust Economic Research Department Link to Article

Today the Fed released May data on the M2 money supply as it signals that the monetary surge propelling US inflation numbers to a four-decade high seems to be slowing.

As a result, the 12-month change fell to 6.6%, the slowest growth rate since the pre-pandemic days of 2019. Six percent growth is what we would consider “normal” from a historical perspective, so this represents welcome progress. So far in 2022, the money supply has grown at a modest 3.1% annualized rate.

High inflation is likely to linger with the expansion of the money supply during 2020 and 2021 and it is the First Trust Economic Research teams’ opinion that if the Fed really does want to achieve a soft landing for the US economy, the best option in their opinion is to somehow keep M2 growth at a below trend rate in the 2-4% range for the next few years.

Global Insights

The U.S. Supreme Court on Thursday imposed limits on the federal government's authority to issue sweeping regulations to reduce carbon emissions from power plants in a ruling that will undermine President Joe Biden's plans to tackle climate change.

"We see this pullback as an attractive opportunity," Manav Gupta, an analyst at Credit Suisse, wrote to clients in a note on Tuesday. Over the last two weeks, the S&P 500 energy index has lagged behind the broader market by 18.5 per cent, following growing calls of a possible global recession ahead.

Some 54% of flights to the four largest airports were bumped off schedule in the seven days between June 22 and 28. More than 44 per cent of the 4,815 flights were delayed while 8.5 per cent were scrapped altogether.

Russia is getting higher prices for its oil as strong demand in Asia undermines western powers’ efforts to curb revenues to Moscow’s war machine. G7 leaders agreed on Tuesday that they want to urgently evaluate how the price of Russian oil can be curbed to limit the energy proceeds that the Kremlin uses to finance its conflict in Ukraine.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc. If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.