Bram Houghton

July 21, 2022

Economy Weekly update Weekly commentaryWeekly Market Update - July 15th, 2022

Market update

A tough week for the markets with recession risks rising with more aggressive rate hikes seemingly on the agenda, though a positive end to the week with some more encouraging data to suggest that consumer spending and economic activity isn’t going to fall off a cliff amidst the aggressive hiking cycle.

The Bank of Canada raised its key interest rate to 2.5% by an entire percentage point, a move not seen since 1998.

Oil prices fell as fears of reduced demand for the commodity amid higher interest rates rose. This as well as the surprise rate hike hit the Canadian Equity markets significantly this week.

The U.S. inflation rate increased to 9.1% in June year-over-year, the highest since November 1981. Energy prices rose 41.6% and natural gas rose 38.4%. This elevated concerns of greater rate hikes on the horizon.

U.S. initial jobless claims increased versus expectations as more companies announced job cuts. Continuing jobless claims fell, however, and the Labor Department confirmed that the economy created 372,000 jobs in June.

U.S. producer price inflation jumped to month-over-month in June, above consensus. Goods prices jumped higher in May, with over half of the increase due to an 18.5% rise in gasoline prices.

U.S. retail sales surprised to the upside in June versus estimates of recovering from a contraction in May.

U.K. retail sales fell for the third consecutive month as inflation hit consumers. Despite this, Britain's economy grew unexpectedly in May, driven by a rise in doctor appointments but also broader demand for things such as holidays, according to data that could reassure the Bank of England about its plans to keep on raising interest rates.

European recession risks have grown, with Russia threatening to reduce gas flows further to Europe.

New Covid-19 measures were announced in China, the world biggest importer of crude oil, and as fears of a global economic slowdown weighed heavily on the demand outlook.

China's exports rose at their fastest pace in five months in June as factories revved up after the lifting of COVID lock downs, but a slowdown in imports, fresh virus flare-ups and a darkening global backdrop pointed to a bumpy road ahead for the economy.

Weekly change: TSX: -3.3%; DOW: -0.2%; S&P 500: -0.9%; NASDAQ: -1.6%; GOLD: -0.6% WTI: -6.9%

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

MacroMemo - July 12 – July 25, 2022 by Eric Lascelles Link to Article

Inflation debate continues

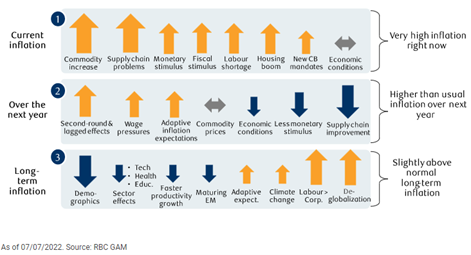

Inflation is extremely high and potentially peaking with a recent decline in Commodity prices on the potential of demand destruction, easing supply chain constraints and lower inflation expectations.

Cleveland Fed’s nowcast calls for a materially lower month-over-month U.S. inflation print in July though the month is still young.

The decline in market-based inflation expectations merits particular attention given its magnitude 5-year inflation expectations dropped from 4% to 2.5%.

As some inflation pressures ease, it is important not to expect a sudden collapse in inflation. It has been previously detailed the extent to which inflation pressures have broadened, complicating any subsequent normalization.

Confidence and activity weaken

Canadian sales expectations have plummeted, though with the significant caveat that the question merely asks whether the growth in sales will slow, rather than whether the level of sales will decline.

Hiring and capital expenditure plans are both falling, U.S. Cap-Ex expectations dropping off quickly, U.S. initial jobless claims trending higher.

Data emerges from real time card spending revealing a deceleration to the point that consumer activity is now just barely above year-ago levels.

Recession risks rise

RBC GAM team continue to view a recession as more likely than not, with perhaps a 75% chance of triggering over the next 18 months. This is no longer an outlier view.

The bond market is also pivoting toward a recession view. The U.S. 2-year to 10-year curve is now slightly inverted and two other key bond indicators also racing toward inversion.

Any recession, should it happen, would likely be of a middling depth – perhaps a 2.5% decline in output spanning two or three quarters.

It would likely start later this year or in early 2023. Of course, that decline would be in contrast to a “normal” 2% rise in GDP.

Using some reasonable market assumptions, this sort of output swing would leave a U.S. unemployment rate of just shy of 6%, and a Canadian unemployment rate of just over 7%. These are undesirable levels, but not nearly as dire as those reached during the prior few recessions.

ECONOMIC FLASH! Bank of Canada: into the neutral zone by Karyne Charbonneau Link to Article

Exceeding most expectations, the overnight rate was raised by 100 basis points to 2.5% in what is the biggest increase by the Bank of Canada since 1998 and the highest level since 2008.

The policy rate now sits in the middle of the estimated neutral rate range of 2-3%. In addition, the Bank will continue with quantitative tightening.

The statement cites clear excess demand in the economy and inflation expectations as drivers of high inflation and reasons for front-loading interest rate increases.

The Bank added a box on the risk of a wage-price spiral. The box implies that they would have to tighten monetary policy a lot more in the event that a wage-price spiral emerged.

The inflation forecast was revised up significantly, with the Bank now expecting CPI inflation to stay around 8% for the next few months.

The Bank forecasts that inflation will end the year at 7.5% (up from 4.5% previously) before easing slower than forecasted in April to 3.2% by end 2023 (previously 2.4%).

The economic growth forecast was revised down due to lower supply, as supply chain disruption is assumed to weigh more and for longer on activity than expected in April, lower household spending in the face of higher inflation and higher interest rates, and slower global growth.

Overall, markets had a relatively muted reaction despite the surprise, which suggests that participants buy the qualification of "front-loading" rather than view that the larger hike suggest a much higher finish line.

Global Insights

Amazon announced Friday it would create more than 4,000 permanent jobs in the U.K. in 2022, defying a wave of job cuts in the tech industry. The roles will include job functions in software development, product management, and engineering, as well as operational duties in fulfillment centres, sort centres and delivery stations.

Twitter’s fight with Elon Musk to enforce his deal to buy the social media platform could attract scrutiny from the U.S. securities regulator over whether Musk has misled the market during the course of the deal.

Utah's Great Salt Lake dropped to its lowest recorded level this month amid a two-decade drought, a grim milestone as researchers and politicians point to grave threats to wildlife and people along its receding shores. The nearby metropolis of Salt Lake City is already subject to dust storms that experts fears could get worse.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.