Bram Houghton

August 02, 2022

Economy Weekly update Weekly commentaryWeekly Market Update – July 22nd, 2022

Market update

A calmer week in the markets with earnings season starting reasonably well, despite Snap making a notable revenue miss on Friday. The Volatility Index trended downwards throughout the week to levels not seen since March 2022.

Canada’s June inflation rate hit the highest level since January 1983 as the consumer price index (CPI) rose to 8.1% versus an expected 8.4% year-over-year. This was supported by a 54.6% surge in gasoline prices. Excluding gasoline, the CPI rose by 6.5% annually, up from a 6.3% increase in May.

Canadian May retail sales rose, led by higher sales of gasoline, motor vehicles, and auto parts. Core retail sales, which exclude gas, motor vehicles, and auto parts also increased. In volume terms, retail sales were up 0.4% in May.

Housing starts in Canada fell by 3% in June month over month, above market expectations, driven by a decline in both multi-unit urban and single-detached starts.

U.S. Federal Reserve meets to set interest rates next week and expectations of a 100 bps hike have faded in favour of pricing for a 75 bps move.

U.S. weekly jobless claims increased by 7,000 versus expectations, suggesting the labor market is beginning to slow.

U.S. existing-home sales in June fell for the fifth straight month by 5.4%. The median existing-home price for all housing types was US$416,000, up 13.4% from June 2021.

U.K. inflation hit new 40-year high of 9.4% year-over-year, coming in ahead of the 9.3% consensus, as food and energy prices continued to rise.

European Central Bank increased interest rates by 50bps for the first time in 11 years in an attempt to cool rampant inflation in Europe.

Euro zone business activity unexpectedly contracted this month, with companies continuing to report rising costs as inflation is forcing consumers to reduce spending.

Russia resumes gas flows to Europe via Nord Stream 1 pipeline following scheduled maintenance downtime.

Japan’s central bank kept rates on hold at ultra-low levels, as expected. The Japanese stock market edged higher accordingly.

China’s central bank pledged stronger implementation of its monetary policy in response to downward economic pressures.

Oil fluctuated, struggling to find direction as markets weighed supply, weakened demand in the U. S. and economic growth in Europe.

Weekly change: TSX: 3.2%; DOW: 1.8%; S&P 500: 2.4%; NASDAQ: 3.3%; GOLD: 1.9% WTI: -3.0%

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

Good policy or good luck by Karyne Charbonneau Link to Article

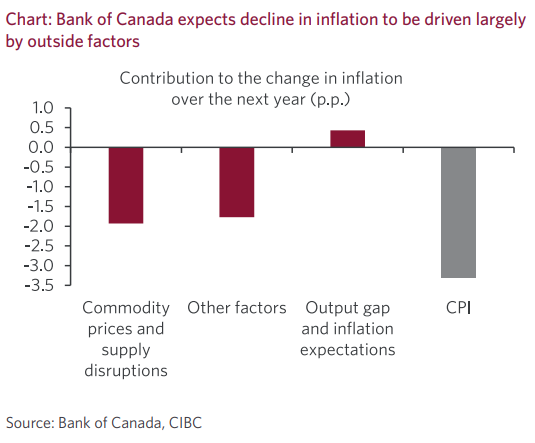

The Bank of Canada’s (BoC) rhetoric has emphasized the role of reducing excess demand to control inflation and their guidance expecting inflation to decelerate over the coming year, a deeper look reveals that a large portion of this dynamic is attributable to factors outside of its control.

About 60% of the deceleration is coming from commodity prices and what they call supply-related disruptions. These factors have been the cause of inflation forecast errors and are also the hardest to predict and are very much tied to geopolitical developments.

Then there are the mysterious “other factors”. The BoC argues that parts of this category will respond to interest rate increases because it reflects excess demand not captured by the impact of the output gap. The main “other factor” that may fit the bill is shelter costs.

Monetary policy does have a strong impact on certain factors that drive inflation, however the BoC’s expectations are the more extraneous factors discussed, which are less directly impacted by monetary policy, will be what drives inflation downwards. In short, if we don’t get a little help from our friends abroad and a healthy dose of luck, we will need a recession to bring down inflation.

We’re Living In The Anomaly Right Now by Lead-Lag Report Link to Article

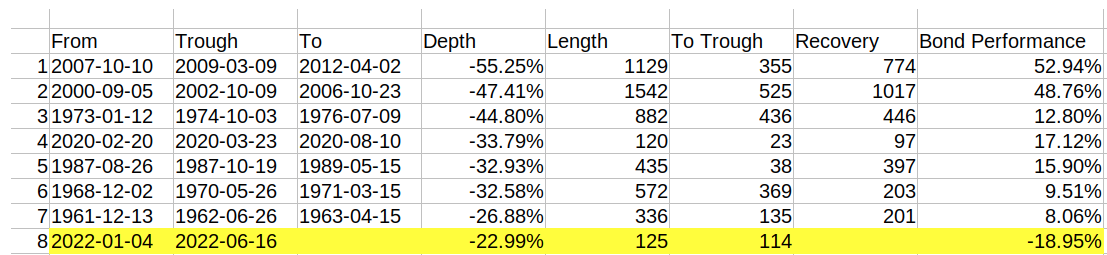

The current market environment has been the toughest many investment professionals and investors alike have ever experienced.

People talk about market anomalies and tail risk events as if they’re always something that will happen eventually at some point in the future, however, investors rarely identify a tail risk event until it’s truly happening.

Some notable observations of the current market:

The 2020 COVID recession bear market ranks #4 in terms of depth. It’s also, by far, the quickest to regain its all-time highs, taking just 120 trading days.

The current bear market ranks #8. It’s currently approaching day 150 and far from recovering to January 2022 highs.

Now for the most notable disconnect in markets: The 18 largest stock market corrections have all seen Treasuries outperform equities by 10% or more, except for one – 2022.

Source: Lead-Lag Report

In only two instances was Treasury performance negative during the drawdown/recovery period - 1977 and 1999. In each case, losses were around 2%.

If you want to look for the silver lining, some of the best opportunities occur during periods of severe disconnect. Treasury volatility is still quite high, but we are starting to see some evidence that it could be close to returning to its traditional risk-off behavior.

The point to derive from the above is this: This is a difficult market to be invested in and there are very few dark corners to have found positive returns – it is understandable to feel concerned. In these times of extreme conditions, it becomes increasingly important to remain diversified and stick to a disciplined investment policy.

Global Insights

U.S. crude shippers are exporting huge amounts of oil to meet strong demand from Europe following Russia's invasion of Ukraine and subsequent sanctions against Moscow. In coming years U.S. oil may find even more buyers overseas, but that could test the capabilities of U.S. export infrastructure.

More than a hundred foreign workers employed through a third-party agency are out of a job and at least some of them have been ordered to leave the country after the Canada Border Services Agency (CBSA) found they were working in the country without the proper documentation.

Britain was heading for its highest temperatures on record and firefighters battled blazes across southern Europe as a heatwave sent people hunting for shade and compounded fears about climate change.

Albania and North Macedonia began membership talks with the European Union on Tuesday, overcoming a series of obstacles thrown up by EU governments despite an original promise to begin negotiations in mid-2018.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.