Bram Houghton

August 02, 2022

Economy Weekly update Weekly commentaryWeekly Market Update – July 29th, 2022

Despite receiving mixed data throughout the week and clear signs the economy is slowing, markets have ended on a positive note, posting gains for the week as investors begin to shift expectations.

Canada’s economy has shown signs of slowing, as the data suggests, even before aggressive rate hikes began. Monthly GDP data for Canada indicates GDP was flat for the month of May though above expectations of -0.2%. In June however, GDP increased by 0.1%, led by increased output for construction, manufacturing, accommodation, and food services industries.

U.S. second-quarter GDP shrank at a 0.9% annual pace versus expectations of 0.5% growth. It is the second straight contraction and is fueling recession fears. Despite this, markets reacted positively, as bets of a greater contraction come off and likely signals a flattening of interest rate expectations.

On Wednesday, U.S. Federal Reserve raised interest rates by 75bps (0.75%), largely in line with expectations – markets reacted positively as bets of a more significant rate hike came off.

U.S. weekly jobless claims were resilient, dropping this week despite being 3,000 above expectations at 256,000.

U.S. June durable goods orders rose in May versus an expected decrease. This is the fourth consecutive monthly increase.

Data from the U.K. indicated that retail sales volumes continued to fall slightly for a fourth consecutive month, as consumers struggle with the rising effects of the cost of living.

In Europe a host of strong earnings from corporate and economic data overshadowed fears of a global recession. The European Union’s economy grew by 0.7% in the quarter, accelerating from 0.5% in the first quarter. Despite this, consumer confidence readings from Germany, France and Italy have deteriorated due to high inflation.

European gas prices have risen nine-fold in the past year and a prolonged reduction in gas flows could force supplies to be rationed for heavy industries.

Russia said it will cut gas supplies to Europe in a blow to countries that have supported Ukraine, while the EU nears an agreement on winter gas reduction plans.

Germany's energy regulator has already warned that the country will likely need to reduce up to 20% of its gas consumption as Russia is cutting flows in the Nord Stream 1 pipeline.

China industrial profits rebounded in June as major cities emerged from lockdown, however, China's demand for commodities is slowing.

Oil prices surge to end the week as chances of OPEC+ supply boost begin to fade.

Weekly change: TSX: 3.7%; DOW: 3.0%; S&P 500: 4.2%; NASDAQ: 4.7%; GOLD: 2.8% WTI: -3.2%

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

Quick Take: US GDP (Q2) by Katherine Judge, CIBC Economics

Economic activity retreated further in the US in Q2, with and annualized drop in growth of 0.9%, which was below the consensus for a 0.4% increase.

Primary driving factor is inventories shaving 2 percentage points off of the quarter, reflecting a decrease in inventories at the retail level, including at car dealerships.

Residential investment declined as higher mortgage rates thwarted demand, adding to a retrenchment in government spending, while business investment didn't provide any offset, which leaves exports and the consumption of services as the only positive contributors.

Over the remainder of the year, we look for an easing in supply chain issues to support inventory restocking, and a return to positive growth, but further out, the Fed is committed to capping the pace of growth.

MacroMemo - July 26 – August 8, 2022 by Eric Lascelles Link to Article

Financial markets improve: The month of July has been good for risk assets such as equities. The main reason appears to be the notion that inflation could be peaking. The lingering question is whether risk assets can really manage a sustained rise when the economy continues to weaken, a recession is likely, and earnings expectations have not yet significantly fallen.

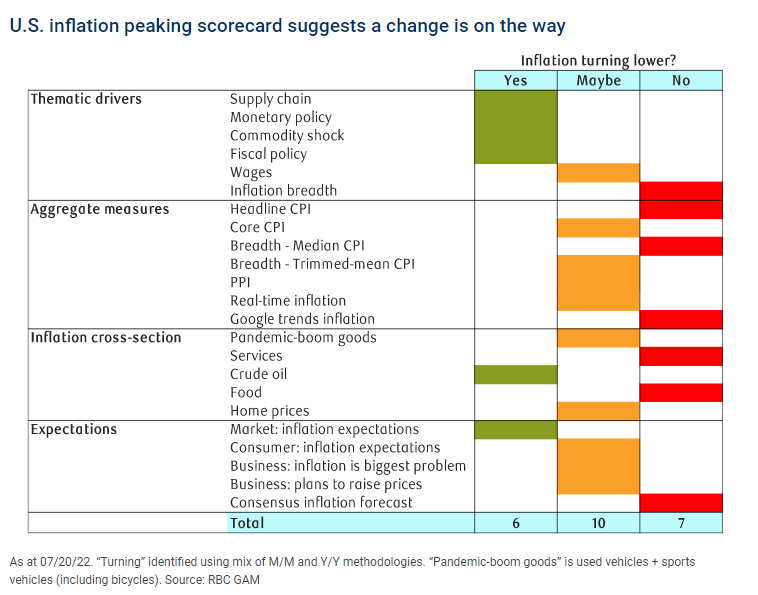

Inflation remains high: U.S. CPI in June was the hottest it has yet been this cycle, however, there is good reason to think that the July print should be somewhat cooler. Main reason is that commodity prices – including, crucially, gasoline prices – have declined during the month. Per the below scorecard, it is particularly notable that real-time inflation measures based on online prices are now flattening out and even beginning to tentatively fall for a wide range of developed countries.

Economic indicators continue to weaken: Real wage growth in U.S. has dropped significantly, U.S. businesses continue to report growth, but deteriorating, U.S. small business expectations for economic outlook at record low, U.S. consumption starts to ebb.

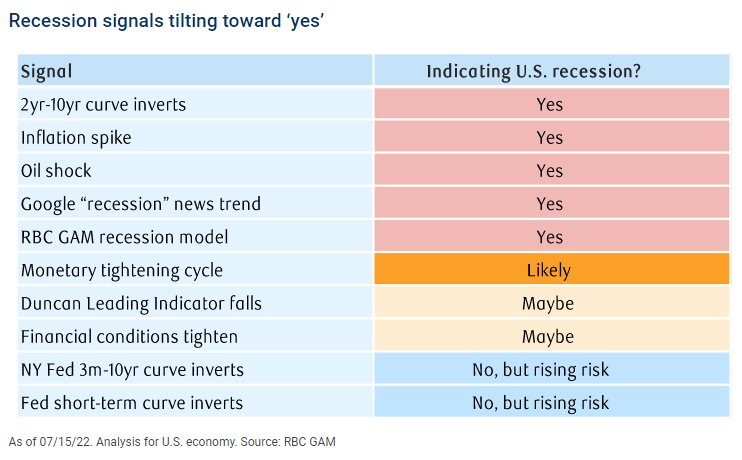

Recession signals: RBC Economics continue to flag the high risk of recession for most of the developed world. In the U.S. context, our new recession scorecard finds that five of the 10 major signals now forecast a recession. RBC GAMs recession model now assigns a 61% chance of a recession over the coming year.

Project cancellations will worsen housing affordability by Benjamin Tal Link to Article

The housing market is not in a free fall. We estimate that most of the decline in the average national home price since the February peak was due to the composition factor, with sales activity shifting from to less expensive (high rise) units. What’s more, the sales-to-new listing ratio, at around 50%, is now where it was for most of the past 15 years — still indicating balanced market conditions.

Sales activity will continue to fall alongside the average home price; however, the point is that the ongoing correction will not solve the housing affordability crisis. In fact, we might be in the process of making the situation worse. The significant and rapid increase in interest rates, along with surging construction costs and a lack of available labour make projects look totally uneconomical.

Based on information we obtained from Urbanation, out of the 30,000 condo units that were supposed to be launched in 2022 in the GTA, no less than 10,000 have been cancelled or put on hold. the units that were supposed to be built now will not be available — making a tight rental market even tighter.

A rental solution must be a big part of any housing affordability policy. We should develop a rental mentality where it is acceptable to rent regardless of your situation. If the propensity to rent rises, the market should realign to increase the supply of rental units. Purpose-built rental could be the difference between an affordable and an unaffordable housing market in Canada. So far it appears that we are marching in the wrong direction.

Global Insights

US crude stockpiles saw the largest draw since the end of May, falling by 4.52 million barrels last week, according to an Energy Information Administration report. US crude exports rose to a record as the WTI-Brent spread widened with Europe scrambling to replace Russian barrels.

European buyers have had to temporarily set aside green aspirations in a rush for coal as the region’s energy crisis deepens, ramping up shipments from Australia, South America, Colombia and South Africa while tightening the global market.

There will be no strike at WestJet this week now that the airline has reached a tentative labour deal with the union representing hundreds of workers at the Calgary and Vancouver airports.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.