Bram Houghton

August 13, 2022

Economy Commentary Weekly updateWeekly Market Update – August 12th, 2022

Market update

The relief rally continued as we saw respite in rising prices this week, with inflation finally showing signs of deceleration in the U.S..

The U.S. consumer price index (CPI) fell to 8.5% in July from 9.1% the previous month, due largely to a drop in gasoline prices. Excluding volatile food and energy prices, core CPI rose 5.9% annually and 0.3% monthly, compared with corresponding estimates of 6.1% and 0.5%.

U.S. producer price inflation (PPI) fell 0.5% month-over-month in July, below the consensus of 0.2%. It is the first decline in the PPI in over two years, attributed to a 16.7% drop in oil prices.

U.S. initial jobless claims increased to 262,000 versus the expectation of 263,000, this is the highest level since November.

European markets continue to see resilient corporate earnings and key economic data points, while assessing the risk of a recession with corporate earnings driving share prices this week, most notably in the tech sector

United Kingdom second-quarter Gross Domestic Product (GDP) contracted by 0.1% as consumer demand decreased and exports fell.

The Bank of England indicated that it will probably have to raise interest rates further from their current 14-year high to tackle inflation pressures.

German final July consumer price inflation came in at 7.5% year-over-year and 0.9% monthly, roughly in line with expectations.

Oil prices are pushed higher after the International Energy Agency raised its forecast for global oil-demand growth, as heatwaves in Europe and tighter gas supplies will prompt more oil to be used for power generation.

Chinese inflation data hit a two-year high, with prices rising 2.7% in July, but below expectations.

China’s trade data for July showed dollar-denominated exports grew 18% versus expectations for a 15% increase, compared to a year ago. Six times the increase experienced this time last year.

China’s Covid cases hit three-month highs overnight with several cities imposing fresh lockdowns on their population to contain the surge in the virus.

Weekly change: TSX: 2.8%; DOW: 3.2%; S&P 500: 2.9%; NASDAQ: 3.1%; GOLD: 1.5% WTI: 3.6%

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

MacroMemo - August 9 – August 22, 2022 by Eric Lascelles Link to Article

COVID-19 wave plays out: U.K and Germany are seeing COVID-19 cases ease, while Japan is suffering mightily under its latest COVID-19 wave. Question remains whether China will eventually crack and experience something similar.

Wheat prices are falling: Scope now exists for some Ukrainian exports after a fragile deal was struck with Russia to permit transportation from Ukrainian ports. As we all know now, Ukraine is normally the world’s third largest exporter of wheat. Other countries have also increased their production and demand is expected to be lower than normal this year as ranchers shift to corn for animal feed.

Geopolitical stress builds: Despite the obvious with the Ukraine-Russia conflict persisting, Nancy Pelosi’s visit of Taiwan caused China to demand an apology and suspend communication and coordination with the U.S as well as sending military aircraft to fly over Taiwanese territory and conducted military drills around the island. Other recent developments include Taliban takeover of Afghanistan, Iran’s imminent possession of nuclear weapons.

Inflation takes a breather in July: It was confirmed on Wednesday that U.S. consumer price index (CPI) fell year-over-year (Y/Y) to an 8.5% gain in July from 9.1% the previous month. It makes theoretic sense that we have seen the peak on account of Monetary stimulus is less supportive, Fiscal policy is now a drag, Supply chains are being fixed and Commodity prices are declining.

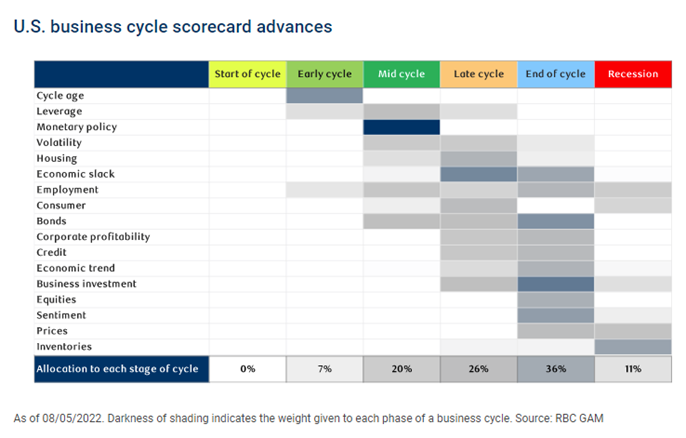

U.S. business cycle score shifts to ‘end of cycle’ as we find that the business cycle has left behind ‘mid cycle,’ skipped right over ‘late cycle,’ and is now firmly in ‘end of cycle’ – a position that normally only lasts for a quarter or two before recession strikes.

Economic miscellany: A number of key variables are starting to weaken despite resilient payroll. Jobless claims are rising, and layoffs have now begun to increase. Business hiring intentions also weakened moderately. Corporate earnings have held up across Q2 reporting season with positive surprises, however there is weakness with Walmart issuing a profit warning and Tech companies starting to lay off or scale back hiring plans.

The economic “gift” that keeps on giving by Avery Shenfeld and Andrew Grantham Link to Article

In the space of only a half a year, the Bank of Canada went from expecting to reattain the pre-Covid trend in real GDP by the end of 2023, to supply disruptions persisting “beyond the forecast horizon”.

Similarly, CIBC Economics forecast for inflation coming down, and staying down, only because growth slows to well below what used to be considered its noninflationary potential and is expected that to remain the case through 2024.

Demand recovers, supply still held back

The Bank of Canada ascribes three reasons for its new and more pessimistic take:

- Longer-lasting supply chain disruptions,

- Greater difficulty in matching those looking for work with available positions, and

- Weaker growth in capital spending. Covid-19 continues to contribute in no small measure to each of these factors impeding the economy’s non-inflationary capacity.

Workers off the job abroad and in Canada

Continued disruptions to global activity have been a challenge this year – the most evident hit has been in China, where authorities continued to impose severe lock downs this year.

Elsewhere, it’s employee illness that is impacting business output. Flights are cancelled when crew members call in sick, hospitals cut back services because of illness and live entertainment shows are postponed.

Moreover, the same Covid-related supply chain issues that are impeding the production of consumer goods are also cutting into capital equipment supplies. The result is less productive capacity in sectors where equipment is on back order, or where Covid uncertainties have forestalled investment.

Labour market mismatching should improve

In both Canada and the US, central banks and economists have cited the mismatch between job availability and hiring as a reason why labour markets might be even tighter than the unemployment rate alone would suggest.

What’s been so atypical in the Covid-19 case is the degree to which some sectors were initially hit by unprecedented job declines, employment droughts, then attempted rehire en masse. That extreme variance has never been seen before – a typical recession doesn’t see air travel drop by 90% and doesn’t see live theatres close outright.

It is seeming apparent that the economy is already migrating towards a more normal degree of volatility, and that time will help the adjustment to a more active service sector in terms of filling low-skill positions. Some high-skill sectors will also shed jobs where rate hikes are ending the boom. Both effects should see the job filling rate improve, and the relationship between job vacancies and the unemployment rate normalize.

Global Insights

As energy bills mount and the threat of rationing increases, some European retailers are turning off lights and considering shorter opening hours this winter.

Indian companies are using Asian currencies more often to pay for Russian coal imports, according to customs documents and industry sources, avoiding the U.S. dollar and cutting the risk of breaching Western sanctions against Moscow.

Walt Disney Co edged past Netflix Inc with a total of 221 million streaming customers and announced it will increase prices for customers who want to watch Disney+ or Hulu without commercials.

The U.S. Transportation Department (USDOT) said on Wednesday a supply chain pilot data-sharing project aimed at easing bottlenecks at congested U.S. ports has begun exchanging data and doubled in size.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.