Bram Houghton

August 29, 2022

Economy Commentary Weekly updateWeekly Market Update – August 26th, 2022

Canada’s July wholesale trade looks to have dipped by 0.6% month-over-month in preliminary estimates. This is mostly due to lower sales of motor vehicles and motor vehicle parts and accessories.

Canada posted an all-time high of 1,037,900 vacant jobs in June, marking the third straight month of over one million open positions, according to Statistics Canada.

U.S. personal spending increased by 0.1% in July, above the consensus of 0.4%. It is the weakest performance so far this year, as consumption increased for services but declined for goods.

U.S. July durable goods orders were unchanged at 0.0% from a month earlier, versus expectations of a 0.6% increase. Excluding transportation, new orders went up 0.3%, and excluding defense, new orders climbed 1.2%.

U.S. second-quarter GDP shrank at a 0.6% annual pace versus expectations of a 0.8% decline. Despite the negative GDP growth and high inflation, real gross domestic income rose by 1.4% complicating the recession debate.

Federal Reserve Chair Jerome Powell signaled the U.S. central bank is likely to keep raising interest rates and leave them elevated for a while to stamp out inflation, and he pushed back against any idea that the Fed would soon reverse course.

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses,” Powell said.

European markets tumbled lower on worries surrounding tightening gas supplies from Russia and aggressive signals from the European Central Bank.

European gas prices continued to rise sharply to new record highs after it became evident that many French nuclear reactors will take longer than expected to start up.

European equity markets are mixed as focus continues on the gas crisis with attention on EU's support of Ukraine which could be in jeopardy as energy prices soar across the region.

EU households and businesses struggle as drought and low river levels come on top of high food and energy prices while economists suggest Germany and France have driven the Eurozone into a recession.

Eurozone flash PMI showed that business activity contracted for a second straight month.

Germany beat manufacturing but fell behind services consensus while France services came in below consensus whereas manufacturing matched expectations.

Japan flash purchasing manager’s index (PMI) grew at slowest pace in 19 months with pressure from raw materials prices and softening global demand.

China's heatwave and drought has prompted factory shutdowns and curbs on power usage while hot weather is damaging autumn grain output, threatening supply chains, and risking more pressure on inflation.

China cut its benchmark lending rate and lowered the mortgage reference rate by a bigger margin than expected in an effort to support a weakening economy.

Weekly change: TSX: -1.2%; DOW: -4.0; S&P 500: -3.9%; NASDAQ: -4.3%; GOLD: -0.6% WTI: 3.3%

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

MacroMemo - August 23 – September 12, 2022 by Eric Lascelles Link to Article

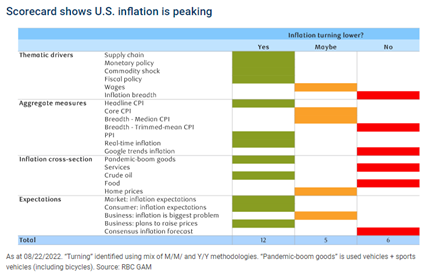

Inflation peaking

In late July, the scorecard had six metrics arguing that inflation was turning lower. Today, 12 indicators say inflation is turning lower, a slight majority of the measures.

Some newly behaved inflation measures could misbehave again, but, for the moment, the great majority of measures argue “yes” or “maybe.” This is consistent with our view that inflation probably reached its peak in June of this year, even if the subsequent deceleration is likely to be choppy and it will probably be some time before inflation has fully normalized.

Calibrating recession risk

The risk of recession is still high but has arguably diminished slightly. We are inclined to think that the risk of a U.S. recession by the end of 2023 has fallen from around 80% back to 70%. The risk remains higher (and the prospective recession even deeper) in the U.K. and Eurozone. There are 4 conditions that have somewhat improved:

- High inflation has been an economic headwind both directly as consumers and businesses pull back on spending due to diminishing purchasing power, though with the recent pull back in WTI price, this constitutes a significant saving for people filling up their gas tank. However, oil is still significantly more expensive than its 2021 average of $68.

- Financial conditions have eased slightly. Bond yields have recently declined as inflation fears and central bank expectations have been scaled back, and as recession expectations have been priced in. The stock market and other risk assets have also mounted a partial recovery.

- Supply chains have continued to make incremental improvements. It seems reasonable to expect further improvements as pinch points are finally resolved.

- China’s economic situation – while still challenging and precarious – may not be quite as problematic as it was a few months ago. Of the four factors, this is admittedly the one that is improving with the least enthusiasm.

Watching U.S. midterms approach

The widespread expectation up until a month ago was that the Republican Party would claim both the House of Representatives and the Senate from the current Democrat incumbents.

That thinking has now, tentatively, changed. While the House of Representatives is thought likely to remain in Republican hands, polls now argue that the Democrats should maintain their Senate majority.

The stock market is usually fairly happy when Congress is divided between two parties. Theoretically this is because the resulting political gridlock means that public policy will not be radically changed and so won’t undermine existing business models.

Will higher rates derail the consumer? by Benjamin Tal and Karyne Charbonneau Link to Article

A generation of Canadians who have never experienced high borrowing costs is now being tested. The claim that even now rates are still notably low relative to previous cycles is correct but irrelevant.

From a macro perspective, households’ fundamentals are now generally stronger than seen at the eve of previous hiking cycles and the structure of household debt will shield many borrowers from the full sting of higher rates in the coming year.

Debt service cost — how bad?

Based on our expectation that the overnight rate will rise to 3.25% in September and stay at that level for the duration of 2023, this translates to close to $19 billion of additional debt payment this year, or a full percent of disposable income.

The one-third of households that are renters of course do not have to worry about rising mortgage rates, but they sure worry about higher rent inflation. We estimate that over the next 12 months rent payments will rise by an additional 0.6 percent of disposable income.

$300 billion excess savings — still available

The inability of Canadians to spend as much as they might have wanted over the past two and half years, combined with high disposable income, led to a large increase in the savings rate and a buildup of savings. Even today, the savings rate remains well above recent historical averages, and excess savings total well over $300 billion.

Still catching up

Consumption patterns in the past two and half years were dictated by forces outside of people’s control, and while consumption occurred where possible, consumers have still not made up for lost time. There is still significant pent-up demand for consumption, which we estimate at the equivalent of about 3% of the current level of consumption.

Service consumption was severely restricted for two years. Consequently, we estimate that relative to pre-pandemic trend, there is still a gap equivalent to about 8% of current service consumption in the form of pent-up demand.

Global Insights

The world’s largest-ever four-day workweek trial is nearing its midpoint and the organizers behind it are sharing some insight into how it is going. Charlotte Lockhart, the managing director and founder of 4 Day Week Global, said there have been statistically significant improvements across a range of well-being indicators.

In this economy, many employees are returning to previous employers, breaking taboos about workplace loyalty and bucking assumptions about the so-called Great Resignation. In the US in the first quarter of this year, 4.2% of all new hires for companies that advertised jobs on LinkedIn were boomerangs, compared to 3.3% in 2019.

Britain's next prime minister must adopt radical ideas - such as discounted power tariffs, energy bill freezes or a "solidarity" tax hike for higher earners - to cushion the energy price shock for a broad swathe of households, a think-tank said on Thursday.

Having played golf with U.S. presidents Donald Trump and Barack Obama, former Malaysian prime minister Najib Razak will now count convicted murderers and drug traffickers as neighbours.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.