Bram Houghton

September 16, 2022

Economy Commentary Weekly updateWeekly Market Update – September 16th, 2022

A rough week for the markets as investors set their sights firmly on the release of U.S. inflation data this week.

U.S. August CPI rose 0.1% month-over-month to 8.3% in August versus expectations for 8.1%. The annual Core CPI accelerated to 6.3% in August versus a 6.1% forecast. Markets are pricing in a 9 in 10 chance that the Federal Reserve will hike interest rates by 75 basis points next week.

Given the contractions in Energy and Food prices for the period, markets saw this as negative news as many other segments of the goods basket had been materially impacted.

Canadian factory sales fell 0.9% month-over-month in July due to decreases in primary metal industries and petroleum and coal products.

U.S. producer prices fell for second straight month in August as the cost of gasoline declined further, resulting in the smallest annual increase in a year,

The average interest rate on the most popular U.S. home loan rose above 6% for the first time since 2008 and is now more than double the level it was one year ago, Mortgage Bankers Association (MBA) data showed on Wednesday.

UK inflation eased in August to 9.9% versus 10.2% forecast and prior 10.1%, driven by a drop in petrol prices, although inflation still remains at its highest levels in 40 years.

The Bank of England looks set to hike borrowing costs by another 50 basis points next week.

U.K. unemployment fell to 3.6% in the three months to July, its lowest since 1974.

Euro zone inflation hit a record high of 9.1% in August, driven by higher energy and food prices.

European Union is set to unveil a package of proposed emergency measures this week to cap the revenues of non-gas energy producers and help power firms stay afloat, but countries are split over the details and whether to impose price cap.

Germany is working on a new trade policy with China to reduce dependence on Chinese raw materials, batteries and semiconductors. Taiwan lobbying the U.S. and EU for new China sanctions to help deter an invasion.

Japan's wholesale prices rose 9.0% in August from the previous year, matching the annual pace of growth in July.

China's sluggish economic growth and persistent Covid lockdowns remain a worry. New restrictions were announced in several towns as travel restrictions were enacted with Covid outbreaks.

China’s data showed growth accelerated in August as retail sales increased 5.4% versus 3.5% forecast and industrial production grew 4.2% versus 3.8% expected.

Oil prices remained resilient this week as worries about tight fuel supplies ahead of winter offset investor concerns about lower demand in China.

Gold prices fell with expectations of an interest rate hike from the U.S. next week as the dollar and Treasury yields gain.

Weekly change: TSX: -2.1%; DOW: -4.1%; S&P 500: -4.8%; NASDAQ: 5.5%; GOLD: -2.5% WTI: -1.0%

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

CIBC Economics - Quick Take: US CPI (August) by Katherine Judge

Core inflation was red hot in the US in August, giving the Fed the green light for at least a 75bp hike at its upcoming meeting. The 0.6% monthly advance in core inflation excluding food and energy prices was double the pace expected by the consensus and left annual core inflation at 6.3% (vs. 6.1% expected), a four-tick acceleration from the prior reading. Shelter and medical care services were key contributors to price pressures in the core measure. Adding energy and food prices back into the mix showed a 0.1% monthly advance (vs. -0.1% expected), leaving the annual inflation rate at 8.3% (vs. 8.1% expected), as pressure in food prices more than offset the drop in gasoline prices, and energy service prices increased. All told, with most categories except for energy commodities looking uglier, the Fed will no doubt be hiking by at least 75bp next week.

MacroMemo - September 13 – October 3, 2022 by Eric Lascelles Link to Article

Ukraine attracts

Over the past week, as Ukraine reclaimed a chunk of its land in the east of the country, near the city of Kharkiv. Given the ongoing supply of western weaponry versus the gradual diminishment of Russian stocks this could very well continue, though this is uncertain, and the war is likely to persist for some time.

Sanctions should endure for even longer – with Russia now effectively sanctioning itself with the sale of natural gas, having steadily reduced its provision of the commodity to Europe. Natural gas prices have surged on the news and at current prices, the European Union is on track to spend seven times more on electricity and gas than normal over the coming year.

With this diminished reliability of Russian supplies combined with the mounting importance of securing domestic energy security – Japan has announced it will return to nuclear power after shunning the technology over the eleven years since the Fukushima nuclear disaster.

France has also continued to invest in nuclear energy with plans to build 6 new reactors over the coming 15 years, which enables them to also have a secure, domestic energy source, which comes in contrast to Russia and China conducting high-risk oil transfers in the Atlantic Ocean. (source 1) (source 2)

European gas subsidies

European governments are recognizing that households, businesses and certain power companies cannot be forced to fully absorb skyrocketing natural gas and electricity prices.

- Germany has now implemented three energy support packages costing 95 billion euros.

- The French relief package is expected to cost 64 billion euros.

- Italy is thought to have already spent 52 billion euros.

- The U.K., under new Prime Minister Liz Truss, has promised to freeze energy costs for two years.

These actions have several important consequences:

- They limit how high consumer prices will rise, since those prices are now being artificially capped in several countries.

- Some governments are looking into placing temporary windfall taxes on energy companies that are profiting from high energy costs. This would discourage investment in future capacity but help to pay for the energy subsidies.

- Fiscal deficits will be significantly larger than before due to these initiatives, at a time when quantitative-easing operations were already coming off. That would suggest, all else equal, higher yields.

- Direct subsidies are a flawed solution in that they don’t incentivize people to reduce energy usage. Without that, the energy shortage could be serious over the winter. A better solution would be rebates unconnected to actual usage or capped at a limited level of usage.

- More support is likely in future years, to the extent it may take several winters for Europe to fully shift its energy consumption away from Russia and natural gas. As such, there will be pressure for these programs to be extended for years.

- At least so far, most European countries remain firm in supporting sanctions despite Russian pressure. An exception is Bulgaria, which is thought likely to strike a deal with Russia.

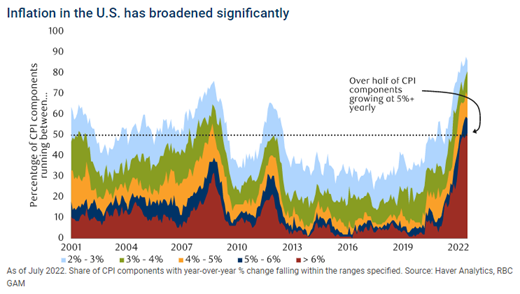

Second-round inflation pressures

- With regard to inflation breadth – the extent to which a variety of different products becoming more expensive is expanding. Breadth inflation again increased (slightly) in July and the numbers were softer in July for a very narrow reason: the decline in gasoline prices. The breadth of high inflation still risks high inflation becoming self-perpetuating.

- Wage pressures may be starting to turn downward. Overall U.S. wage growth has ebbed only slightly, but the bellwether limited-service restaurant sector has experienced a sharp deceleration in wages. This sector includes fast food restaurants, which employ lower skilled workers who are the last to be hired and the first to lose their bargaining power as labour markets sour.

- Inflation expectations continue to ease. While financial market-based inflation expectations declined some time ago, main street inflation expectations were more reluctant to drop. For inflation to sustainably decline, businesses and households need to be convinced as well. Fortunately, there has recently been a tangible though small decrease in business inflation expectations and a slight decline in consumer expectations.

Global Insights

Fossil fuel firms may have to share their excess profits to help European households and industries cope with red-hot energy bills, a draft European Union plan showed on Monday as the cost of the West's "energy war" with Russia took a growing toll.

Germany said on Tuesday it would step up lending to energy firms at risk of being crushed by soaring gas prices, as the European Union readied proposals to help households and industry cope with an energy crisis sparked by Russia's invasion of Ukraine.

The Biden administration plans next month to broaden curbs on U.S shipments to China of semiconductors used for artificial intelligence and chipmaking tools, several people familiar with the matter said.

A wave of international visitors predominantly from the United States has poured into Mexico City's cafes, parks and AirBnbs as they work untethered from daily office commutes by the COVID-19 pandemic.

Roger Federer, regarded by many as the greatest male player to wield a tennis racket and who took the sport to new levels during a career spanning more than two decades, will retire after next week's Laver Cup in London.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.