Bram Houghton

October 06, 2022

Economy Commentary Weekly updateWeekly Market Update – September 30th, 2022

Statistics Canada has preliminarily stated that Gross Domestic Product (GDP) rose 0.1% in July (matching June’s growth). It previously estimated a contraction for the month. The growth was powered by output in the agriculture and oil sands sectors.

Statistics Canada reported this past week that, fueled almost completely by immigration, Canada’s population grew by nearly 285,000 in the second quarter, a 0.7% increase that was the country’s largest since Newfoundland joined confederation in 1949.

U.S. durable goods orders declined by 0.2% in August on a monthly basis versus the market expectation for a decrease of 0.4%. Excluding transportation, new orders increased 0.2%, and excluding defense, new orders decreased 0.9%.

U.S. Initial jobless claims decreased 16,000 to a seasonally adjusted 193,000 for the week ended Sept. 24, the lowest level since April.

U.S. Personal Spending increased 0.4% in August from July beating market forecasts of 0.2%. U.S. Personal Income increased 0.3% in August from July in line with expectations.

U.S. second-quarter GDP shrank at a 0.6% annual pace, confirming on a technical basis the economy has entered a recession following a 1.6% drop in Q1.

West Texas Intermediate (WTI) crude oil prices are higher off of a nine-month low, supported by supply cuts in the U.S. Gulf of Mexico ahead of Hurricane Ian. Despite this, WTI will still post its first quarterly loss in over two years on fears of a global economic slowdown and a stronger dollar.

UK markets fell as the pound crashed to an all-time low and bond yields surged to the highest in more than a decade, putting pressure on the Bank of England for emergency action.

German inflation was at its highest in more than a quarter of a century in September, driven by high energy prices, increasing by 10.9% on the year, the federal statistics office said.

The German economy is heading for recession as data shows a plunge in business morale across all sectors as Germany scrambles to avoid a gas shortage this winter.

Latest headlines on suspicious leaks in Nord Stream 1 and 2 pipelines in the Baltic Sea suggest that leaking is probably the result of sabotage according to officials in Denmark, Germany and Poland.

Japan's factory activity growth hit a 20-month low in September, as firms struggled with a global slowdown and supported by high energy and raw material prices with a weak yen.

China’s August industrial profits contracted again while World Bank was the latest to lower China GDP growth forecasts, as the rest of Asia will outgrow China for first time since 1990.

The onshore Chinese Yuan reached its weakest levels since 2008 and the Indian rupee also marked a record low. China Beige Book survey warned of building deflationary pressures with demand weakening under the weight of the ongoing property crisis.

Gold prices are hovering around a 2 and a half year low as a strong dollar and rising interest rates weighed the commodities price down. The price dropped to below $1,620 per ounce, the lowest level since April 2020.

Weekly change: TSX: FLAT; DOW: -2.9%; S&P 500: -2.9%; NASDAQ: -2.7%; GOLD: FLAT WTI: FLAT

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

CIBC Economics Quick Take: Canadian GDP (Jul, Aug adv) by Andrew Grantham

The Canadian economy continued to slow at the start of Q3 but did at least manage to eke out some growth in contrast to the advance estimate. July GDP showed a gain of 0.1%, which while very marginal is still better than the -0.1% initial estimate and consensus expectation. An advance estimate for August showed that GDP was essentially unchanged during that month. In July, growth was driven by the goods sector (+0.5%) and in particular mining, oil & gas and agriculture. Service industries weighed on growth in July, and pullbacks in both retail and accommodation & food services could be a sign that high inflation and interest rates are now having a wider impact on consumers outside of just housing resale activity.

With July and August combined showing no material advance in the Canadian economy, Q3 GDP is tracking just under a 1% annualized growth pace. That's well below the Bank of Canada's July forecast of 2% , although the monthly industry figures and subsequent expenditure data don't always line up. With inflation still high policymakers are likely to press ahead with another rate hike next month. However, signs of consumer spending weakening even in some service industries should see the Bank then take a pause to more fully assess how growth and inflation are responding to higher interest rates.

Global Currency Outlook - Fall 2022 by D.Fijalkowski, MBA, CFA Link to Article

U.S Dollar (USD)

A hawkish U.S. central bank, the uncertain financial-market outlook and softening global economic growth have all played roles in driving both a stronger USD and foreign-exchange markets in general. Developments abroad have also contributed to USD gains: slower economic activity in China buoys the dollar’s appeal and the energy crisis in Europe threatens the region’s political and economic stability.

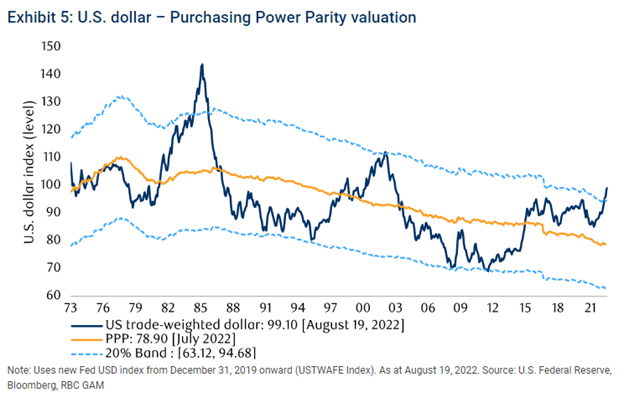

One factor underpinning RBC Economics’ conviction that the U.S. dollar will fall is that the greenback is that Purchasing Power Parity (PPP), which measures the relative cost of goods across different currencies. The model indicates that USD strength over the past few months has pushed the currency beyond thresholds for what can be considered extremely expensive (Exhibit 5), and history has taught us that currencies typically don’t remain at such levels for very long.

Historical analysis conducted by Deutsche Bank tells us that currencies have tended to return to fair value within months of crossing outside of their PPP bands. We can therefore expect dollar weakness, when it comes, to unfold relatively quickly.

It is also conceivable that the temporary factors underpinning gains in the greenback could persist for longer than investors currently expect. Three items could prolong this period of USD strength:

- The Fed could maintain tighter monetary policy for longer than the markets expect in order to demonstrate its commitment to stamping out today’s inflation problem.

- A slower-than-expected rollout of effective COVID-19 vaccines in China could result in continued lockdowns and further disappointment on economic activity, which would support the greenback versus the renminbi.

- A more severe energy crisis in Europe could depress the euro even further. However, the unpredictability of both the weather and Russia’s tactics in withholding natural gas from Europe make predictions in this area especially difficult.

Canadian dollar (CAD)

The CAD’s 2022 trading range has been remarkably narrow given the extreme market volatility and the U.S. dollar rallying strongly. The loonie has meaningfully outperformed against its other G10 peers all year, a resilience that can be attributed to a few key factors:

- A central bank that has kept up with U.S. interest-rate hikes and is expected to outstrip the Fed’s pace this cycle,

- Elevated commodity prices that support strong terms of trade,

- The outperformance of Canadian equities over stock markets in the U.S. and Europe, and

- Healthy levels of immigration that will make for a more balanced labour market at a time when demand for talent has been strong; strong immigration also supports economic growth

A decade-long string of Trade deficits has turned into Trade surpluses, large due to high energy prices and from growing income receipts on the country’s foreign direct investments. Canada has also experienced a significant improvement in portfolio inflows as Canadian companies issue debt in U.S. dollars.

We should note some risks for the loonie:

- It is probable that a recession in the U.S. would drag the currency down as oil prices and equities would both be likely to decline. when shocked for these scenarios, suggest the loonie could weaken to $1.35 per U.S. dollar.

- Falling Canadian real estate prices and high household debts also present risks to our outlook, especially since the Bank of Canada (BOC) seems bent on raising rates faster than many other central banks.

It is the view of RBC Economics that the USD should weaken over the medium term, but extraordinary factors may lend it further support for the rest of this year. On a 12-month horizon, we remain more constructive on the Canadian dollar and Japanese yen than we are on the euro, pound or U.S. dollar.

Global Insights

President Vladimir Putin is preparing to formally annex around 15% of Ukrainian territory after referendums on joining Russia in areas controlled by Russian forces or Russian-backed separatists.

Any intentional disruption of EU energy networks would meet a "robust and united response", a top diplomat said, after several states said two damaged Russian pipelines to Europe were probably attacked, causing gas to spew into the Baltic Sea.

Analysis: Truth or bluff? Why Putin's nuclear warnings have the West worried

President Vladimir Putin's latest warning that he is ready to use nuclear weapons to defend Russia amid the war in Ukraine has made a troubling question much more urgent: Is the former KGB spy bluffing?

Britain's new economic agenda represents the biggest gamble for growth in a major Western democracy in at least 40 years, for which the chance of success fell instantly as investors ditched sterling assets.

Prime Minister Liz Truss's "Growth Plan" is Britain's second roll of the dice at economic renewal following the 2016 vote for Brexit which, so far at least, has failed to yield returns.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.