Bram Houghton

November 11, 2022

Economy Commentary Weekly updateWeekly Market Update – November 11th, 2022

Today in particular we remember those who sacrificed, served, fought, and died for our freedom. We sincerely thank and salute those who made the ultimate sacrifice for all of us. Lest we forget.

In a speech on Thursday, Bank of Canada governor Tiff Macklem says Canada's low unemployment rate is not sustainable and is contributing to high inflation.

Canada is facing diesel supply constraints and experts believe prices will remain elevated as inventories near decade lows. Diesel prices have nearly doubled year-over-year due to a global shortage in refinery capacity, according to a statement from Natural Resources Canada Monday.

U.S consumer prices rose less than expected in October, pushing the annual increase below 8% for the first time in eight months. The Consumer price index increased 0.4% in October for an increase of 7.7% year-on-year, the smallest gain since January

Coming off the news, all North American markets gained in early trading. The S&P 500 jumped 3.6 per cent at the opening bells, which marked its biggest climb in two years.

The U.S. NFIB Small Business Optimism Index fell to a 3-month low of 91.3 in October compared to 92.1 in September and below the consensus of 92.0. A third of respondents reported that inflation was the most important issue in operating their business, up 3% from September.

U.S. weekly jobless claims rose by 7,000 to 225,000 versus the expectations of 220,000.

In the EU agenda, ECOFIN MEETING will discuss the implementation of the Basel III regulation, reform measures intended to help reinforce the resilience of the EU banking sector and strengthen its supervision and risk management.

Industrial production in Germany rose 0.6% month-over-month in September against a consensus estimate of 0.2%.

In a major retreat, Russia has ordered troops to withdraw from Ukrainian city of Kherson. Oil prices extend losses as renewed Covid-19 curbs dampens demand outlook.

China’s latest Covid-19 development and poor trade data. China's exports and imports unexpectedly contracted in October as exports fell 0.3% year-over-year, amid lackluster overseas demand as cost pressures grew globally; while imports shrank at a faster 0.7%, and as domestic demand weakened amid strict Covid-19 curbs.

China said it would ease some Covid measures, however shrugged off the latest Covid data that more than 10,000 new infections were found Thursday.

Oil fluctuated ahead of U.S. inflation figures that will provide clues about the prospects for the world's largest economy, while China's COVID Zero policy continues to weigh on the demand outlook. West Texas Intermediate slipped below $86 a barrel. China's anti-virus policies are hurting consumption.

Gold ended the week strongly as recent inflation data suggests that FED interest rate hikes may begin to taper along with the USD softening.

Weekly change: TSX: 3.4%; DOW: 4.2%; S&P 500: 5.9%; NASDAQ: 8.0%; GOLD: 5.4%; WTI: -3.7%

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

Midterms and the US Deficit: Que Sera, Sera by Avery Shenfeld Link to Article

The last 10-year projection from the Congressional Budget Office dates from May, and while nominal GDP and revenues will be helped by this year’s persistent inflation, the rest of the outlook looks too rosy. Not only does it assume only a very minor economic slowdown in 2023, but it allows the economy to sustain a jobless rate in the mid-3% range over the forecast horizon.

Republicans look likely to take control of the House, while the Senate could be a close call. While the GOP professes concern over deficits and will once again use the debt ceiling to try to force spending cuts, recent history suggests that they are a party of big deficits, given their willingness to turn any savings on expenditures into quick tax cuts.

Moreover, with the White House likely to exercise veto power over attempts to trim key social programs like Medicare and Social Security and should take aim at spending on infrastructure and climate change, there’s not really that much scope for a divided Washington to slash expenditures. Tax hikes, including Biden’s threatened windfall tax on energy companies, will be a non-starter if Republicans have the reins in the House.

It’s just one more reason why, when we look past the current spurt of inflation into 2024 and beyond, we’re unlikely to see a sustained return to the lows in bond yields that we got used to in the prior cycle. We still expect to see the longer-term bonds to rally in the next couple of years if inflation is vanquished, but fiscal policy might then create a push in the other direction if US politics continues along its current path.

MacroMemo - November 8 - November 21, 2022 by Eric Lascelles Link to Article

Chinese re-opening rumours

Chinese equity markets surged last week on rumours that the country might be on the cusp of significantly easing its zero-tolerance policy toward COVID-19 infections. However, a major change in COVID-19 policy seems less likely in the near term.

Economic trends

North American jobs data was hot, while other metrics were lukewarm, and measures of economic intentions were outright cold. The one twist was that the unemployment rate rose to 3.7%. This wasn’t simply because more people on the sidelines decided to start looking for work, it was because the unemployment rate is estimated by the household survey rather than the establishment survey. Business establishments have no idea how many people don’t have jobs, after all.

It is further notable that the household survey has reported job losses in three of the past seven months – unlike the payroll survey. The household survey has also been the weaker of the two in six of the past seven months

U.S. manufacturing activities are deteriorating

The U.S. Institute for Supply Management (ISM) Manufacturing Index continues to fall and is now on the cusp of a contracting manufacturing sector. The ISM Service Index also fell somewhat, though it remains in the territory of moderate growth.

Recession views

Business cycle update

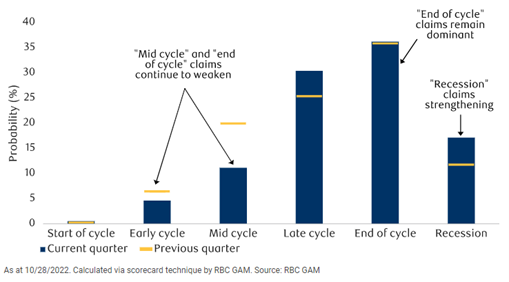

Our refreshed U.S. business cycle scorecard makes the same claim as a quarter ago: that the economy is at the “end of cycle”. Furthermore, the cycle continues to march forward in subtle ways. Counterclaims for “early cycle” and “mid cycle” have palpably weakened relative since last quarter, while “recession” counterclaims have strengthened (see chart).

What inflation drivers have turned

We expect inflation to soon begin the choppy process of softening. The four original thematic drivers of high inflation have all turned:

- Monetary stimulus has become restraint.

- Fiscal stimulus has become a fiscal drag.

- Supply chain problems are resolving.

- The commodity shock has de-intensified (if not disappeared).

Real-time inflation readings extracted from internet retailers and other websites continue to show a deceleration in North American inflation.

Commodity prices are clearly declining, whether one looks to agricultural products, base metals, lumber or even energy. Oil prices are significantly lower than in the early months of 2022. Even natural gas prices in Europe have retreated somewhat in recent months – while remaining exceedingly high

Market scenarios

There are two obvious scenarios, both hinging on inflation starting to decline in earnest.

Scenario 1: Markets recognize that inflation was the greatest threat to long-term prosperity, and thus that declining inflation is the most important achievement, regardless of a temporarily weak economy in 2023. Stocks and bonds would remain positively correlated but reverse course, offering superior returns to investors across both asset classes.

Scenario 2: Inflation also declines, but this pleases only the bond market. The stock market remains depressed as attention turns to weak economic activity and declining corporate earnings from high inflation. There would presumably be an equity rebound later as the recession comes to an end, but there would be a period of rallying bonds and weakening stocks. This scenario argues for an overweight of bonds.

An interesting takeaway is that bonds perform well in both scenarios, but equities in only the first scenario. The first scenario is arguably the more likely one, and equities will possibly recover to a greater extent in this scenario than bonds. However, the yield available from bonds now easily outpaces the dividend available from equities, suggesting a superior return from bonds if the stock market remains depressed.

U.S. mid-term elections

A quick note that U.S. mid-term elections are on November 8. Republicans are highly likely to capture the House of Representatives and now – for the first time in months as polls gyrate – deemed likely to capture the Senate as well. Legislation will be hard to come by over the next two years given a Democrat in the White House.

Global Insights

Factbox: Market implications from Tuesday's U.S. midterm elections – Investors are turning their focus to Tuesday's midterm elections, which will determine control of the U.S. Congress.

The Competition Tribunal's public hearing on Rogers Communications Inc.'s $26-billion proposed takeover of Shaw Communications Inc. begins today as the telecom companies look to take the deal across the finish line.

West Texas Intermediate lost 3.5 per cent to settle near US$86 a barrel. US crude stockpiles rose 3.93 million barrels, climbing to the highest since July 2021, according to government data. Meanwhile, swelling virus outbreaks in China show the strain its COVID Zero strategy is facing, with cases in Beijing hitting the highest in more than five months.

Ukrainian troops pushed forward, and a battle-scarred stretch of the front fell silent on Thursday, after Moscow ordered one of the war's biggest retreats, though Kyiv warned that fleeing Russians could still turn Kherson into a "city of death".

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.