Bram Houghton

November 28, 2022

Economy Commentary Weekly updateWeekly Market Update – November 25th, 2022

Canada’s retail sales decreased by 0.5% in September from August. The decrease was led by sales of gasoline and food and beverages.

Core retail sales, which exclude sales of gasoline and motor vehicles and parts decreased by 0.4%. Providing an advance estimate of retail sales, Statistics Canada suggests that sales increased by 1.5% in October.

U.S. durable goods orders rose 1% month-over-month in October, beating market forecasts of a predicted 0.4% rise. Durable goods orders, minus transportation, edged up 0.5%.

U.S. initial jobless claims rose by to 240,000 versus the 225,000 expected and is the highest since mid-August.

German producer prices unexpectedly dropped 4.2% in October the first monthly fall in two and a half years.

German GDP figures show the country’s economy has grown slightly more in the third quarter than anticipated on the back of consumer spending.

European Union is rushing to fill storage tanks with Russian diesel before an EU ban begins in February, with alternative sources remaining limited.

Euro zone November flash Purchasing Manager’s Index (PMI) readings confirmed that the 19-member currency bloc has entered a recession, but the downturn in business slowed slightly. A separate survey showed that the UK economy is in recession, with the downturn expected to worsen into 2023.

Data showed that German business morale rose more than expected in November and pessimism heading into the coming months eased noticeably.

EU countries agreed to a 45-billion-euro plan to fund the production of chips, putting the Euro bloc a step closer to its goal of reducing its reliance on U.S. and Asian manufacturers.

Oil prices hit two-month lows this week as the level of a proposed G7 cap on the price of Russian oil raised doubts about how much it would limit supply. Saudi Arabia also denied media reports that it was discussing an increase in oil supply with OPEC. Lower fuel demand from China with tightening Covid curbs also continues to weigh in.

China's Covid outbreak continues to widen as daily cases are at the highest since April and China records its first Covid deaths in almost six months. Analysts have estimated that restrictions have been imposed across cities that comprise around 20% of Chinese GDP.

Chinese banks were reportedly encouraged to increase credit to support the economy, especially industries that have been hit harder by Covid. Officials indicated the People's Bank of China would allow banks to reduce capital reserves to stimulate growth.

China's local governments face a debt squeeze worth U.S. 2 trillion of maturity over the next five years, equivalent to more than 40% of outstanding debt.

Japan's November manufacturing activity contracted at the fastest pace in two years as demand worsened due to strong inflationary pressures

Weekly change: TSX: 2.0; DOW: -1.1%; S&P 500: 1.5%; NASDAQ: 0.7%; GOLD: FLAT; WTI: -4.4

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

MacroMemo - November 22 - December 5, 2022 by Eric Lascelles Link to Article

Inflation eases

The inflation numbers for October were substantially below consensus for CPI month-over-month. Those were also considerably softer than the average of the past year. Annual CPI has now decelerated for four consecutive months since peaking in June.

RBC Economics remain firm in the following views:

- The original drivers of high inflation have all turned (commodity shock, supply chain problems, monetary stimulus, fiscal stimulus).

- There is evidence of changing corporate pricing behavior – Amount of U.S. businesses planning to raise prices is falling precipitously.

- Inflation can therefore continue to fall from here, albeit in choppy fashion, and not necessarily immediately back to 2.0%.

Supply chain update

The supply chain story remains favourable toward declining inflation Here are some notable trends (see link for subsequent charts):

- Container shipping costs are plummeting and increasingly normal.

- Dry bulk shipping costs are lower.

- The number of ships waiting at southern Californian ports has fully normalized.

- The demand for trucks relative to the supply has largely normalized.

U.S. midterm elections wrap up

Two weeks after the U.S. midterm elections, the precise results remain elusive. However, enough is now known that we can draw important conclusions.

The Democrats managed to hang onto the Senate after all. Meanwhile, the Republicans picked up enough seats to take over the House of Representatives, but the gain was the weakest for the opposition party at a midterm election in decades.

Relevant takeaways include:

- Congress is now divided, greatly limiting legislative action over the next two years.

- The Republicans gained but fared surprisingly poorly despite Biden’s low popularity and present economic pain.

- Former President Trump-supported Republican candidates performed particularly poorly, even as he formally announces his candidacy for the 2024 presidential election.

- Law and order appears to be a reviving issue after a recent crime surge, to the advantage of Republicans in some normally Democrat districts.

Where might Democrats and Republicans find common legislative ground? Presumably they will look to avert debt ceilings and fiscal cliffs, and to pass care-taker budgets. Both parties are certainly unified in their anti-China views and anti-big tech sentiment – so there is the possibility of further action on these files.

Should the U.S. economy descend into recession, one could expect a concerted effort to revive the economy. However, government action on the usual scale is not likely given mounting evidence that prior stimulus efforts were too generous.

Economic signals remain mixed

The economy continues to project mixed signals, especially in the U.S. The U.S. economy apparently remains fine, with fourth-quarter real GDP tracking a robust 4.2% annualized gain according to the Atlanta Fed.

However, not all retailers agree. Target observed a “dramatic” downturn in consumer spending in October and into early November, Amazon observed a slowdown in October, and even Walmart conceded that discretionary spending had weakened, even if spending on essentials was offsetting this.

The bottom line is that consumer spending may indeed be starting to weaken and is at a minimum vulnerable to softening.

Recession outlook

We continue to anticipate a recession for much of the developed world in 2023. The consensus outlook for 2023 developed-world growth continued to decline in November according to Consensus Economics, though not quite to the point of matching our own forecasts.

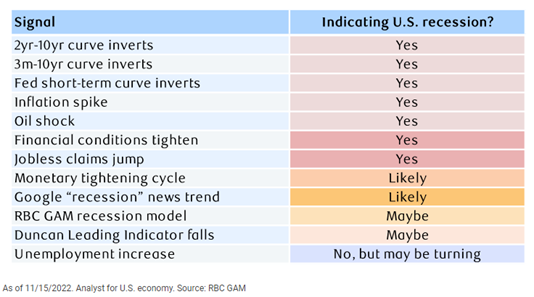

Our scorecard of simple recession signals recently witnessed the migration of two indicators from “no” to “yes”. The 3m-10yr curve recently inverted, as did the Fed’s short-term curve. Those developments have historically presaged a recession. Now, only one of 12 indicators continues to say “no”, though with the caveat that a “yes” may not be far away based on expectations.

Global Insights

European traders are rushing to fill tanks in the region with Russian diesel before an EU ban begins in February, as alternative sources remain limited.

The European Union will ban Russian oil product imports, on which it relies heavily for its diesel, by Feb. 5. That will follow a ban on Russian crude taking effect in December.

Canadians are continuing to pay more for rent, with prices climbing by almost 12 per cent in October, according to a report by Rentals.ca.

In its latest report, the Toronto-based rental company said the average rent rose 11.8 per cent in October compared to a year ago. On a monthly basis, the average rental price increased 2.2 per cent from September.

Thousands of British railway workers will stage further strikes over the next two months in a long-running dispute over pay, the RMT union said on Tuesday, signaling travel disruption before and after the Christmas holiday period.

The United States is looking to crack down on environmental criminals behind surging deforestation in the Brazilian Amazon, using penalties such as Magnitsky sanctions to tackle climate change more aggressively, U.S. sources and officials told Reuters.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.