Bram Houghton

January 16, 2023

Economy Commentary Weekly updateWeekly Market Update – December 23rd, 2022

Market update

The latest Canadian inflation data shows a cool down in November, though some measures still above expectations. The consumer price index rose 6.8 per cent from a year ago, which is just above the 6.7 per cent most economists were expecting but down from the 6.9 per cent annual rate we saw in October.

The core measure of CPI – trim and median, which are the Bank of Canada’s general focus outside headline inflation climbed higher, averaging more than five per cent. The core rate strips out volatile food and energy prices.

Meanwhile, the increase in food and shelter prices were key drivers in the latest round of data with mortgage interest costs up 14.5 per cent, the biggest increase since February 1983. Food costs were up 11.4 per cent year over year, following a rise of 11 per cent in October.

Statistics Canada says retail sales in October posted their largest increase in five months, led higher by gains at gasoline stations and food and beverage stores. The agency says retail sales increased 1.4% in October.

The national unemployment rate held steady at 5.1 per cent in November. Statistics Canada says the number job vacancies fell by 4.8 per cent in October to their lowest level since August 2021.

The number of Americans filing new claims for unemployment benefits increased less than expected last week, pointing to a still-tight labor market, while the economy rebounded faster than previously estimated in the third quarter.

U.S. consumer spending barely rose in November, while annual inflation increased at its slowest pace in 13 months, but demand is probably not cooling fast enough to discourage the Federal Reserve from driving interest rates to higher levels next year.

U.S. Third quarter Gross domestic product (GDP) increased at a 3.2% annualized rate last quarter which was revised upwards from the 2.9% pace reported last month. The economy had contracted at a 0.6% rate in the second quarter.

U.S. single-family home building tumbled to a 2-1/2-year low in November and permits for future construction plunged as higher mortgage rates continued to depress housing market activity. However, closing prices still climbed, and the Fed will continue to raise rates if housing remains costly, which could be detrimental for risk assets in the long-term.

European Union energy ministers on Monday agreed a gas price cap, after weeks of talks on the emergency measure that has split opinion across the bloc as it seeks to tame the energy crisis.

British factories' output and export orders slid this month, according to a survey on Monday that underlined the troubles faced by the manufacturing sector, including high inflation and a weak global economy.

Continued supply disruptions in the U.S. are also supporting oil. Output in North Dakota has fallen by about 300,000 barrels a day since a winter storm last week and the recovery will take some time. The decision to lift its strict restrictions has led to a surge in COVID cases but China has vowed to provide support for its economy spurring hopes of higher consumption in the long term.

China this month began dismantling its stringent "zero-COVID" regime of lockdowns and testing after protests against curbs that had kept the virus at bay for three years but at a big cost to society and the world's second-largest economy.

Cities across China scrambled to install hospital beds and build fever screening clinics on Tuesday as authorities reported five more deaths and international concern grew about Beijing's surprise decision to let the virus run free.

Weekly change: TSX: 0.3%; DOW: 0.8%; S&P 500: FLAT; NASDAQ: -2.0%; GOLD: 0.2%; WTI: 6.9%;

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

MacroMemo - December 20, 2022 – January 9, 2023 by Eric Lascelles Link to Article

China’s pandemic about-face

As cases surged and the country locked down, intense protests recently arose to an extent not witnessed in more than 30 years. Surprisingly, the government has responded constructively to that dissent. First, the country conducted local experiments with lighter COVID-19 restrictions. It is now easing restrictions at the national level. The consensus thinking had been that China wouldn’t make such large changes until the spring.

Financial markets are pleased, as the Chinese economy will be less constrained by restrictions going forward. Over the medium run, the economic upside is unambiguous: the pandemic surge eventually fades and then the Chinese economy can operate more freely. Keep in mind that this was already expected to happen – it is simply occurring several months ahead of schedule, pulling that Chinese rebound forward. Chinese policymakers appear to be putting together a plan to encourage more consumption.

All of that said, and at the risk of drifting too far from the pandemic’s effect on the Chinese economy, we mustn’t forget that China has other economic challenges that remain unaddressed:

- The demographic picture is poor.

- The property sector is unlikely to resume driving the economy forward even as the government seeks to stabilize it.

- Entrepreneurs remain beaten down as the balance of power shifts back to the state.

In short, China is reopening in deference to popular demand and the needs of the economy, but there will be a price to pay via public health.

Economy in focus

We passed through an unusual stretch in 2022 when good economic news was interpreted negatively by the stock market due to the implication that inflation would stay high for longer and central banks would have to raise rates by more. This relationship has again reverted back to where good economic data is welcomed by the stock market and poor economic data is not.

There is still some data that bucks this trend - in particular, labour market strength continues to represent a threat to inflation trending downward from here. The relative sensitivity to inflation risks versus growth risks will likely continue to ebb and flow. But it seems reasonable to think that the stock market has now pivoted from inflation concerns only to incorporating growth concerns. There is a good chance that the growth concerns and the possibility of recession will preoccupy the stock market more than other issues.

Unemployment rate increases demands further attention. It is a remarkable signal: every time the 3-month average of the unemployment rate rises by a mere 0.5 percentage points or more, a recession occurs shortly afterward. That isn’t much margin for error. Apparently, once the labour market starts to weaken beyond a fairly minimal point, there is a snowball effect, and a significant amount of damage may be inevitable.

Presently the U.S. unemployment rate is going essentially sideways. This is unusual – unemployment rates are usually rising or falling, not treading water. Looking at past data, it appears that a period with a flat unemployment rate usually only happens at the trough, right before the unemployment rate is about to start rising.

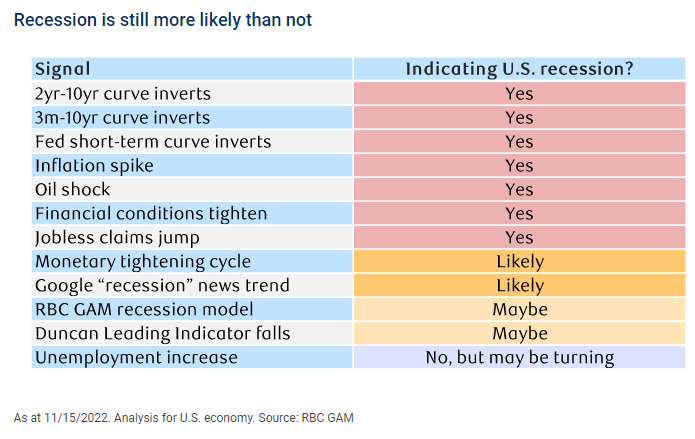

That’s why, in our recession signal scorecard, we have suggested an ‘Unemployment increase’ has not yet triggered, but that may be turning.

More good inflation news

The inflation news was mostly good for a second straight month – a happy reversal after more than 18 months of relentless upside inflation surprises. Consistent with this, global inflation surprises are becoming substantially less positive.

Annual inflation is now down to 7.1% year-over-year, from 7.7% the prior month and a peak of 9.1% in July. This was a third soft month for inflation out of the past five, and the first time two such months have been strung in a row.

The U.S. Federal Reserve has remained reluctant to celebrate inflation’s tentative decline for two reasons:

- Annual inflation has only made a quarter of the journey back to a normal reading.

- Various measures of inflation breadth and of core inflation are still much too elevated.

A new, higher inflation target?

There has been an up-swell of chatter about central banks potentially opting to officially target higher inflation rates. The thinking goes that instead of targeting the standard 2% inflation rate, they might choose 3-4% instead. We are dubious.

A higher inflation target admittedly has some theoretical appeal:

Central banks would have less hard work to do in the coming months if they are only 3 percentage points from their target instead of 5 percentage points.

A higher inflation target would also reduce the risk of central banks getting stuck in deflation and/or bumping into the zero lower bound when disaster strikes.

The combination of de-globalization, the rising clout of workers and climate change will make it incrementally harder to hold inflation down to 2.0% in the future. This is in contrast to the past 30 years, when the opposite trends prevailed.

A significantly higher inflation target would probably be a mistake, for several reasons:

The timing would actually be poor for a sudden pivot toward a higher inflation target, however well-intentioned. Central banks are fighting to restore their credibility and would immediately lose quite a lot of it if they abruptly declared a change in target.

The main argument for a higher inflation target as presented during the global financial crisis was that it would allow for an additional buffer against the threat of deflation. Those particular arguments seem much less persuasive today given that the threat of sustained deflation seems quite low.

In Canada, the government carefully considered the pros and cons of lifting its inflation target in 2016, but ultimately opted not to because the advantages were at least matched by the disadvantages.

Emerging market central banks have spent the past few decades working hard to lower their inflation rates. They clearly see an advantage in a lower inflation target.

From an economic standpoint, people can forget about inflation when it is a mild 2%, but this becomes harder to do as inflation rises from there. In turn, inflation expectations could become less anchored, and workers might start to demand their wages be indexed to inflation – a problematic linkage.

Shifting the inflation target from 2% to 4% would mean borrowing rates would have to rise by two percentage points, rewarding those with locked-in loans and punishing those who had made the loans. The effect on banks, insurers, pension funds and the mortgage market would all be significant and potentially problematic. Stock market valuations would change to reflect altered discount rates.

The bottom line is it would be unwise and quite surprising if major central banks raised their inflation targets any time soon, despite some attractive arguments.

Global Insights

The national unemployment rate held steady at 5.1 per cent in November. Statistics Canada also released seasonally adjusted, three-month moving average unemployment rates for major cities.

Statistics Canada says the number of job vacancies fell in the third quarter after reaching a record high in the second quarter.

European Union nations' energy ministers have agreed a gas price cap, a spokesperson for the Czech Republic said on Twitter on Monday.

The deal follows weeks of talks on the emergency measure that has split opinion across the bloc as it seeks to tame the energy crisis.

In a year marked by yet more climate-linked floods, hurricanes and droughts, governments and companies were forced to look more closely at the financial risks and their exposure to liability.

Nowhere was this more apparent than at the U.N. climate conference in Egypt, where countries reached a landmark agreement to set up a fund to help poor countries cope with climate-fueled disaster costs.

America’s chip war against China will make only partial inroads in 2023. After unveiling sweeping new export restrictions in October, Washington appears to have successfully lobbied friendly governments including Japan and the Netherlands to join. A full anti-China alignment, however, will be tricky while global semiconductors demand slows.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.