Bram Houghton

January 16, 2023

Economy Commentary Weekly updateWeekly Market Update – January 13, 2023

Wicks Houghton group – Weekly Market Update

Canada’s employment rose in December from November well above forecast. The unemployment rate fell to 5.0% in December from 5.1% in November, just above the record low of 4.9% reached in June and July.

The Canadian dollar rose against the greenback rebounding from a two-week low on signs that central banks are making progress against inflation.

In November, Canada's merchandise imports and exports were down. Canada's merchandise trade balance went from a surplus to a deficit in November.

The U.S. CPI report showed prices rose 6.5% in December down from 7.1% in November and in line with expectations. U.S. core CPI which excludes, food and energy, went up by 5.7% as expected.

US jobless claims fell for a second week in a row, hitting a three-and-a-half-month low last week. This is a sign the US labor market is still too hot for the Fed.

The U.S. economy created new jobs in December from November, well above forecasts. The U.S. unemployment rate fell to 3.5% in December, below market expectations and down from 3.6% in November.

Inflation in the euro zone dropped in December to 9.2% from 10.1% year over year, well below forecast with the decline driven by lower energy prices. Excluding volatile food and energy prices, inflation picked up to 6.9% from 6.6% which means the ECB will likely continue with it’s hawkish interest rate path.

The U.K. economy is doing better than expected as Gross domestic product (GDP) growing in November from October versus an expected drop. The German GDP rose 1.9% for the full year 2022 versus 1.8% expected.

Chinese authorities claimed many cities have passed their peak infection rate with others set to follow in coming days, however, COVID spreads through rural China ahead of Lunar New Year migration.

Oil prices rose this week on China demand hopes despite U.S. crude and fuel inventories building up and global economic uncertainty.

Gold gained throughout the week as the USD hit a 9 month low across major currencies.

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | +2.8% | +2.7% | +2.0% | +4.8% | +1.6% | +8.3% | +2.9% |

| Last Week | +2.2% | +1.4% | +1.5% | +1.0% | +4.5% | -8.1% | +2.4% |

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

MacroMemo – January 10 – January 23, 2023 by Eric Lascelles Link to Article

Chinese economy

Chinese policymakers continue to scramble to stabilize the economy after a series of ill-advised policy decisions in 2022. Just before Christmas, the Chinese government made two further commitments:

Prioritize consumer spending and employment: Both have lagged badly over the past year and there is some potential here as the country’s savings rate soared during the pandemic

Provide targeted support to the private sector: After a series of actions that greatly limited China’s entrepreneurial spirit and the growth prospects for private sector, officials are now partially backtracking.

RBC Economics still believe Chinese policy inclinations lie toward strict control, aggressive foreign relations and a large role for the state. The country is unlikely to return to the era of +6% growth.

Happy inflation trends

Eurozone inflation falls profoundly, though not broadly However, as with elsewhere, core inflation has been slower to turn. With inflation still much too high and core inflation still not fully cooperating, the European Central Bank appears to be on a path of 50 basis point rate hikes in each of February and March.

U.S. manufacturers have become much less worried about inflation, implying that they are no longer being hit by extraordinary increases in their input costs. This hints that price declines could even be trickling down the supply chain, so consumers will eventually benefit.

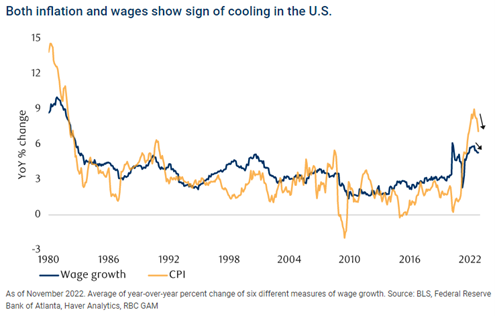

In assessing the danger that high wages may create a wage-price spiral, it is worth keeping in mind that wages are hardly leading the charge. To the contrary, they are both undershooting and lagging the CPI:

In contrast, Canada is still waiting for a big drop which failed to arrive in November. Inflation excluding food and energy actually edged higher as did and three of BOCs special core inflation metrics. Easing supply chain woes, reversing commodity prices and tightening monetary policy should all help over the coming year.

But with the strength of November CPI, the Bank of Canada will presumably have to raise its policy rate at the next opportunity, to a minimum of 4.5%.

CIBC Economics Quick Take: Canadian employment (Dec) by Andrew Grantham

Last year was another wild ride for the Canadian labour market, and there was one final twist in store in December. Employment jumped by 104,000 on the month, blowing way past consensus expectations for a paltry 5,000 gain. Full time positions led the way (+84,500), and by sector there were particularly strong gains in construction and transportation. While the big rise in employment was partly mirrored by an increase in the labour force, the unemployment rate did drop by a tick to 5.0% as well. However, the big gain in employment was once again not reflected in working hours, which Statistics Canada stated were little changed compared to the prior month. That divergence is due to a further increase in staff absenteeism due to illness which, at 8.1% in the reference week, was up from 6.8% in November and compares to a pre-pandemic average of 6.9% for the month of December. The strength in hiring therefore partly appears to be a reflection of companies having to retain more staff in order to obtain the same level of supply.

Still, the strong headline readings raises the probability of another 0.25% hike at the January meeting, and is a clear risk to our forecast for a hold. However, the next CPI report and the BoC's own business and consumer surveys, released in two weeks' time, will also be important in making that final decision.

Notable News

Countries should consider recommending that passengers wear masks on long-haul flights, given the rapid spread of the latest Omicron subvariant of COVID-19 in the United States, World Health Organization (WHO) officials said on Tuesday.

Getting the design of a digital pound right is a bigger priority than a rapid launch, Britain's Financial Services Minister Andrew Griffith said on Tuesday.

China has pushed ahead with piloting a digital yuan and the European Central Bank is studying a digital euro, piling pressure on Britain to do the same and keep abreast of advances in financial technology.

U.S. flights were slowly beginning to resume departures and a ground stop was lifted after the Federal Aviation Administration (FAA) scrambled to fix a system outage overnight that had forced a halt to all U.S. departing flights.

The cause of the problem, which delayed thousands of flights in the United States, was unclear, but U.S. officials said they had so far found no evidence of a cyberattack.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIB