Bram Houghton

January 27, 2023

Economy CommentaryBi-Weekly Market Update - January 27, 2023

Wicks Houghton group BI-Weekly Market Update

Canada’s December Consumer Price Index (CPI) rose 6.3% vs. the expected 6.4%. CPI is down from 6.8% in November. Excluding food and energy, prices rose 5.3% on a yearly basis in December, following a gain of 5.4% in November.

The Bank of Canada (BoC) raised the target for its overnight rate by 25 bps to 4.5%, the highest it’s been since 2007. This was expected by markets and signaled the end of its aggressive tightening cycle. The BoC indicated growth in the economy will stall in the first half of the year, while inflation will ease to 3% by mid-2023.

Canadian retail sales decreased 0.1% in November on a monthly basis. The decrease was led by lower sales of food and beverages, building materials, garden equipment and supplies dealers. Core retail sales, which exclude gasoline, motor vehicles and parts, decreased 1.1%, their largest decline in 11 months. Retail Sales increased 5.20% over the same time in November of 2022.

The U.S. gross domestic product (GDP) showed the economy advanced 2.9% in the last three months of 2022 vs. 2.6% expected. This raised hopes that a soft landing for the economy is possible.

U.S. initial jobless claims unexpectedly fell by 15,000 and 6,000 over the last two weeks, below expectations. Last week was the lowest level since late June 2022. The labor market is still strong despite layoffs in parts of markets and a slowing economy.

Chinese economic data showed gross domestic product grew by 3% in 2022, marking one of the slowest growths in decades. China’s December retail sales beat estimates, falling only 1.8% year over year, better than the decline of 8.6% expected.

UK inflation in December was in line with expectations at 10.5% year over year versus November 10.7%. December inflation in the Eurozone was 9.2% as expected down from 10.1% in November.

Economic data showed UK consumer confidence fell back to a near 50-year low at the start of 2023 and December retail sales unexpectedly fell from November, finishing the worst year ever. Retail sales volumes also slid over the last month at the fastest rate since April last year.

German inflation eased further in December of 2022, with consumer prices rising by 9.6% in December, compared to a rate of 11.3% in November. Data showed improved business sentiment in Germany and an uptick in eurozone services and manufacturing activity, prompting optimism that a recession in the eurozone might be avoided.

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | +1.0% | +2.5% | +1.8% | +4.3% | -0.2% | -2.4% | FLAT |

| Last Week | +0.7% | -0.7% | -2.7% | +0.5% | -0.3% | +1.8% | +0.3% |

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

MacroMemo - January 24 – February 13 by Eric Lascelles Link to Article

A run of good news

Economic news has skewed heavily in a positive direction over the past few months including:

- Inflation continuing to fall across the globe.

- China abandoning their strict COVID policy.

- Warmer weather in Europe has supported their energy conservation efforts, and

- economic data hasn’t collapsed amidst the rate hiking cycle.

Eric Lascelles warns the shift from extreme pessimism to substantial optimism could be considered an overreaction as global economies continue to face macro challenges including:

- A recession remains likely due to tighter financial conditions.

- De-globalization is growth-negative and inflation-positive.

- China’s economy is still structurally constrained even as its cyclical impediments fade.

- The weaker U.S. dollar may complicate the decline in U.S. inflation, and

- The war in Ukraine could get messier now that Russia has taken the town of Soledar.

Economic trends

A range of economic data has recently weakened:

- U.S. retail sales fell by a sharp 1.1% in December, after a 1.0% decline in November U.S. consumers are also starting to scale back their ravenous appetite for durable goods. Many of these are big-ticket items like vehicles, furniture, appliances, and electronics.

- Global trade appears to be weakening, though this can be difficult to disentangle from distortions related to currency movements and inflation movements.

- Canadian firms continue to scale back their hiring and investment plans. While the Canadian Business Conditions Index appears to be improving, more Canadian firms now expect their sales volume to decline over the next year than at any point outside the past two recessions.

More inflation good news

Happily, the consensus 2023 inflation forecast for a range of nations finally began to descend with enthusiasm in January.

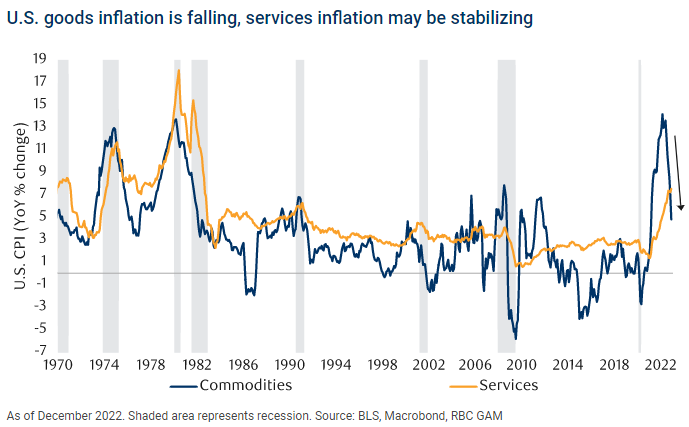

In the U.S., goods inflation is getting nicely under control, but more time is needed for service inflation to be tamed.

Global Insights

CIBC Economics Quick Take: Bank of Canada hikes 0.25% by Andrew Grantham

The Bank of Canada hiked rates by a further 25bp today, but provided some unexpected guidance that this may be the peak for the current cycle. The 25bp increase, taking the overnight rate to 4.5%, was well anticipated by the consensus. The Bank pointed to stronger than expected growth at the end of 2022, a tight labour market and still elevated short-term inflation expectations as reasons for the policy move today. However, the statement also pointed to an easing in the 3-month rates of core inflation, and the expectation that overall inflation will come down "significantly" this year due to the energy prices, improvements in supply chains and the lagged effects of higher interest rates. Possibly because of greater confidence that inflation is easing, the Bank changed its guidance to state that if the economy evolves as it expects then the policy rate will be kept on hold at its current level, although the statement also warned that the Bank was willing to raise rates further if needed. The MPR projections for GDP growth are set at 1% this year and 1.8% in 2024, which is little changed relative to October but a bit higher than our own forecasts. Because of that, we suspect that the economy will indeed evolve in-line or even a little weaker than the Bank suspects, and that today's hike in interest rates will indeed mark the final one of this cycle.

CIBC Economics Quick Take: US Q4 GDP by Katherine Judge

The US economy grew at an impressive 2.9% annualized pace in Q4, in line with our forecast, and a touch above the 2.6% expected by the consensus. The growth was driven by inventory restocking as supply chain issues faded, and consumption, with both services and goods gaining ground. While the headline figure represented a very modest deceleration from the 3.2% pace of growth seen in Q3, final domestic demand (which removes inventories and net trade) slowed more significantly, to 0.8% annualized, from 1.5% in Q3, as business investment cooled markedly, with the equipment category posting a decline. The core PCE price index slowed to 3.9% q/q, from 4.7% in the prior quarter, in line with expectations. With inventories now elevated across many industries, and consumers running through excess savings, we see the potential for a contraction in the economy in the first quarter as the impact of past rate hikes materializes more fully, and consistent with a tapering off of momentum in recent monthly indicators.

Notable News

Explainer: Shutdown? Default? Congress is supposed to pass detailed spending legislation for each fiscal year, which begins on Oct. 1, or temporary extensions to keep the government operating. If these bills don't get passed, agencies like the Defense Department and the Internal Revenue Service don't get the money they need to operate and must shut down or scale back their work.

UKICE said polling it conducted in December showed 56% of Britons said they would vote to rejoin the EU, up from 45% in February, largely consistent with other polls. However, Britain's governing Conservative Party is committed to Brexit and the opposition Labour Party is keen to avoid suggestions it would seek to unravel the post-2016 settlement.

China's population fell last year for the first time in six decades, a historic turn that is expected to mark the start of a long period of decline in its citizen numbers with profound implications for its economy and the world.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.