Bram Houghton

March 01, 2023

Economy CommentaryBi-Weekly Market Update - February 24, 2023

Wicks Houghton group BI-Weekly Market Update

Canada’s January annual inflation rate fell to 5.9% vs. the 6.1% expected, leaving the Bank of Canada some room to hold interest rates at current levels next month. Core inflation rate eased to 5% in January, the lowest rate since February 2022 and below the forecasted 5.5%. Canadian retail sales rose by 0.5% in December from the previous month, in line with expectations.

Canadian employment data showed a in January, ten times the consensus forecast, and much higher than December. Most of the jobs were full time and private sector. Despite the increase in employment, the unemployment rate held steady in at 5.0% supported by an increase in the participation rate and strong population growth. Moreover, wage inflation decelerated to 4.5% from 4.7% in December.

New home prices in Canada declined in January as buyers worried about higher interest rates. Mortgage rates increased in January when the Bank of Canada increased rates by 0.25% to 4.5%. Housing starts also declined in January, well below expectations. New home sales in January were at the lowest since 2009.

The U.S. consumer price index rose 0.5% in January, more than expected, though down from December’s readings. Excluding food and energy, the core CPI was at 5.6% vs. 5.5% from a year ago.

U.S. weekly initial jobless claims unexpectedly fell by 1,000 last week to 194,000 and 2,000 this week to 192,000 giving further evidence that the U.S. labor market remains tight.

January housing starts in the U.S. fell by 4.5% from a month earlier in January. This was well below market expectations and the lowest since June 2020.

U.S. retail sales increased by the most in nearly two years in January after two straight monthly declines as Americans boosted purchases of motor vehicles and other goods, pointing to the economy's continued resilience despite higher borrowing costs.

January Eurozone inflation came in at 8.6% vs. forecasted 8.5%, but down from 9.2% in December. Euro zone employment grew twice as fast as expected to a new record high in Q4 of 2022, as the economy avoided a recession.

The unemployment rate in the U.K. was unchanged in Q4 2022 while wages rose more than expected in a further sign of inflation. British retail sales held steady in February after falling in January. Sales volumes are expected to fall in March as disposable incomes are reduced by the rising cost of living.

British inflation cooled to 10.1% last month, the lowest reading since September 2022. It fell by more than expected and there were signs of cooling price pressure in parts of the economy watched closely by the Bank of England, adding to signs that further hefty interest rate hikes are unlikely.

Germany's inflation rate showed no signs of easing raising by 9.2%, as energy and food price pressure remains high due to the war in Ukraine. Data from Germany showed its economy contracted 0.4% in Q4 of 2022 as inflation and energy costs weighed on consumption and investment.

Japan’s trade deficit has expanded to 3.5 trillion yen (US$26 billion) in January amid weakening Chinese demand for cars and chipmaking machinery.

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | -0.7% | -1.1% | -0.6% | -2.4% | +0.3% | +8.7% | FLAT |

| Last Week | +0.2% | +1.6% | +0.2% | +3.3% | +0.4% | -7.9% | -2.4% |

MacroMemo - February 14 – March 6, 2023 by Eric Lascelles Link to Article

Recent economic news has been mostly positive, with falling inflation, a strong labor market, and eased financial conditions.

However, there are still risks that could lead to a recession, such as increased commodity prices, a worsening of the war in Ukraine, an overheated labor market, financial risks in Japan, and the U.S. debt ceiling. While not all of these risks will trigger, some could, so caution is still advised.

Economic Signs of Strength

North American hiring remains incredibly strong, with the U.S. unemployment rate at its lowest in 53 years. Canada has also seen a large increase in jobs, particularly in retail and wholesale trade, which is unusual for this time of year. The market reacted negatively to this news as it suggests that more monetary tightening may be necessary to control inflation.

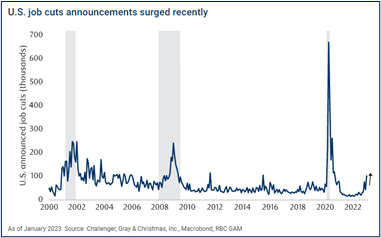

There are some signs that the labor market is starting to soften, such as increasing job cuts and falling temporary employment. Economic growth is still solid, with consumer spending showing signs of strain. Business expectations have fallen to levels lower than their 2020 trough. In summary, the labor market is still strong but there are some warning signs that suggest a slowdown may be on the horizon.

Growth forecasts

RBC GAM has new interim growth forecasts, which have mostly been upgraded from a quarter ago due to falling inflation, China's reopening, and the labour market holding together. The forecasts range from -0.2% to +0.1% growth for 2023. The consensus has also moved higher recently, but the forecast is still more cautious than the market. There is expected to be a robust recovery in 2024, with many developed countries averaging 3% growth per quarter.

Recession Risks remain elevated final

Despite recent mixed economic data, the risk of a recession in the developed world in 2023 is still high. This is evidenced by the New York Fed's yield curve recession model, the Philadelphia Fed's survey of private-sector forecasters, as well as RBC GAM’s econometric model, which all point to an elevated risk of recession.

IN FOCUS: Wage pressures not as inflationary as perceived by Benjamin Tal and Karyne Charbonneau Link to Article

The COVID recession has resulted in a lower share of low-paying jobs and a higher average wage due to the compositional factor. This is evident in job creation by education, establishment size, and self-employment. All of these have seen a shift towards higher-paying jobs, resulting in a higher average wage.

Changes in employee tenure can also affect average wages. Job changers who tend to have higher wage growth, make up a small portion of the workforce and that the more tenure someone has with their employer, the higher their wage. It also discusses how changes in the occupation mix of employees and the drop in the number of self-employed in Canada contribute to overall wage growth. In conclusion, it is estimated that compositional changes account for about a fifth of measured wage growth.

Wages have increased for low-wage workers, particularly in the second quintile of the wage distribution. It suggests that this wage growth is due to firms having to react to shortages in lower-skilled jobs, and that the wage growth is due to the composition of the labour market and not necessarily an increase in demand. The article also points out that the Bank of Canada is aware of this issue, and that market participants should look beyond the headline wage numbers.

Global Insights

Should we be worried about the debt ceiling? By Angelo Katsoras Link to Article

The United States hit its statutory borrowing limit of $31.4 trillion on January 19th of this year. This means lawmakers must raise or suspend the limit before the Treasury Department can issue more debt.

What happens if the debt ceiling is not raised in time?

If the debt ceiling is not raised in time, the US government would have to prioritize certain payments over others, potentially leading to a recession and global ramifications. Unorthodox moves such as minting a $1-trillion coin or invoking the 14th Amendment have been suggested, but these would likely be challenged in court and further undermine confidence in the US economy.

Negotiating an agreement has proven much more problematic when a Democrat is president and the Republicans control at least one chamber of Congress.

The close call of 2011

In 2011, the United States came perilously close to defaulting on some of its financial obligations when a Republican-controlled House refused to back an increase in the debt ceiling without deficit reduction. This caused the S&P500 equity index to drop 17% and sectors most exposed to the U.S. federal government to drop 25%. As a result of this act of brinkmanship, Standard & Poor's stripped the United States of its triple-A credit rating.

The most likely scenario

The most likely scenario is that the U.S. debt ceiling will be raised before any payments are missed and the parties will reach a compromise to avoid economic catastrophe.

Notable News

ChatGPT, a fast-growing artificial intelligence program, has drawn praise for its ability to write answers quickly to a wide range of queries, and attracted U.S. lawmakers' attention with questions about its impact on national security and education.

European countries' bill to shield households and companies from soaring energy costs has climbed to nearly 800 billion euros, researchers said on Monday, urging countries to be more targeted in their spending to tackle the energy crisis.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.