Bram Houghton

March 10, 2023

Economy CommentaryBi-Weekly Market Update - March 10, 2023

Wicks Houghton group BI-Weekly Market Update

The Bank of Canada (BoC) said Wednesday that it is holding its key interest rate at 4.5 per cent. Economists widely expected the BoC to pause its tightening cycle, which began last March from a pandemic low of 0.25 per cent.

Canada recorded a CAD$5.54 billion budget deficit for the first nine months of the 2022/23 fiscal year, partly due to rising debt charges linked to higher inflation and interest rates. Year-to-date revenues were up from improvement in income streams. Program expenses were down largely reflecting lower transfers to individuals and businesses as COVID-19 supports were wound down.

Canadian GDP came in nearly unchanged on an annualized basis and stalled quarterly from Q4 from Q3 2022, following five consecutive quarterly increases. It was well below market forecasts for growth with slower inventory buildups along with declines in business investment.

Canada's January exports increased by 4.2% and Imports increased 3.1%, causing a surprise trade surplus versus expectations. The U.S. trade deficit in January rose slightly above forecast.

The monthly total value of building permits in Canada decreased by 4.0% in January. Residential permits decreased 6.6% and non-residential sector permits were up slightly by 0.7%.

U.S. February Private Payrolls rose by 242,000 well above expectations, supporting the view that the economy is strong. Data for January was revised higher to show 119,000 jobs added instead of 106,000 as previously reported. Economists polled by Reuters had forecast private employment increasing 200,000.

The February S&P Global Canada Manufacturing Purchasing Managers' Index (PMI) rose further from the previous month. The latest reading pointed to the second consecutive month of expansion in factory activity and the quickest since last July.

U.S. initial jobless claims increased by 10% to 211,000 – the highest since December. The rise in jobless claims should continue over the coming months as companies are prepare for an economic slowdown by cutting workers and slowing hiring. Unit labor costs jumped 3.2% vs. the 1.6% forecast from October to December. This could force employers to raise wages, adding to inflationary pressures.

Beijing announced sweeping changes to its regulatory bodies which is likely to give President Xi and the Chinese Communist Party (CCP) more control on financial regulatory, technology and data management sectors.

Euro zone inflation fell to 8.5% in February down from 8.6% the previous month, but is was above the 8.2% forecast. Euro Area unemployment rate stood at 6.7% in January, unchanged from December and slightly above market estimates of 6.6%.

Inflation figures from France and Spain came in higher than expected for February, with price rises advancing on an annual and monthly basis. Purchasing Managers' Index (PMI) for February showed Spain, U.K. and Italy beat consensus while France and Germany fell below preliminary readings and the Eurozone matched preliminary readings.

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | -3.9% | -4.5% | -4.4% | -4.7% | -1.7% | -3.8% | +0.9% |

| Last Week | +1.8% | +1.9% | +1.7% | +2.6% | +1.2% | +4.4% | +2.0% |

MacroMemo - March 7 – 27, 2023 by Eric Lascelles Link to Article

Strong economic data

Recent economic data was mostly strong, although some of it may have been artificially inflated due to seasonal adjustments, warmer weather, and pension plan adjustments. This includes US retail sales, US personal spending, US ISM services index, and European composite. Canada was an exception, with a 0.1% decrease in December GDP. Despite this, markets did not celebrate this development as high inflation levels and monetary tightening could lead to economic weakness.

Although traditional economic data is indicating a strong economy, unconventional and real-time metrics suggest otherwise. Walmart and Home Depot, two major retailers, have reported subdued sales due to high inflation and mortgage rates. Additionally, Canada's real-time business conditions index has been volatile and inconclusive.

RECESSION WATCH

Dubious ‘no landing’ argument

the current economic debate is between a ‘soft landing’ and a recession, with a ‘no landing’ scenario being unlikely to occur. The economy is already overheated, which makes it difficult for growth to be sustained without leading to a recession later on.

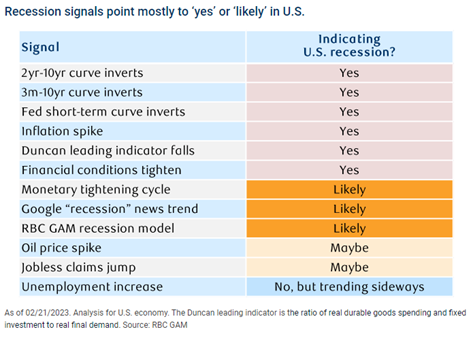

Updated recession scorecard

RBC Economics’ U.S. recession scorecard suggests that there is a high probability of a recession, with half of the indicators signaling ‘yes’ and another three signaling ‘likely.’ However, two indicators have been downgraded from ‘yes’ to ‘maybe’ due to recent changes in oil prices and jobless claims.

Stuttering inflation

Inflation has been choppy in the U.S., U.K., Eurozone and Canada, with CPI in each country falling in January. Despite the stutter, inflation is expected to decline further in the coming months, with the Cleveland Fed's model predicting a YoY decline to 5.4% in March. Signs of inflation abating point to the global economy softening in the coming quarters.

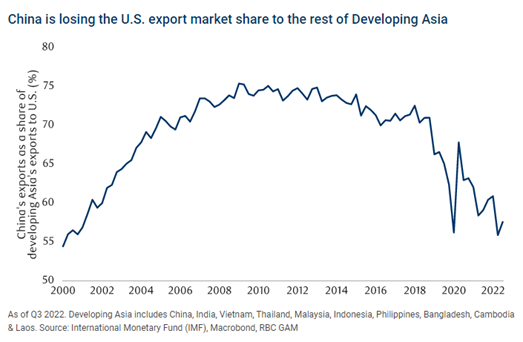

‘Friendshoring’ advancing quickly

Globalization is reversing due to various factors, leading to a shift in manufacturing from countries such as China to more ideologically aligned countries like India, Mexico, and Southeast Asia. This transition is happening quickly, with China losing its global market share in certain industries, such as furniture and footwear, to countries like Vietnam. While Chinese companies are not necessarily losing, the country itself is losing its output and workforce.

Bank of Canada keeps its eyes on the home front by Avery Shenfeld Link to Article

The Bank of Canada (BoC) has decided to keep its interest rates on hold, despite the Federal Reserve in the US increasing their rates. The Bank of Canada has not expressed any concern about the widening gap between rates in the US and Canada, or the weakening of the Canadian dollar, which signals that rates in Canada can remain the same for now.

In a statement released recently, they signaled that they are not concerned about the weakening of the Canadian dollar impacting inflation. The expectation is economic growth slows, leading to a decrease in labour market tightness and a rise in inflation. This slowdown in growth must be sustained in order to reach their 2% inflation target. They also note that a slower job market will be helpful for businesses, as it reduces the cost of wages and makes it harder for businesses to pass on higher costs in their prices.

The Bank of Canada is expecting the economy to stay largely the same, with the overnight rate remaining at 4.5%. The job market is seeing the last of the hiring related to last year's increased demand, but interest sensitive demand is slowing.

Global Insights

Declaring victory against inflation by National Bank Investments Link to Article

Inflation is starting to decrease, signaling the possible beginning of an easing cycle. However, the recent period of low inflation may be coming to an end, posing potential challenges for central bankers. As a result, they may need to exercise caution.

There are many factors that suggest inflation may be headed downwards, such as transportation costs, supply chain costs, and wage expectations. However, there are still factors that could keep inflation higher than expected, such as the reopening of China, which could be both inflationary and disinflationary, and oil and commodity prices, which remain a wildcard. The US has announced that it will begin buying oil back in 2023 after drawing down its strategic petroleum reserves last year, creating potential for long-term supply gaps, which could affect prices if long-term demand continues to grow.

Many believe that inflation data will improve in 2023, leading to increased confidence in the markets. However, major central banks are likely to remain cautious and will require clear evidence of service sector inflation moderating before easing policy. This is not expected to occur until the end of 2023 at the earliest. In the long term, the question remains on how central banks will handle the disinflationary impulse from goods prices, which may lead to a challenging economic environment.

Notable News

General Motors Co on Thursday said it was offering buyouts for most of its salaried employees and global executives and expects to take a pre-tax charge of up to $1.5 billion to cover the costs.

The announcement comes as layoffs by U.S. companies in the past two months touch their highest since 2009, with the tech sector accounting for more than a third of the over 180,000 job cuts announced.

Emerging markets are facing their demons as traders mull whether U.S. Federal Reserve interest rates will rise as high as 6%, a level that could kick weaker countries when they're down, while diverging global growth paths and China's reopening might cushion some of the blow for the bigger ones.

When you read the content we share and it causes you to think of others in your life who would benefit from seeing it, please don’t hesitate to share it with them.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.