Bram Houghton

March 27, 2023

Economy CommentaryWeekly Market Update - March 24, 2023

Wicks Houghton group BI-Weekly Market Update

Canada’s February Consumer Price Index (CPI) eased to 5.2% vs. the expected 5.4%. It is down from 5.9% in January, making it the largest deceleration in headline inflation since April 2020. On a monthly basis, CPI rose 0.4 vs. expectations of 0.5%.

Canadian Retail sales increased more than expected by 1.4% in January. Estimates for February show a decline of 0.6% as well as declines for wholesale trade of 1.6% and manufacturing sales of 2.8%.

Housing starts in Canada rose by 13% in February beating market expectations. The New Housing Price Index also declined for the month, down in five of the last six months. The Index decreased to a 1.40% gain in February from 2.70% in January.

The US Federal Reserve raised the target federal funds rate by a modest 0.25 percentage points on Wednesday, stating “The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time”.

US retail sales fell 0.4% vs. a consensus decline of 0.3% in February. It was dragged down by a 1.8% slide in auto sales.

U.S. initial jobless claims fell were down and below expectations for the last two weeks, indicating the labor market remains strong despite large companies announcing layoffs. Amazon (9,000) and Accenture (19,000) both announced significant layoffs this week

Single-family housing starts, which account for the bulk of homebuilding, increased 1.1% to a seasonally adjusted annual rate of 830,000 units last month in the US.

The Bank of England hiked interest rates by 25 bps to 4.25% to their highest level since 2008. The Swiss National Bank also raised its benchmark interest rate by 50 bps and Norway's central bank hiked by 25 bps, both in line with market expectations.

The European Central Bank raised interest rates by 50 basis points on Thursday as promised to curb inflation, ignoring financial market chaos and calls by investors to dial back policy tightening at least until sentiment stabilizes.

UK inflation registered first increase in five months in February to 10.4%, much higher than the 9.9% forecast.

The U.K. recorded a £16.7 billion budget deficit for February, the biggest loss for the month since records began in 1993.

The U.K. labor market showed some signs of cooling as wage growth slowed for the first time in more than a year.

UBS agreed on Sunday to buy its embattled domestic rival Credit Suisse for 3 billion Swiss francs ($3.2 billion) as part of a government-backed, cut-price deal. The rescue deal means Switzerland is on track to see its two biggest and best-known banks merge into just one financial giant.

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | +0.6% | +1.4% | +1.2% | +1.7% | +1.6% | +3.7% | +0.4% |

| Last Week | -2.0% | +1.4% | -0.1% | +4.4% | -3.0% | -13.0% | +5.7% |

Unhappy in its own way (Economic Insights) by Avery Shenfeld Link to Article

The Fed is advised to decelerate its tightening pace until the dust settles in the aftermath of the Silicon Valley Bank demise and the risks faced by mid-sized banks in the US. The rush into safe assets has pushed the yield curve to the point where the market is eyeing rate cuts by this summer, but Avery Shenfeld believes that no cuts will occur until 2024.

How weak is the core (CPI)...

The use of mortgage interest payments in the CPI means that the Bank of Canada's interest rate hikes are directly affecting one component of the basket. The mortgage interest contribution to inflation is the highest it’s ever been on record.

expectations.

Some Relief…

There is some good news for consumers as relief is expected at grocery stores by the second half of this year. The impact of last year's exchange rate depreciation on food prices and other items should have peaked, and there should be greater pass-through from softening global food prices to those at grocery store shelves.

Returning to ‘Normalcy’…

Changes in spending behavior in the food sector could impact demand and inflation for discretionary items. Inflation for both discretionary and non-discretionary items increased last year due to pent-up demand and excess savings amid the pandemic. However, signs of consumer behavior returning to normal could lead to disinflationary consequences. Activity in bars and restaurants fell to a seven-month low in November, and some households are shifting from traditional grocery stores to lower-cost bulk distributors. These changes could indicate a reduced ability for companies to pass on cost increases through rapid price hikes.

The pain threshold by Avery Shenfeld Link to Article

Policymakers face challenges at the upcoming Federal Reserve committee meeting having to balance the risks of issues in the banking system with the need to control inflation.

While the markets are pricing in a quick reversal with easing expected to begin in the fall of this year, the Fed is unlikely to come to such a conclusion as inflation remains high and labor markets are tight. The forecast will likely include at least one more quarter point hike ahead and then a pause.

Avery Shenfeld of CIBC Economics believes that investors should prepare for a world where the Fed hikes one or two times and then stays on hold for a couple of quarters, with a non-negligible probability that the economy goes into a tailspin and requires a major tumble in interest rates.

Global Insights

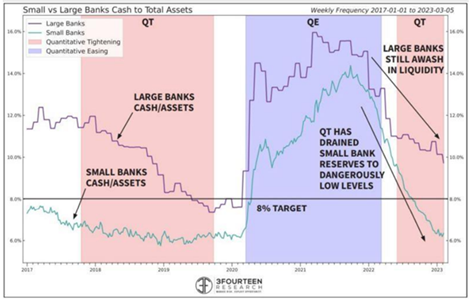

An interesting look at the capitalization of Small Banks vs. Large Banks in the U.S

Quantitative tightening has impacted small banks more than large banks by draining their reserves to cover deposits and inherently to lend to potential clients.

An update on the war in Ukraine By Angelo Katsoras Link to Article

Ukraine’s contaminated farmland

It is estimated that at least a quarter of Ukraine's agricultural land has been damaged, and decontamination and debris removal could take many years. This could have a long-term impact on supplies of agricultural commodities, as Ukraine was one of the world's top exporters of corn and wheat before the war.

Ukraine war: China is caught between Russia and the West

China stands to benefit from the West's diversion of resources, but if it provides Russia with weaponry, it could trigger a crisis in its relationship with the EU and US. China must also weigh the economic benefits of its trade with Russia against the potential for Western financial sanctions if it does not take the right steps. The student can also consider how digital currencies and other financial market infrastructure could help to reduce China's reliance on the US dollar and other Western currencies.

Russia’s economy has resisted but does face longer-term challenges

Despite predictions that Russia's economy would shrink by over 10%, it actually only shrank by 2.2% in 2022. The oil and gas sector is being affected by higher operational costs, lower revenues, and the need to offer larger discounts. Additionally, natural gas pipelines to Europe are almost completely shuttered, and there is a historic exodus of Russians leaving the country.

Notable News

Credit Suisse and UBS could benefit from more than 260 billion Swiss francs ($280 billion) in state and central bank support, a third of the country's gross domestic product, as part of their merger to buffer Switzerland against global financial turmoil, documents outlining the deal show.

In February, an American a subsea cable company began laying a cable to transport data from Asia to Europe, via Africa and the Middle East, at super-fast speeds over 12,000 miles of fiber running along the seafloor.

It has now become a trophy in a growing proxy war between the United States and China over technologies that could determine who achieves economic and military dominance for decades to come.

U.S. lawmakers on Thursday battered TikTok's CEO about potential Chinese influence over the platform and said its short videos were damaging children's mental health, reflecting bipartisan concerns about the app's power over Americans.

When you read the content we share and it causes you to think of others in your life who would benefit from seeing it, please don’t hesitate to share it with them.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.