Bram Houghton

June 05, 2023

Economy CommentaryBi-Weekly Market Update – June 2nd, 2023

Wicks Houghton group BI-Weekly Market Update

In a nutshell: Another two weeks of mixed signals with GDP numbers showing some signs of economic resilience while global PMI numbers suggest otherwise. Interesting to note that US unemployment increased by 0.3% which suggests a significant increase in people looking for work and Germany just entered ‘technical recession’ territory, with a second quarter of negative GDP growth.

April industrial producer prices edged lower in Canada by 0.2% against expectations of a 0.2% increase. This was the third consecutive month of deflation, supported by lower energy and lumber prices.

Canadian gross domestic product (GDP) rose 0.8% in Q1 from the previous quarter against the 0.4% expected. The economy expanded at an annualized rate of 3.1% in the first three months of the year, exceeding expectations of both analysts and central banks.

U.S. gross domestic product (GDP) from Q1 rose at a 1.3% annualized pace vs. the 1.1% reading expected by economists. Q1 2023 GDP growth remains the weakest since Q2 2022.

U.S. Manufacturing PMI declined into sector contraction in May below neutral results in April and below expectations. This was the biggest contraction in the manufacturing sector in three months, signaling a significant deterioration in operating conditions. U.S. Services PMI expanded in April, above market expectations.

The U.S. economy unexpectedly added 339,000 jobs in May 2023, above the market forecast of 190,000. The unemployment rate in the U.S. increased to 3.7% in May from 3.4% in April, the highest since October 2022 and above the 3.5% expected.

U.S. initial jobless claims rose over the last two weeks but far below expectations, suggesting the tight labour market in the US continues. U.S. private payrolls also increased well above expected in May, showing the sector has strong job growth.

U.S. consumer spending increased more than expected in April, supported by strong wage gains in a tight labor market. Consumer spending accounts for more than two-thirds of U.S. economic activity.

UK inflation falls to 8.7% in April versus the 8.2% predicted and are expecting a 25 basis point hike to 4.75% in June. British retail sales declined this month after a modest rise in April but stores expect sales volumes to stabilize in June.

German gross domestic product, which unexpectedly dropped in Q1 is confirming Germany entered a technical recession and consumer confidence was a bit weaker than forecast. German business morale fell further than expected in May, mainly due to a sharp decline in future expectations German import prices are the lowest since 2020 as natural gas prices retreat and German unemployment rose less than expected in May.

China’s official manufacturing PMI showed a contraction in May, below the expected modest expansion. This signaled sluggishness in a rebound in the world's second-largest economy that began earlier in the year following the removal of strict COVID-19 rules.

Oil prices is slightly down over the fortnight as demand concerns and further rate hikes weighed in on OPEC+ supply cut musings and dip in U.S. stockpiles.

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | +0.5% | +1.8% | +2.0% | +2.0% | -0.7% | -1.2% | +1.0% |

| Last Week | -2.0% | +0.3% | -1.0% | +2.5% | -1.2% | +1.6% | -1.9% |

ECONOMIC FLASH! Canadian GDP: Stronger and broader than expected by Andrew Grantham Link to Article

The Canadian economy grew at an annualized rate of 3.1% in Q1 2023, which is higher than what was expected by most forecasters at the start of the year. Net trade was the main driver of growth, reflecting a surge in exports and sluggishness in imports. Domestic demand, particularly consumer spending, was much stronger than in the second half of 2022 due to solid growth in services and semi-durable consumption. A slump in the household savings rate, however, suggests that there may not be much more scope for spending to increase. While the end of Q1 was weaker than the start, the flat reading for March GDP was slightly better than expected. The better-than-expected end to Q1 and start to Q2 means that GDP for the current quarter is projected to track around 1%. The odds of another Bank of Canada rate hike have increased, but the bank may wait until July to revise its forecasts before making a final decision.

Implications & actions Re: Economic forecast — While growth has only been only modest since January, GDP resilience suggests further rate hikes are not off the table. Bank of Canada will still likely need to see more data and revise their forecasts for July MPR, rather than pull the trigger on a further 25bp increase as early as next week.

Global Insights

BMO GAM’s Monthly House View - ECONOMIC OUTLOOK by Frederick Demers Link to Article

U.S. Outlook

The growth outlook for the U.S. economy remains concerning, particularly the impact of the banking crisis on credit growth. While the interest rate hiking cycle has already heightened the risk of a recession, the banking stress could be the trigger for a slowdown. A further cooling of growth and a recession is likely in the near future, but the timing is unclear. The recently resilient economic numbers have pushed the expected downturn down the road, and the summer appears to be the earliest a recession could hit, with the second half of the year being a likelier possibility. Investors should be concerned about the impact of banking stress on credit growth, which could lead to economic contraction.

Canada Outlook

While Canada's economy does not usually veer far from the US, and concerns have been expressed about a slowdown, recent economic data shows that the Canadian economy has remained resilient. While the housing sector has been a cause of worry for the nation, a strong population growth represents a floor on housing demand and housing prices. This indicates that Canada has already reached a bottoming out stage earlier than expected and the article views it as good news for the Canadian housing market.

International Outlook

While Europe has shown some resilience in terms of economic growth, the backdrop remains weak. Germany’s factory orders are showing signs of faltering, and the pace of growth is near zero, indicating that the economy is effectively stalled. It is not clear whether the Eurozone is already in recession, but the situation remains worrying. While China presents a better economic outlook, a fully reopened Chinese economy lifting growth, it is unclear if this will be enough to meet markets' high expectations. Investors should be more concerned about potential growth downsides in Europe and the United States than in China.

MacroMemo - May 30 - June 12, 2023 by Eric Lascelles Link to Article

Debt ceiling solution arrives?

President Biden and House Leader McCarthy have reportedly reached a tentative deal to suspend the US debt ceiling for two years in exchange for spending restraints over the next two years that would keep spending flat in fiscal 2024 before tolerating a small 1% increase in fiscal 2025. The deal is expected to exempt the defence budget, pension obligations and various healthcare programmes. Certain Republican-pleasing reforms will also be made including incrementally stricter eligibility for some social services and reduced funding for the Internal Revenue Service. The House Republican group are expected to vote against the deal.

Murky economic data persists

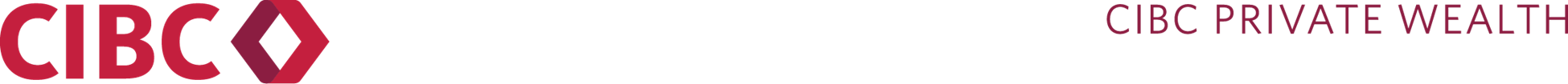

The economic data is inconsistent and contradictory, with some metrics showing strong demand for discretionary services and an increase in global commercial flights, while US business confidence worsens. Possible outcomes for Q2 GDP range widely, with estimates from 1.9% to -0.3%. Germany has experienced two consecutive quarters of contraction, but its central bank's activity index has been trending higher. Overall, it is a time of uncertainty, with different economic indicators supporting both constructive and destructive narratives.

Recession musings evolve

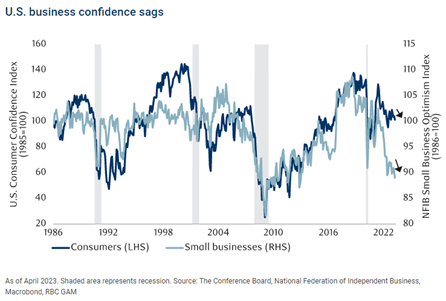

The global economy is forecasted to enter a recession in the latter half of 2023. Germany has arguably just entered a recession following a second-straight quarter of output decline. While standard measures of the yield curve may show an inverted yield curve, this could be flawed as recession predictors during periods of high inflation. For a broader perspective on the economy, the CEO of CN railway has said that their current volumes are consistent with a mild recession and that they are budgeting for an outright decline in industrial production. When examining the inflation-adjusted yield curve, it is also inverted and to an extent usually associated with a recession, but less definitive in its conclusion than if one solely used the nominal yield curve.

Notable News

Innovation Insights Quarterly: Q2 by Matthew Moberg, CPA Link to Article

Chatbot hailed as the next disruptive force in AI

A new AI chatbot, developed for language learning, has been hailed as a disruptive force in AI with potential benefits for coding, science, productivity, finance, law, and education. The chatbot has already achieved high levels of adoption and has been integrated into various corporate communication platforms. Language AI can improve software productivity and create text-to-video or 3D models. However, as with any AI implementation, it is important to identify effective business models for monetization.

Laser-based fusion achieves scientific milestone

Scientists at the National Ignition Facility in the US have produced more energy from a fusion reaction than was needed to start it by focusing 192 lasers on a fuel capsule the size of a peppercorn. The milestone marks a significant breakthrough in fusion energy, but its use as an energy source is still some way off. Researchers are working on resolving technical challenges and have received billions in funding from government and private investors.

Agriculture benefits from the Intelligent Machine revolution

A new high-tech farming machine uses sensors and robotic machinery to release timed bursts of fertilizer to coat individual seeds, reducing fertilizer chemical use by 60% and preventing weeds from growing between fertilized space. Robotics and machine learning are becoming more sophisticated and agile, making farming another beneficiary of innovation in the digital realm by realizing applications for repetitive processes that cover massive amounts of land in the physical realm.

Other innovations include fully autonomous tractors controlled from a phone, robots that identify and pick ripe fruits and vegetables, and drones to monitor crops.

Efficient use of fertilizer using robotic technology also reduces costs and negative downstream effects such as fertilizer runoff that pollutes rivers, causes excessive growth of unwanted algae blooms, and kills marine life.

When you read the content we share and it causes you to think of others in your life who would benefit from seeing it, please don’t hesitate to share it with them.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2023.