Bram Houghton

June 19, 2023

Economy CommentaryBi-Weekly Market Update – June 16th, 2023

Wicks Houghton group BI-Weekly Market Update

IN A NUTSHELL: While markets have been stable, we have seen continued weakness in employment across North America. Economic expansion across the globe in both Manufacturing and Services has also been muted. Some positive news on the inflation front; the US saw their lowest annual inflation reading since March 2021. Some more interesting discussions around AI in our notable news section.

Overall employment was little changed in May, as employment fell very slightly from April. The unemployment rate rose 0.2% to 5.2% from 5.0%, the first increase since August 2022.

Canada's merchandise exports increased 2.5% in April, while imports edged down 0.2%. As a result, Canada's merchandise trade surplus with the world widened in April.

Canada Ivey Purchasing Managers Index (PMI) was 53.5 versus forecasted 57.2 and a previous result of 56.8

The total monthly value of building permits in Canada declined 18.8% in April, the lowest level since December 2020.

The U.S. services sector barely grew in May with the ISM Non-Manufacturing Purchasing Managers Index (PMI) coming in at 50.3 versus forecasted 51.8 and previous 51.9. With new orders slowing, this pushed a measure of prices paid by businesses for inputs to a three-year low.

The trade deficit in the U.S. widened to a six-month high in April. Exports declined by twice as much as imports increased for the month.

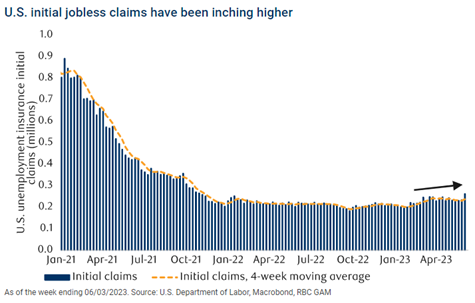

U.S. initial jobless claims surged to the highest level since October 2021 last week. This is the third week of increases in a sign the labour market strength may be fading. U.S. initial jobless claims this week however were unchanged from last week.

The U.S. Consumer Price Index (CPI) increased 0.1% in May, slightly below the market consensus of 0.2%. Year over year CPI declined to 4.0%, below expectations of 4.1%, to the lowest since March 2021.

U.S. retail sales rose 0.3% month-over-month vs. the consensus estimate of a 0.1% decline. Sales in building materials, garden equipment and motor vehicles & parts rose the most while sales in gas stations dropped.

U.K. Composite Purchasing Managers' Index (PMI) stayed resilient while slowing for the month at 54.0 versus forecasted 53.9 and previous 54.9

Eurozone S&P Global Composite Purchasing Managers Index (PMI) also showed signs of fading at 52.8 versus forecasted 53.3 and previous 54.1

West Texas Intermediate crude oil is slightly down over the two weeks with concerns about China's fuel demand growth and rising Russian crude supply weighing in on Saudi Arabia’s one million barrel-a-day supply cut in July, taking its production to the lowest level for several years.

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | FLAT | +2.5% | +1.2% | +3.2% | +1.5% | +1.8% | -0.3% |

| Last Week | -0.6% | +0.4% | FLAT | FLAT | -0.7% | -2.2% | +0.4% |

CIBC Economics: Quick Take: Canadian employment (May) by Andrew Grantham

Some cracks appeared within the Canadian labour market in May, but these may not yet be wide enough to convince the Bank of Canada that inflation is about to meaningfully cool off. Employment fell by 17,000 (consensus +21,000), which led to a two-tick increase in the unemployment rate to 5.2% despite a slight reduction in participation. Full-time employment drove the decline in the overall job count, with part-time actually up slightly. By industry, the decline in employment was driven by a number of service sectors, with the job count in goods producing sectors actually up on the month. Total hours worked fell by 0.4% in May, representing a larger percentage decline than the change in employment. Despite the weakness in employment, average earnings still rose by 5.1% year-over-year, although this was no higher than the consensus expectation. The weak jobs figure will have markets paring back expectations for further interest rate hikes from the Bank of Canada, although policymakers will probably like to see some further softening ahead to convince them that no more rate increases are needed.

Canadian Immigration and Inflation: It’s complicated by Andrew Grantham Link to Article

Job matching

There is a clear correlation between an increase in employment and a reduction in job vacancies for this group, which includes temporary foreign workers and international students who returned after the pandemic. However, the link between new permanent immigration into Canada and the current or future needs of the economy is not as tight. Certain industries, such as food & accommodation and other personal services, have seen little-to-no increase in the numbers of new immigrants in the workforce, contributing to higher vacancy rates in these areas. There needs to be a greater focus on attracting people with specific skills in trades may prove beneficial to meet potential future needs of the workforce.

Demand side

New immigrants who come to Canada contribute not only to the supply of labour but also to the demand for goods and services. The increasing number of immigrants finding jobs in higher-paying sectors has resulted in their average earnings moving closer to the national average. This is a positive development for growth but may also add to inflation pressures due to the higher demand created by immigrants.

Immigration and inflation: It’s complicated

The Canadian economy has seen upside surprises in GDP performance due to rapid immigration-fueled population growth. However, the impact of immigration on inflation is complicated. Newcomers are finding jobs and participating in the labour market to a greater extent than in the previous economic cycle, but they may not be working in sectors where the current or future needs of the economy lie. Additionally, higher earnings among newcomers suggest that while immigration is having a greater impact on supply, it is likely having a greater impact on demand as well.

MacroMemo - June 13 -26, 2023 by Eric Lascelles Link to Article

Softer economic data

While the US labor market has been strong in recent months, other signs point to a softening economy, according to David Rosenberg, the chief economist at Gluskin Sheff & Associates. Although May saw the strongest job numbers in years, the unemployment rate rose from 3.4% to 3.7%, while jobless claims also rose significantly. The May ISM Manufacturing Index fell, hinting at contraction, while the ISM Services Index showed growth only barely broke into positive territory.

In Canada, Q1 GDP growth rate was above expectations at +3.1%, but the final quarter of 2022 experienced a slight contraction. Canadian employment in May shows a negative trend with 17,000 jobs lost and a rise in the unemployment rate. However, the loss was primarily concentrated among young workers and may reflect seasonal distortions. It is too early to determine if this indicates a lasting decline in the labor market.

Rolling recessions?

An out-of-sync market could unexpectedly prevent a developed-world recession because each sector is experiencing economic corrections at differing times, according to a note by Tyler Cowen on Bloomberg Opinion.

Several may still have further difficulties, with the US housing market remaining weak in line with increasing policy rates and unaffordability, while the US banking industry still has institutions which are not resilient. However, Cowen suggests the cross-sector impact will hurt every industry through the lending channel as risk aversion rises.

Fed Lays the Groundwork for Further Tightening by Katherine Judge Link to Article

The Federal Open Market Committee (FOMC) has decided not to raise interest rates at the latest announcement, but it has signaled two 25 basis-point rate increases are ahead for the next two meetings. The bond market only expected a single quarter-point increase, so yields initially rose, before falling during chairman Jerome Powell's conference. The latest meeting also predicted a rise in the PCE inflation rate to 2.1% by the end of 2025, implying the possibility of a steeper path for rate cuts in 2024, with 100bps of cuts forecast in the year, and 125bps the following year.

NOTABLE NEWS

MacroMemo - June 13 -26, 2023 Technology and the economy by Eric Lascelles Link to Article

New technologies such as artificial intelligence (AI) have exciting potential to improve productivity. Generative AI may be used to generate text, images, and other media by finding patterns in data and has potential across programming, legal research, literature review, customer services and even composing information such as job postings.

Despite the exciting potential, it often takes considerable time to refine and integrate these new technologies before we see any form of tangible productivity boost in the economy. They can also pose the risk of job losses, however, historically, new technologies have created just as many new jobs as they have displaced. The risk for significant job losses does seem higher with this advance due to the rapid rate of technological change and the broad set of sectors affected.

Over the long term, technological advances could mean that productivity growth could rise more rapidly, but new technologies could potentially raise the prospect of significant job losses, requiring governments to provide a greater financial safety net for the structurally unemployed.

When you read the content we share and it causes you to think of others in your life who would benefit from seeing it, please don’t hesitate to share it with them.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2023.