Bram Houghton

July 04, 2023

Economy CommentaryBi-Weekly Market Update – June 30th, 2023

Wicks Houghton Group Bi-Weekly Market Update

IN A NUTSHELL: North American economies continued to show signs of resilience with sentiment also improving, though signs of labour market weakness persisted across these past two weeks. The story isn’t so positive in Europe and China, with the UK continuing to face challenges controlling inflation and China lowering interest rates.

Canada’s gross domestic product (GDP) was unchanged in April as goods-producing industries edged up 0.1% while services-producing industries were unchanged. However Statistics Canada is suggesting 0.4% jump in real gross domestic product in May, which does leave the door open for more rate hikes.

Canada's annual inflation rate came in at 3.4% in May, its slowest pace in two years, weakening the case for another interest rate hike as soon as next month. Month over month, the consumer price index was up 0.4%, Statistics Canada said, a tick lower than forecasts for an increase of 0.5%.

Canadian Retail sales increased 1.1% in April above expectations. Core retail sales increased 1.5% and on a yearly basis, retail sales advanced by 2.9%. Canadian Housing Price Index was slightly up (0.1%) for May which is not overly notable, however it was above the -0.1% posted for April.

The U.S. trade deficit in goods narrowed in May as imports fell, but the improvement was probably insufficient to prevent trade from being a drag on economic growth in the second quarter.

U.S. initial jobless claims remain unchanged from last week at 264,000 versus 260,000 expected. It matches the highest reading since October 2021, a sign the labour market strength may be fading. U.S. personal income rose by 0.4% over a month in May vs. the 0.3% expected. U.S. spending edged up by 0.1% in May, just short of the 0.2% expected.

U.S. building permits increased by 5.2% to an annual rate of US$1.491 million in May, surpassing market expectations. U.S. housing starts unexpectedly jumped 21.7% month-over-month (M/M) to an annualized rate of US$1.631 million in May.

Sales of new U.S. single-family homes surged to the highest level in nearly 1-1/2 years in May, benefiting from a dearth of previously owned homes available for sale. New home sales jumped 12.2% to a seasonally adjusted annual rate of 763,000 units last month, the highest level since February 2022, the Commerce Department said on Tuesday.

Britain's consumer price index rose by 8.7% in annual terms in May, unchanged from April and defying forecasts among analysts polled by Reuters for a slowdown to 8.4%. Although down from 11.1% last October, it left the country with the highest inflation rate among the Group of Seven advanced economies.

Britain's measure of underlying inflation that excludes volatile items, such as energy and food, took investors by surprise by accelerating for a second month in a row in May, hitting 7.1%, up from 6.8% in April.

German business morale worsened for the second consecutive month in June, a survey showed on Monday, indicating that Europe's largest economy faces an uphill battle to shake off recession. German business activity also slowed notably this month as growth in the services sector decelerated and a slump in manufacturing deepened, a preliminary survey showed on Friday.

The People’s Bank of China cut its key lending benchmarks on Tuesday, in the latest sign that the country’s authorities are concerned that the post-pandemic recovery in the world's second-largest economy is losing momentum. The one-year loan prime rate was lowered by 10 basis points to 3.55%, while the five-year LPR was cut by the same margin to 4.20% - the first such reductions in 10 months.

West Texas Intermediate crude oil prices dipped as the Fed allude to more rate hikes, mutiny in Russia and demand concerns are countered by bullish U.S. oil inventory data.

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | FLAT | +2.5% | +1.2% | +3.2% | +1.5% | +1.8% | -0.3% |

| Last Week | -0.6% | +0.4% | FLAT | FLAT | -0.7% | -2.2% | +0.4% |

Parsing Canada’s productivity gap by Katherine Judge Link to Article

Canada's productivity has worsened since the pandemic's onset, exacerbating inflationary pressures through higher unit labour costs. However, industry-level data suggests there may be a rebound in productivity in some sectors, which could help the Bank of Canada's efforts to bring inflation back to its target. Higher productivity is a straightforward way to limit inflation without the negative effects of higher interest rates. Canadian companies are generally less capital-intensive which meant that the productivity gap between US and Canada widened during the pandemic.

Since the lifting of public health restrictions, labour productivity in higher-value added service sectors, especially the tech sector has been deteriorating on both sides of the border. Canada has seen a faster recovery in retail trade output, especially in financial activities, though they maintain a lower share of online sales within total retail sales. With cyclical goods sectors poised to slow with higher interest rates, a rebound in services productivity could aid the Bank of Canada in cooling inflation.

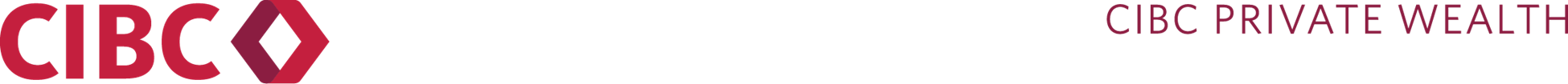

The US has experienced slower wage growth recently, which is related to the lower unit labour costs we may see due to the removal of COVID-19 public health restrictions. In comparison, Canada has made more progress in lowering job vacancies per unemployed person, which places pressure on wage growth. This may have led to a downward trend in job openings in discretionary services in Q2.

A productivity boost could benefit the Bank of Canada in combating inflation, especially in key service areas where unit labour costs indicate future core inflation. Containing unit labour cost would enable interest rates to remain neutral and even lower in 2024. Surveys of businesses this year with respect to Capital Expenditure suggest there may be a further productivity boost in the medium term if executed once interest rates fall.

MacroMemo - June 13 -26, 2023 by Eric Lascelles Link to Article

Inflation is mostly cooperating

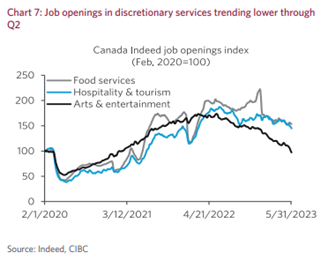

In the US, May's Consumer Price Index (CPI) fell from 4.9% to 4.0% annually, and June's print is expected to show a decline to around 3.0-3.4%. Core inflation, however, remains sticky with a monthly pace of 0.4%. The breadth of U.S. inflation has sharply narrowed, with fewer items in the price basket rising by more than 10% per year. The U.S. producer price index also shows an annual price decline, indicating positive signs for consumer prices in the future. However, caution must be taken as inflation may not smoothly descend to 2.0%; the St. Louis Fed's model suggests a probability 70% of inflation remaining above 2.5% over the next 12 months, although that probability is declining.

Central banks return to tightening

Central banks around the world are taking a more hawkish stance in their fight against inflation. The Bank of England, Bank of Canada, and Reserve Bank of Australia have all raised interest rates recently, while the Federal Reserve plans for further tightening. These central banks recognize that inflation is still a concern and are signaling their commitment to taming it. They hope that by signaling their intentions, they can dampen inflation expectations. However, there is concern that further tightening may lead to a weaker labor market and potentially induce a recession. Central banks may be forced to take more aggressive measures to achieve their inflation goals.

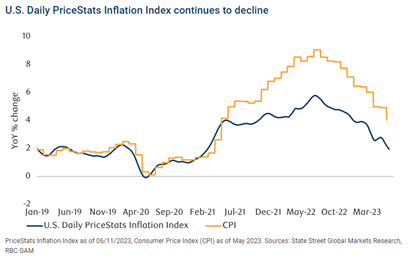

China’s economy underwhelms

China's economic recovery is underwhelming as post-lockdown growth has failed to meet expectations. Exports are shrinking, service-sector demand is outperforming goods-sector demand, but even tourism spending is weakening. The biggest concern is the soft housing market, with home sales and prices falling over the past year. Housing is a significant part of the Chinese economy, and its weakness affects consumption and non-real estate businesses. Chinese households may also be facing a crisis of confidence in their government, leading to uncertainty and a reluctance to spend. The Chinese government is implementing stimulus measures, including rate cuts and potential infrastructure spending, to stimulate the economy, but there are concerns that consumer-targeted stimulus may result in more public debt without boosting the economy.

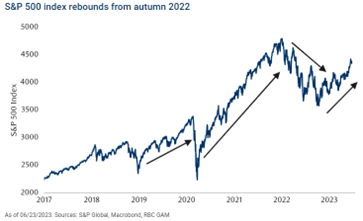

Stock markets rebound

Despite recent weeks equities are significantly higher than they were last fall. The best explanation is simply that the economy has continued to expand, in contrast to expectations of weakness or even recession by now. Declining inflation has also been helpful.

However, we remain on the cautious side of the spectrum, expecting some further stock market weakness ahead. Market sentiment has now pivoted from pessimistic to optimistic – creating space for a later decline. Critically, at least from the perspective of this economist, we still believe a recession is substantially more likely than not.

Burns or Volcker? by Brian S. Wesbury Link to Article

The Federal Reserve's report on the money supply notes that all key measures of the money supply have been falling, which means the Fed has been tight with money supply. Tuesday's report is important in determining whether monetary policy will remain tight or loosen.

The Feds pause on rate hikes in June, while signaling two more down the road sends mixed signals to the market, though it seems likely to follow through on its projected rate hikes based on recent economic data. The UK's inflation problem might influence the Fed's decision to raise rates in July. The UK’s persistent inflation problem means that they will continue to hike even if that causes a recession.

Fed Chairman Powell's has a decision to make in shaping his legacy, will he be compared to Arthur Burns, who let inflation reignite, and Paul Volcker, who is remembered as the slayer of inflation. Powell's decision is politically complicated – The upcoming presidential election and perception of political motivation could add complexity to the current signaled trajectory for the Fed.

NOTABLE NEWS

China’s youth unemployment rate continues to soar, now hitting a whopping 21% . That’s nearly double the pre-pandemic level and more than quadruple the overall unemployment rate. The youth unemployment rate was never this high during COVID-19 lockdowns and continues to rise even as the country’s economy staged a modest economic recovery over the first half of 2023.

The International Monetary Fund (IMF) is working on a platform for central bank digital currencies (CDBCs) to enable transactions between countries “To have more efficient and fairer transactions we need systems that connect countries: we need interoperability,” Georgieva told a conference attended by African central banks in Rabat, Morocco.

When you read the content we share and it causes you to think of others in your life who would benefit from seeing it, please don’t hesitate to share it with them.

Aurie Wicks, CA, CPA, CFP Bram Houghton, CFA, CFP

Wealth Advisor Wealth Advisor

(403) 835 – 4785 (403) 690 – 9376

Aurie.Wicks@CIBC.com Bram.Houghton@CIBC.com

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2023.