Bram Houghton

October 23, 2023

Economy CommentaryBi-Weekly Market Update - October 20th, 2023

Wicks Houghton Group Bi-Weekly Market Update

In a Nutshell: Inflation starting to show signs of the aggressive interest rate policy taking effect, the Canadian economy appears to be slowing more noticeably than the US. The US labour market still remains tight and the UK still facing a continuing battle with elevated inflation. The Israel – Hamas conflict also adds an additional layer of geopolitical tension to global relations.

Canadian inflation slowed to an annualized 3.8% in September from 4.1% in August, marking the end of a two-month surge in price pressures across sectors such as travel services, durable goods, and groceries. This deceleration follows a June peak of 8.1%, but consumers continue to express concern due to sustained high inflation.

Canadian August Retail sales declined 0.1% vs. 0.3% expected. Core retail sales, which exclude gasoline, motor vehicle and parts dealers, decreased 0.3% in August. Total retail sales volumes declined 0.7%. August Canadian manufacturing sales rose 0.7% vs. 1.0% expected, mainly on higher sales in the petroleum and coal, food and machinery subsectors..

September Housing starts in Canada edged up by 8% over a month earlier, above market expectations of 240,000 units. Despite this, Canadian new Home sales fell for a third straight month in September and US September Building permits declined by 4.4% from August but above expectations.

Headline US consumer prices grew at a faster-than-anticipated rate in September, potentially complicating the Federal Reserve's upcoming policy decisions. The consumer price index (CPI) registered 3.7% on an annual basis, the same pace as in August, above expectations of 3.6%. US September Retail Sales also rose by 0.7% vs. 0.3% forecast.

The US job market showed signs of robust growth in September, with nonfarm payrolls adding 336,000 jobs, exceeding the expectations. US initial jobless claims also declined to a nine-month low this week, a sign the labour market is still tight. This uptick in employment led to a decline in stock market futures and an increase in the 10-year Treasury yield, which rose to 4.83%.

For August, the JOLTS survey revealed an 5.8% increase in job openings in the US, beating the estimate significantly. The bulk of new openings came from professional and business services. Both the quit rate and hires rate remain unchanged.

The Federal Reserve Bank of New York has confirmed that the central bank's balance-sheet runoff, also known as quantitative tightening (QT), is advancing steadily. Over the past 18 months, the Fed has offloaded more than $1 trillion in bond holdings. QT has also reduced cash reserves at the Fed's reverse repo program to $1.3 trillion from $2.55 trillion at the end of 2022.

The UK's inflation rate remained steady at 6.7% in September, contrary to economists' predictions of a decrease, according to a report released by the Office for National Statistics on Wednesday. This rate is triple the Bank of England's 2% target, sparking concerns among homeowners about enduring high rates.

The UK economy experienced a mild recovery in August, following a contraction in July. This rebound is attributed to disruptive industrial action within the NHS and railway sectors, as well as adverse weather conditions that affected the July figures. July's slide, compounded by rainy weather and strikes by teachers and other workers.

China's industrial output in September grew 4.5% from a year earlier, matching the pace in August, as policy support measures start to stabilize some parts of the world's second-largest economy while deflationary pressures remain.

China’s economy grew slightly more than expected in the third quarter, as sustained monetary stimulus and improving local consumption somewhat helped offset weak overseas demand and ructions in the property market. GDP grew 4.9% annually in September, above expectations but weaker than the prior quarter’s reading of 6.3%.

West Texas Intermediate crude oil is up over the two weeks as potential supply disruptions related to military clashes between Israel and the Palestinian Islamist group Hamas. Gold also recovered with those geopolitical tensions.

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | -1.8% | -2.4% | -1.7% | -3.2% | -3.0% | +1.5% | +2.6% |

| Last Week | +1.1% | +0.4% | +0.8% | -0.2% | +1.3% | +5.9% | +5.2% |

Market data taken from https://www.marketwatch.com

The geopolitical and market risks of a prolonged Israeli-Hamas conflict By Angelo Katsoras Link to Article

A drawn out Israeli-Hamas conflict could see the conflict spill over into neighbouring countries such as Lebanon, which could result in Iran becoming involved. This may place some strain on an already tight oil market. Further to this, it creates the potential for instability in other neighbouring countries, such as Jordan and Egypt.

In the event of a significant rise in oil prices, Saudi Arabia faces a challenge. On one hand, increasing production to lower prices may lead to accusations of favoring Israel and angering a portion of the Arab public. On the other hand, Saudi Arabia is concerned that a spike in oil prices could contribute to a global economic slowdown, ultimately causing prices to collapse and negatively impacting its finances.

The conflict adds geopolitical tension to an already challenging world. This tension is compounded by ongoing conflicts in Ukraine, rivalries between major powers, and escalating tensions over Taiwan. Additionally, Western leaders are facing political challenges at home, along with near-record debt levels and high interest rates, further complicating the situation.

CIBC Economics A broken record (The Week Ahead) by Avery Shenfeld

There is a repetitive pattern to economic forecasts, which include an upward revision to the US economic outlook, an additional Fed rate hike before the year's end, and a delay in the expected slowdown.

The Fed has shifted its perspective and is no longer aiming for an inverted yield curve, indicating an effort to avoid a recession. The article suggests that a soft landing is possible if the central bank manages its policies effectively. The Fed is leaning towards a pause on interest rates at the upcoming meeting, relying on higher bond yields to slow economic activity.

The upgraded US economic outlook will have mixed effects on Canada, possibly delaying an export pullback but negatively impacting domestic demand due to higher Fed funds rates and Canadian bond yields. For resource-exporting countries dependent on global growth, the outlook remains modest, influenced by geopolitical risks and global events.

The Canadian economic outlook is less optimistic, with expectations of negligible Q3 growth and a muted Q4 rebound. The jobless rate may increase due to brisk population growth. The Bank of Canada is seen as having a weaker case for an additional interest rate hike compared to the Fed, as current interest rates are already affecting economic conditions in Canada.

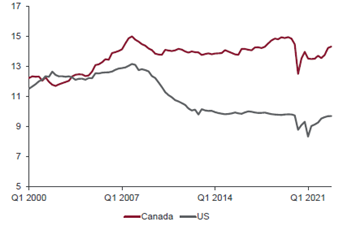

Household Debt Service Ratio – Canada vs. US (% Disposable Income) The BoC usually stops at a lower rate than the Fed: This is because Canadian Debt Service Ratio is higher than that of the US.

Source: Statistics Canada, FRED, CIBC

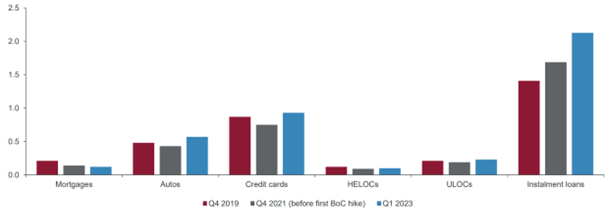

% of Loans in arrears in Canada – Mortgages are stable but Auto, Credit Card and Installment Loans have all spiked in delinquency since rate hikes begun in Q4 2021.

Source: Statistics Canada, CIBC

Variable Lags by Benjamin Tal Link to Article

How long does it take for changes in monetary policy to affect the real economy and inflation. While some believe in a rule of thumb of 12-24 months, the late economist Milton Friedman disagreed, emphasizing the variability in this impact. The article points out that the lag is influenced by factors like adjustment costs, sticky prices, and nominal contracts.

Different central banks have varying views on this, with the Bank of Canada suggesting an 18-24 month lag, while the Fed's officials have conflicting opinions, ranging from 9 to 24 months. There's a growing belief that the transmission mechanism works faster than previously thought due to technical reasons, such as the early signaling of monetary policy changes.

However, it notes cycle-specific factors that are very likely to extend the lag. This includes the following:

-

The well documented excess savings held by consumers

-

Increased government spending and heightened debt levels of Central Banks; and

-

Inflation driven by supply (supply chain and product shortages)

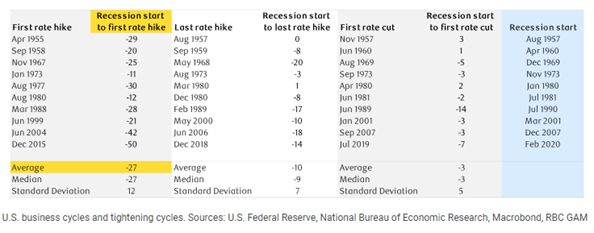

The lagging economic impact of rate hikes – History suggests a US Recession in June 2024

Weekly Commentary with Sadiq S. Adatia BMO GAM Chief Investment Officer Link to Article

Volatility

While current market turbulence could partially be due to seasonality, the underlining reason is uncertainty about the direction of central banks. Investors are working hard to understand which direction the markets will take, and are looking at the consumption trends, with the most recent Fed meeting interpreted as being hawkish. The situation is also weighed down by other sources of uncertainty, ranging from labor actions in the US, to the Israel-Gaza conflict, and the Energy picture.

Positioning

Quality companies are a key focus, being agnostic to industry. On the consumer front, Staples are favoured over Discretionary, as we expect the consumer to tweak their spending as the economy weakens. Health Care is also a focus as BMO GAM think it’s undervalued and there is also the belief that it’s too early to worry about potential political ramifications of the 2024 U.S. Presidential election. Finally, we believe that Communication Services has gone too far too fast, so we’re happy to take some profits from that area.

NOTABLE NEWS

Since May, Google has begun rolling out a new form of search powered by generative AI. Search Generative Experience (SGE), uses AI to create summaries in response to some search queries. The still-evolving product has raised concerns among publishers as they try to figure out their place in a world where AI could dominate how users find and pay for information.

Following Fitch’s historic downgrade of US government debt in August, only 6% of the total sovereign debt outstanding still holds the top rating of AAA. As a result, the value of junk-rated bonds has exceeded those with the highest rating for the first time, a historic first for the bond market.

When you read the content we share and it causes you to think of others in your life who would benefit from seeing it, please don’t hesitate to share it with them.

Aurie Wicks, CA, CPA, CFP Bram Houghton, CFA, CFP

Wealth Advisor Wealth Advisor

(403) 835 – 4785 (403) 690 – 9376

Aurie.Wicks@CIBC.com Bram.Houghton@CIBC.com

Wicks Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

The CIBC logo and “CIBC Private Wealth” are trademarks of CIBC, used under license. “Wood Gundy” is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2023.