Bram Houghton

November 17, 2023

Market Update - November 17, 2023

Wicks Houghton group BI-Weekly Market Update

In a Nutshell: The last two weeks saw global equity markets breathe a sigh of relief; experiencing significant upside off previous lows. Meanwhile softening U.S. economic data may be sufficient evidence for the Fed to justify a pause in an aggressive rate hiking cycle that began over 18 months ago. Recent Q3 data suggests the Eurozone is very likely to enter a technical recession in the last quarter of 2023.

Canadian economic activity expanded at a slightly faster pace in October with the index rising to 53.4 from 53.1 in September. It was the third straight month that the index was above the 50 or expansion. Contraction in Canada's service sector deepened however, as inflation and higher borrowing costs weighed on new business activity.

Canada's global trade surplus increased twice as much as forecast in September, as higher crude prices helped exports gain for a third straight month. Energy products led the gains, mainly due to higher prices that coincided with the extension of voluntary production cuts by OPEC+. Wheat exports also contribute with a more-than 50% rise.

September building permits in Canada fell sharply by 6.1% versus an expected decline from last month of 1.6%. Canada also saw a notable decrease in existing home sales, dropping by 5.6% in October.

The Federal Reserve held interest rates steady on Wednesday as policymakers struggled to determine whether financial conditions may be tight enough already to control inflation, or whether an economy that continues to outperform expectations may need still more restraint.

Federal Reserve Chairman Jerome Powell said Thursday the Fed wasn't confident yet they had reached a sufficiently restrictive level on monetary policy to bring inflation down to target, suggesting further rate hikes cannot be ruled out.

U.S. CPI increased 3.2% from a year ago compared to forecasts of 3.3%. Core CPI was up 4% over past year vs. 4.1% expected, as underlying inflation showed signs of slowing. Americans paid less for gasoline, and the annual rise in underlying inflation was the smallest in two years.

The number of Americans filing new claims for unemployment benefits edged down the last two weeks, signaling that layoffs remain low even as the still-strong job market shows some signs of cooling. Meanwhile, the rolls of those receiving benefits after an initial week of aid, a proxy for hiring, rose for a seventh straight week, the highest level since April.

The U.S. trade deficit widened more than expected in September, making it less likely for trade to have contributed to growth in the third quarter. The trade deficit was the lowest level since September 2020 and below economist forecasts.

U.S. consumer spending showed signs of cooling in October as retail sales slightly dipped, signaling a potential economic deceleration in line with Federal Reserve expectations. This followed upward revisions for sales data from the previous two months, suggesting that consumer spending is slowing but remains resilient.

The UK economy, in the month of September, managed to dodge a potential recession with a slight 0.2% economic upturn, bouncing back from a downturn experienced in July. This recovery was largely attributed to growth in the construction sector, despite a slight decrease in the services sector.

The euro zone economy contracted marginally quarter-on-quarter in the third quarter, a new estimate confirmed on Tuesday underlining expectations of a technical recession if the fourth quarter turns out equally weak, but employment still rose.

China recorded its first-ever quarterly deficit in foreign direct investment (FDI), according to balance of payments data, underscoring capital outflow pressure and Beijing's challenge in attracting overseas investment. That’s the first quarterly shortfall since China's foreign exchange regulator began compiling the data in 1998.

Oil prices to a four month-low on Thursday on worries over global demand as concerns over a slowdown in global crude demand remain.

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | +2.7% | +2.2% | +1.9% | +2.4% | +2.0% | -1.7% | +2.4% |

| Last Week | -1.3% | +1.3% | +0.6% | +2.4% | +0.2% | -4.1% | -3.1% |

Market data taken from https://www.marketwatch.com/

A Canadian recession? What’s in the eye of the beholder? By Avery Shenfeld Link to Article

While the popular definition of a Recession often involves two consecutive negative quarters for GDP, the National Bureau of Economic Research (NBER) uses a more sophisticated definition, requiring a significant and prolonged decline in economic activity spread across various sectors. By the NBER definition, Canada hasn't officially entered a recession.

NBER considers real personal income (excluding transfers) and employment as crucial indicators. According to available data, real household income in Canada was still growing in Q2, and employment continued to advance through October. Other indicators like real retail sales and industrial production have shown some decline, partly influenced by strikes and fires.

However, the rise in the unemployment rate, from 5.0% to October's 5.7%, is a concern, as historically, any 0.8% move in the three-month moving average jobless rate within a 12-month period has been associated with a recession since 1979.

CIBC Economics forecast suggests Canada's unemployment rate peaking at 6.3%, a level that historically might be considered a recession, however, the GDP forecast may not align with that definition.

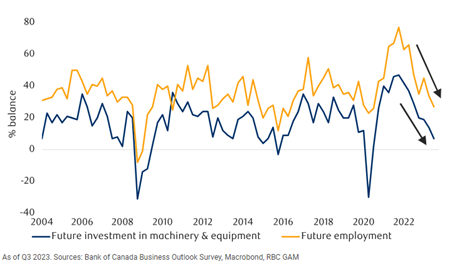

Canadian businesses pare back on hiring and Cap Ex plans

Canadian inflation: A sticky situation? by Avery Shenfeld Link to Article

The summary of recent discussions at the Bank of Canada (BoC) indicates a consensus on sluggish economic growth, but there is division on whether inflation will persist. Governor Macklem appears less concerned about inflation becoming a long-term issue, anticipating that labor market slack will ease wage inflation and lead to a moderation in prices. Some factors mentioned, such as oil prices and elevated wage hikes, are expected to be temporary. Concerns at the BoC include fears that corporate behavior is shifting towards more frequent and larger price hikes.

However, weaker spending power as the job market softens should deter firms from implementing substantial price increases. The only persistently problematic aspect of Canada's inflation is in shelter costs, particularly tied to house prices, mortgage interest costs (MIC), and rent. MIC, influenced by higher interest rates, captures renewals resetting at higher rates, and rents rise due to mortgage rates making home ownership less accessible and new unit supply slowing.

The Governor hinted at the possibility of an easing cycle before overall inflation reaches the 2% target if there is clear progress in "core" inflation. If Q1 core inflation falls but the overall CPI remains near 3% due to the significant contribution from MIC, rate cuts may be considered before mid-year. Paradoxically, in this case, sticky inflation becomes a reason to ease monetary policy.

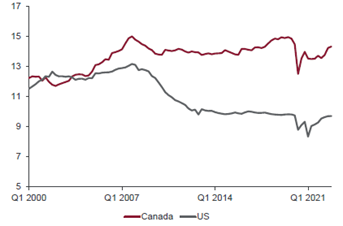

Household Debt Service Ratio – Canada vs. US (% Disposable Income)

Canadian Debt Service Ratio is higher than that of U.S. which could add pressure to ease core CPI back down to 2% next year.

Source: Statistics Canada, FRED, CIBC

Canada’s Housing Timebomb Keeps Ticking by Sadiq S. Adatia Link to Article

Housing Market

There is a divergence between the Canadian and American economies, with Canada experiencing more weakness. Canadian consumers have higher levels of debt and face higher mortgage rates compared to their American counterparts.

As a result, consumer spending is expected to be more favorable in the U.S. Bank of Canada is likely to cut interest rates before the U.S. Federal Reserve, potentially in the first half of 2024. This divergence in economic outlooks is expected to have implications for the Canadian housing market. While there has already been a significant decline, there is still room for further downside.

Oil Prices

Oil prices initially increased at the start of the Israel-Hamas conflict but have since declined significantly. While this decline is positive in the short term, geopolitical conflicts, not only in the Middle East but also in other regions, will continue to pose a risk throughout the rest of the year and into 2024. This indicates that there is a possibility of more temporary supply shocks that could support oil prices.

Additionally, OPEC is expected to monitor supply, aiming to keep oil prices above $70 per barrel. The economic environment is also predicted to remain relatively stable, with any potential recession being mild. Considering the expected decent demand, the article suggests that oil prices are currently undervalued, and the fair value could be around $80-$90 per barrel.

Sadiq’s Final Comments

With pullbacks in September and October, stocks became more attractive, further to that, the Fed’s most recent comments indicated their preference to stay on the sidelines and avoid any more rate hikes. This positive investor sentiment stemming from those two developments potentially sets things up for a Q4 rally.

NOTABLE NEWS

Ratings firm Moody’s lowered its assessment of U.S. credit outlook to “negative” last week, underscoring America’s worsening fiscal outlook. Standard & Poor’s (S&P) and Fitch have already downgraded the U.S. to one notch below AAA. It means very little for your portfolio today, but it speaks to the longer-term decay of fiscal balances that is visibly starting to matter.

CEO of CPP Investments, John Graham, says Albertans should not want to lose the benefits of the Canada Pension Plan. He said there is a strong business and public policy case for Albertans to stay with what he called an established global investment fund with a proven track record.

Belgium has decided to temporarily ban the use of Novo Nordisk's diabetes drug Ozempic as a weight loss treatment amid a shortage of the medicine.

Ozempic is approved to treat Type 2 diabetes but has increasingly been prescribed "off-label" to treat weight loss because it has the same active ingredient as Novo's hugely popular - and scarce - anti-obesity drug Wegovy.

Aurie Wicks, CA, CPA, CFP Bram Houghton, CFA, CFP

Wealth Advisor Wealth Advisor

(403) 835 – 4785 (403) 690 – 9376

Aurie.Wicks@CIBC.com Bram.Houghton@CIBC.com

If you know someone who would benefit from our market updates, don't hesitate to share it with them.

Wicks Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

The CIBC logo and “CIBC Private Wealth” are trademarks of CIBC, used under license. “Wood Gundy” is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2023.