Bram Houghton

December 18, 2023

Economy CommentaryMarket Update - December 15, 2023

Wicks Houghton Group Bi-Weekly Market Update

In a Nutshell: After a choppy affair last week, equity markets and bond markets leapt higher this week with the Fed pausing on rate hikes again, validating the likely end of the rate hiking cycle along with other central banks that placed a halt on rate hikes. Investors are keenly watching central bank policy and the path to potential rate cuts in 2024.

Canadian Economy

Canada showed signs of economic softness that justified the Bank of Canada (BoC) pausing their benchmark rate at 5% last week. Most notables changes were a continued slump in Services as well as Imports this month. This continues to justify the potential for lower borrowing costs which continue to take their toll on consumers and business as inflation continues to cool.

The Bank of Canada decided to keep its benchmark interest rate steady at 5%. The bank raised the rate to its current level in July, but has since held rates as the Canadian economy shows signs of cooling.

Canada's service sector downturn deepened in November as borrowing costs and recession worries weighed on activity. It was the sixth straight month that the S&P Global Purchasing Managers Index (PMI) was below the 50 threshold which indicates contraction - the lowest reading since June 2020.

Canada recorded a larger-than-expected trade surplus in October, as exports rose marginally but imports slumped. By volume, total imports were down 3.2%.

Despite this, the Ivey Purchasing Managers Index (PMI) showed that Canadian manufacturing expanded at its fastest pace in seven months. The seasonally adjusted index rose to 54.7 in November from 53.4 in October, its highest level since April.

U.S. Consumer

Despite a record breaking Black Friday and retail sales continuing to remain steady, the consumer is starting to show signs of softness as new orders for U.S. Goods, and Inventories fell. Falling inventories impacts GDP as well as indicating businesses expectations for the U.S. consumer. As we have been monitoring, a weak U.S. consumer supports lower inflation and the rate cut hypothesis for 2024.

U.S. business inventories unexpectedly fell in October, suggesting that inventory investment could weigh on economic growth this quarter. Business inventories dipped 0.1%, the first decline since June, after increasing 0.2% in September.

New orders for U.S.-made goods fell more than expected in October, marking the biggest monthly drop in roughly three and a half years, driven by weakening demand for durable goods and transportation equipment.

U.S. retail sales unexpectedly rose in November as the holiday shopping season got off to a brisk start amid deep discounting, likely keeping the economy on a moderate growth path. Retail sales increased 0.3% last month after falling 0.2% in October.

U.S. Economy

Inflation slowed again in November providing a predicate for the Fed’s posture on rates. Manufacturing and Labour trajectories further support this and the potential for lower rates in 2024. While we see this as slightly aggressive, the Fed has plotted points for 3 rate cuts in 2024.

The U.S. Federal Reserve held rates at 5.25% on Wednesday and is widely expected to have hit terminal rate for this hiking cycle. This was no surprise to markets as the committee has seen the desired effect of cooling the economy/inflation.

The U.S. annual inflation rate in November slowed to 3.1% as expected, the lowest reading in five months. The annual core consumer price inflation rate was 4.0%, matching market forecasts, the lowest since September 2021.

U.S. manufacturing was subdued in November, with factory employment declining and layoffs increasing, more evidence that the economy was losing momentum. The ISM Manufacturing PMI was unchanged; the 13th consecutive month that the PMI stayed below 50, indicating contraction.

U.S. job openings dropped to more than a two and a half year low in October, the strongest sign yet that demand for labour was cooling amid higher interest rates. The number of available roles dipped to 8.733 million as of the final business day of the month. Economists had called for a reading of 9.300 million.

UK & Euro Zone Economy

Signs out of UK and Europe suggest we have seen terminal rates across the Atlantic as well with continued cooling inflation and economic activity to the point where BoE and ECB held rates this week as well. While it provides clarity on potential rate cuts next year, the path to economic recovery is a little more nuanced with Germany budget issues and the Ukraine-Russia conflict adding complexity.

The BoE has held rates at 5.25% since August after 14 back-to-back rises starting in December 2021. Governor Andrew Bailey has stressed borrowing costs need to stay high "for an extended period" to kill off the threat posed by inflation pressures.

The European Central Bank left interest rates unchanged as expected and signaled an early end to its last remaining bond purchase scheme, wrapping up a decade-long experiment in consolidating debt across the 20-nation euro zone.

Britain's economy shrank in October, raising the risk of a recession and testing the Bank of England's resolve to stick to its tough anti-inflation line. GDP fell by 0.3% from September; wet weather being cited as a possible driver.

Three leading German economic institutes cut their 2024 economic growth forecasts, citing consumer and business uncertainty, and a weeks-long government budget crisis as delaying recovery.

Commodities

Despite the recent OPEC+ decision on supply cuts and uncertainty about global fuel demand, oil prices rose on Friday, on track to notch their first weekly rise in two months after benefiting from a bullish forecast out of the International Energy Agency (IEA) on oil demand for next year, in additional to a weaker dollar.

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | -0.6% | +0.2% | FLAT | +0.7% | +1.1% | -3.8% | -3.6% |

| Last Week | +1.0% | +2.5% | +2.9% | +2.8% | +0.1% | +0.6% | +0.9% |

Market data taken from https://www.marketwatch.com/

Economic Flash Fed announcement: It's working! By Ali Jaffery Link to Article

The Federal Reserve chose to maintain its mid-point interest rate at 5.375%, as expected. The significant change was an indication that policy tightening is likely complete. The statement addresses uncertainties from three months ago, highlighting a robust output and a still reasonably tight labour market.

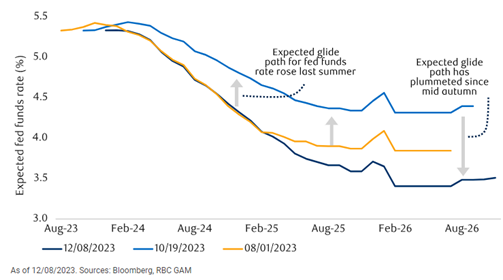

Looking ahead, the median voter anticipates a 75bps policy easing by the end of 2024 and an additional 100bps by the end of 2025. The FOMC's dovish stance relies on a slightly faster deceleration of inflation, while growth and unemployment remain mostly unchanged. Powell emphasized progress on inflation, attributing it to the strong rebound in the supply-side of the economy and resolving demand-supply imbalances.

Despite some signals not aligning, Powell sees the restrictive policy as sufficient to guide inflation down. While the Fed's view suggests a painless adjustment, signs of weakness in the labor market and slower inflation progress in underlying measures may add complexity. The Fed's shift from a hawkish tone in September to a more dovish stance in December, emphasizes the rebound of the supply side and resolution of demand-supply imbalances.

Market expects interest rate cuts to start in 2024

THIS WEEK WITH SADIQ by Sadiq S. Adatia Link to Article

Consumers

As the holiday spending season unfolds, there is a shift in consumer behavior from higher-priced items to lower-priced ones, as noted by Amazon. The positive news is that people are still spending, which is crucial in avoiding signs of a potential recession. Despite the adjustment in spending patterns, people might turn to credit card debt to sustain their expenditures, especially with cracks in consumer confidence and eroding excess savings. There is the potential for sticker shock in January, prompting consumers to tighten their belts for a few months. We’ll continue to watch the data to see if cracks in the consumer get bigger, but so far, holiday spending — including Black Friday — has been fairly good.

Oil Prices

Oil is likely undervalued, though patience may be required to achieve that value. West Texas Intermediate (WTI) crude dropped briefly below $70 per barrel but is rebounding, with a fair value for oil estimated to be in the range of $80 to $90 per barrel. While short-term price fluctuations are expected, if consensus expectations of avoiding a long and severe recession hold true, there could be a positive surprise in energy demand. Additionally, production cuts from OPEC and OPEC+ are noted as factors contributing to a potential increase in oil prices. Geopolitical risks could also cause temporary shocks but are not expected to have a long-lasting impact on prices.

Macro Memo December 12, 2023 - January 8, 2024 by Eric Lascelles Link to Article

Strong data, weakening trendline

The U.S. employment data presents mixed signals, with November payrolls showing nuances such as 30,000 jobs being striking auto workers returning to their jobs. Despite this, the unemployment rate dropped from 3.9% to 3.7%, creating a considerable gap from the Sahm's Rule recession threshold. Sahm's Rule suggests a recession begins when the three-month moving average of the national unemployment rate rises by 0.50 percentage points or more relative to its low in the previous 12 months.

However, the unemployment rate drop is influenced by a different, more volatile labor market survey—the household survey. Despite these findings, there are signs of deterioration in other labor market indicators, including a decline in temporary employment, higher youth unemployment compared to previous quarters, a drop in job openings, and a significant increase in continuing jobless claims since September.

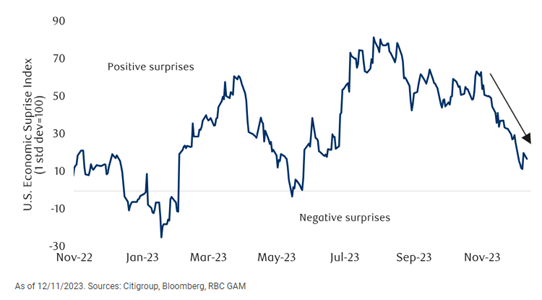

U.S. economic data has softened – There are far less positive economic surprises

De-globalization under the microscope

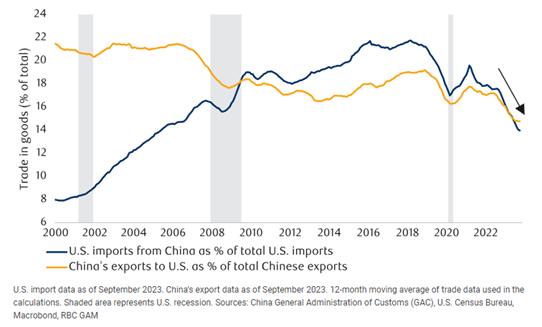

Over the past five years, direct trade between the U.S. and China has significantly decreased as a proportion of each country's total trade. The U.S. share of Chinese exports is currently at its lowest point in decades, and China's share of U.S. imports has sharply declined to the lowest level in nearly 20 years.

Consequently, China has lost its position as the largest exporter to the U.S., now falling below the EU and potentially dropping below Mexico and Canada soon. Despite appearances of decoupling, where the West seems less dependent on China, China still benefits from global trade as it is a key supplier of components to other developing Asian nations. However, many of the companies operating in these nations are Chinese, indicating continued integration with China and potential production freezes in the event of a serious conflict.

U.S. – China trade has been declining

Notable News

European Union leaders will declare the start negotiations to allow Ukraine into the EU at their summit in Brussels – the talks themselves are likely to take years. Ukraine, which has a population of 44 million and is geographically bigger than any EU member, presents some unique challenges for admission to the 27-member bloc.

Canadian government-owned Trans Mountain Corp asked the country's energy regulator on Thursday to reverse a decision rejecting proposed construction changes on its oil pipeline expansion, warning of a possibly "catastrophic" two-year delay and billions of dollars in losses.

If you know someone who would benefit from our market updates, don't hesitate to share it with them!

Wicks Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

The CIBC logo and “CIBC Private Wealth” are trademarks of CIBC, used under license. “Wood Gundy” is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2023.