Bram Houghton

February 01, 2024

Economy CommentaryMarket Update - January 26, 2024

WICKS HOUGHTON GROUP BI-WEEKLY MARKET UPDATE

In a Nutshell: Markets posted strong results for the last two weeks, with continued resilience from the consumer, with the U.S indices hitting all time highs. Though the spectre of inflation still hasn’t entirely disappeared globally, the path for the U.S to start cutting rates this year continues to thread the needle.

Global Monetary Policy

Central banks across the globe maintain a cautious approach to rates this month, with three major economies maintaining their rates as is. While it is very likely we’ve reached the top of the interest rate cycle, we’ve seen recent economic data to support that road still isn’t certain.

The Bank of Canada (BoC) held its key overnight rate at 5% on Wednesday and said that while underlying inflation was still a concern, the bank's focus is shifting to when to cut borrowing costs rather than whether to hike again. This is the 4th consecutive policy meeting that rates have remained unchanged.

The European Central Bank held interest rates at a record-high 4% on Thursday and reaffirmed its commitment to fighting inflation even as the time to start easing borrowing costs approaches. The ECB ended its fastest-ever cycle of rate hikes in September and has continued to reiterate that it is too soon to discuss a reversal in rates, since price pressures have not been fully extinguished.

Bank of Japan reaffirmed its commitment to ultra-loose monetary policies, with the central bank deciding to maintain negative interest rates at -0.1% The dovish stance is validated with Japan’s core Consumer price index inflation fell more than expected in January, falling to an annualized 1.6% in January – its slowest pace of growth since March 2022.

Canadian Economy

The Canadian economy continues to show weakness in business activity to start the year though the inflation read to begin 2024 still adds a layer of complexity to the rate cutting cycle. The Bank of Canada further expressed that concerned in this week’s policy meeting.

Canadian factory sales most likely fell 0.6% in December from November, largely due to decreases in the transportation equipment and chemical product subsectors, Statistics Canada said in a flash estimate on Thursday.

Canada posted a surprise 0.2% month-on-month decline in retail sales in November led by a slowdown in sales of food and beverages. Statistics Canada's preliminary estimate of a 0.8% gain in December, which meant the result was a surprise to the downside.

Canadian home sales rose in December to end the year on an upbeat note after the market was buffeted by higher borrowing costs in 2023. Home sales rose 8.7% in December from November and were up 3.7% year-over-year, the largest year-over-year gain since August.

U.S. Economy

Eyes continue to be on the U.S. and their ability to lower rates in 2024. The economy continues to remain strong as does the U.S. consumer while the employment outlook continues to give mixed readings. Initial inflation reports this week suggest that the U.S. can remain on their path to cut interest rates this year.

U.S. prices rose moderately in December, keeping the annual increase in inflation below 3% for a third straight month, which could allow the Federal Reserve to start cutting interest rates this year. In the 12 months through December, the PCE price index increased 2.6%, matching November's unrevised gain.

The U.S. economy grew faster than expected in the fourth quarter amid strong consumer spending and sentiment. Gross domestic product increased at a 3.3% annualized rate last quarter after advancing at a 4.9% pace in the third quarter with growth for the full year coming in at 2.5%.

Unemployment rates increased in 15 U.S. states in December, up by three states from the prior month, but was unchanged in the majority of states and the District of Columbia. Nonfarm payroll employment levels, meanwhile, remained essentially unchanged from November, the unemployment rate remained unchanged at 3.7% in December and the economy added 24% more jobs in December from November. U.S. Initial jobless claims were also lower over the last two weeks.

Production at U.S. factories barely rose in December as increases in motor vehicle output were partially blunted by declines in machinery and electrical equipment. Manufacturing output edged up 0.1% last month, while November was revised lower to show production at factories rising 0.2% instead of 0.3% as previously reported.

U.S. retail sales increased more than expected in December, boosted by motor vehicle and online purchases, keeping the economy on solid ground heading into the new year. While this is great news for the resilient U.S economy, it does cast further doubt on financial market expectations that the Federal Reserve would start cutting interest rates in March.

U.S. import prices were unexpectedly unchanged in December after two straight monthly decreases, but the trend in imported inflation remained subdued. The unchanged reading in import prices last month followed a revised 0.5% decline in November rescued from a 0.4% drop.

Euro Zone Economy

Euro Zone continues to show their position at the end of the business cycle with external factors that could again impact inflation limiting their ability to lower rates presently. The U.K, like Canada saw an uptick in inflation to start the year, further creating uncertainty around the start of the rate cutting cycle.

Euro zone business activity appears to have contracted again in January as demand continued to fall while price pressures rose due to tensions in the Red Sea. HCOB's preliminary euro zone Composite PMI rose to 47.9 this month from December's 47.6, just shy of expectations in a Reuters poll for 48.0 but marking its eighth month below the 50 level separating growth from contraction.

Britain's annual rate of consumer price inflation (CPI) sped up for the first time in 10 months in December, rising to 4.0% from November's more-than-two-year low of 3.9% and denting market expectations for an early Bank of England rate cut.

Exports to Germany's most important overseas trade partners, including the United States and China, fell significantly at the end of last year. In December, exports to countries outside the European Union fell 4.0% in December and compared with December 2022, there was an even steeper decline in exports to non-EU countries of 9.2%.

German inflation rose in December to 3.8%, the federal statistics office said on Tuesday, confirming preliminary data. German consumer prices, harmonised to compare with other European Union countries, had risen by 2.3% year-on-year in November.

The German economy contracted in 2023, due to persistent inflation, high energy prices and weak foreign demand, but it avoided a recession at the end of the year. Gross domestic product (GDP) shrank by 0.3% over the full-year 2023 and was in line with expectations.

Global Energy

WTI Crude Oil futures are up 10% over the past two weeks as positive U.S. economic growth and signs of Chinese stimulus boosted demand sentiment, while Middle East supply concerns added further support. We expect the supply chain issues in the red sea to continue to place upward pressure on the price of WTI which could put a dampener on the cooling inflation narrative.

The International Energy Agency (IEA) joined producer group OPEC in forecasting strong growth in global oil demand and as cold winter weather disrupted U.S. crude output while the government reported a big weekly draw in crude inventories

The United States, the world's biggest oil consumer, registered faster than expected economic growth in the fourth quarter, data showed on Thursday. Oil demand sentiment was also buoyed this week by China's latest measures to boost growth

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | -0.4% | 1.2% | 0.7% | 2.3% | -1.1% | 1.0% | -1.1% |

| Last Week | 1.1% | 1.1% | 0.6% | 0.9% | 3.5% | 6.5% | -0.5% |

Market data taken from https://www.marketwatch.com/

Economic Flash - Bank of Canada signals relief, but not just yet by Avery Shenfeld Link to Article

The Bank of Canada has decided not to make any immediate changes to the interest rates, holding the overnight target at 5%. However, there are indications that lower rates may be on the horizon later in the year. The central bank's statement expresses concern about persistent core inflation but emphasizes weak growth in the first half of 2024 and emerging disinflationary slack.

Although the growth forecast for Canada remains unchanged, the bank appears to be counting on rate cuts to stimulate growth in the latter half of the year and in 2025. The bank acknowledges concerns about inflation but recognizes the downside risks to growth from sustained high interest rates

In summary, while the Bank of Canada is cautious about inflation, it seems open to rate cuts later in the year to boost a lackluster economy, projecting better growth in the latter part of the year and into 2025.

The U.S. avoided recession last year. What comes next?

by Mark Casey, William L. Robbins, Darrell R. Spence, Capital Group Link to Article

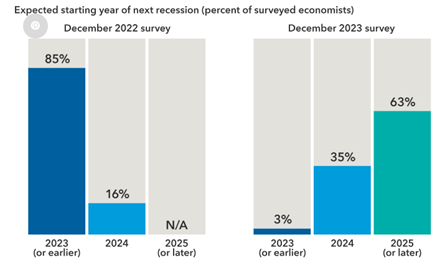

In early 2023, over 85% of economists predicted a U.S. recession by the year's end, citing reasons like a yield curve inversion and increased public concern as indicated by Google searches for "recession", interestingly a common indicator for an impending recession.

However, as of early 2024, the anticipated recession has not occurred. There are a fair amount of economists that have called for a soft landing, noting positive economic indicators such as a 4.9% expansion in the third quarter, unemployment below 4%, and the Consumer Price Index down to 3.1% in November.

The lesson drawn from these changing expectations is that the economy and markets can be unpredictable, suggesting that investors may be better off avoiding attempts to time the market.

Recession Expectations declined rapidly from 2023 to 2024

Sources: Capital Group, Financial Times, University of Chicago. Figures for December 2022 and December 2023 are based on survey results from 44 respondents and 39 respondents, respectively. The December 2022 survey did not include a specific option for 2025 as a potential start date for the next recession. Figures may not add up to 100 due to rounding. Latest data available as of December 27, 2023

Were the recession indicators a signal or just noise?

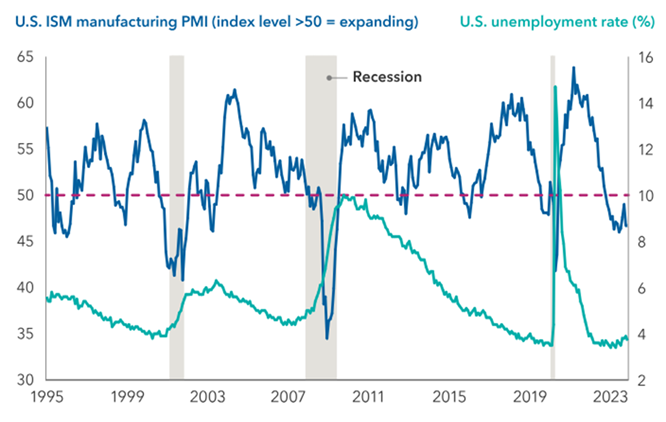

The article highlights the significance of the ISM Manufacturing PMI (Purchasing Managers Index) as a measure of industrial activity. The PMI, currently at 46.7 as of November 30, 2023, indicates a contraction in manufacturing activity. The author notes that historically, a PMI below 50 has accompanied recessions, and the last time it was around 45 without causing a recession was in June 1995.

While the current economic conditions are considered solid in comparison to historical data, the author emphasizes the likelihood of surprises in the coming year. Instead of waiting for a clear signal to re-enter stock and bond markets, the article suggests that maintaining diversified and balanced portfolios throughout economic cycles remains a sensible strategy for long-term investors.

A recent PMI downturn has not seen a corresponding hike in unemployment

Sources: Capital Group, Bureau of Labor Statistics, Institute for Supply Management (ISM), National Bureau of Economic Research. Figures reflect the seasonally adjusted survey results from ISM's Manufacturing Purchasing Manager's Index (PMI); a PMI reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally declining. As of November 30, 2023.

MacroMemo - January 23 – February 5, 2024 by Eric Lascelles Link to Article

Making Head or Tail (Winds) of it

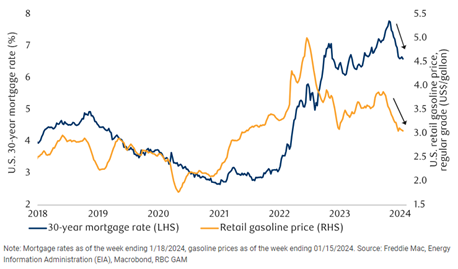

Gas Prices and Mortgage rates have been trending downwards to end 2023 in the U.S. which is a great support for the consumer when other spending supports are beginning to diminish, with pandemic savings becoming exhausted and the resumption of student loan payments in October 2023.

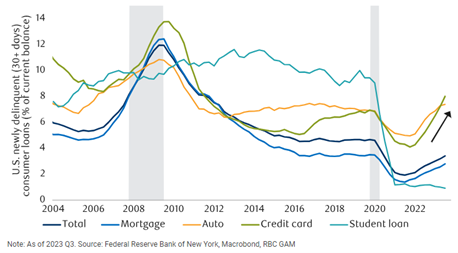

Rising interest rates however are beginning to hurt with overall U.S. consumer loan delinquency rate rising, most sharply in Auto and Credit card repayments. Auto loan delinquencies are now at their highest point in over a decade, though mortgage rate delinquency is still low by pre-pandemic standards

Mortgage rates and gas prices in U.S. have dropped markedly

U.S. consumer loan delinquency

Canadian housing financial stress

Canadian home prices have fallen materially over the past two years as mortgage rates soared leading RBC Economics to believe housing unaffordability and a possible recession to likely outmuscle rapid population growth.

But despite housing market weakness, there has been surprisingly little outright financial distress in the Canadian housing market with the mortgage delinquency rate remaining low half that of a ‘normal’ delinquency rate five years ago.

There are a variety of reasons to explain this. Some primary reasons are as follows:

• Unemployment remains fairly low.

- The great majority of Canadian homeowners have considerable equity in their home through original downpayments and house value appreciations.

- Most borrowers whose mortgage terms have reset over the past 18 months have faced an increase in mortgage rates of approximately 1.0 to 1.5 percentage points. That’s significant, still within the stress test they would have faced 5 years earlier

Looking at the financial distress aspect of Canada’s housing market downturn it is proving manageable, given the steeply climbing interest rates over the last two years.

NOTABLE NEWS

Assets in money market funds are rising to start the year, challenging some expectations that investors are set to pour cash on the sidelines into stocks and fixed income.

The U.S. House of Representatives could vote next week on a bipartisan tax package that includes benefits for businesses and families. It has backing from Republicans and Democrats even as Congress is deadlocked over other fiscal issues.

When you read the content we share and it causes you to think of others in your life who would benefit from seeing it, please don’t hesitate to share it with them.

Aurie Wicks, CA, CPA, CFP Bram Houghton, CFA, CFP

Wealth Advisor Wealth Advisor

(403) 835 - 4785 (403) 690 - 9376

aurie.wicks@cibc.com bram.houghton@cibc.com

Wicks Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2024.