Bram Houghton

February 13, 2024

Economy CommentaryMarket Update - February 9, 2024

WICKS HOUGHTON GROUP BI-WEEKLY MARKET UPDATE

In a Nutshell: Markets continued a strong start to the year in the U.S. as jobs data exceeded expectations, and quarterly corporate earnings have also largely impressed. Canadian equities slid this week however as hopes for rates cuts in Q1 were dampened.

U.S. Economy

Continued signs of resilience from the U.S. Economy as GDP and new orders data impressed. Significant improvements to new orders in both the Services and Manufacturing sectors. If inflation can be contained as this economic recovery continues to occur, it is reasonable to suggest the Federal Reserve can cut rates mid year as expected.

- U.S. Real Gross Domestic Product rose at an annual rate of 3.3% in Q4, according to an advance estimate by the Bureau of Economic Analysis. The consensus was for a 2% gain in a survey compiled by Bloomberg. In the third quarter, Real GDP grew 4.9%.

- The U.S. services sector growth picked up in January as new orders increased and employment rebounded. The ISM non-manufacturing PMI increased to 53.4 last month from 50.5 in December. A reading above 50 indicates growth in the services industry, which accounts for more than two-thirds of the economy. Economists polled by Reuters had forecast the index rising to 52.0.

- U.S. worker productivity gains had another strong quarter, which can be considered a key measure of how fast the economy can grow without rising inflation. Output increased 3.2% in the last quarter of 2023, the third quarter of productivity gains above 3% in a series that averaged about 1% from 2010 through 2019.

- U.S. manufacturing stabilized in January amid a rebound in new orders, but inflation at the factory gate picked up. The ISM PMI increased to 49.1 last month from a slightly downwardly revised 47.1 in December. It was the 15th straight month that the PMI stayed below 50, which indicates contraction in manufacturing. That is the longest such stretch since the period from August 2000 to January 2002.

U.S. Labour Markets

Still the most closely watched indicator for the U.S. economy - Employment showed further strength with impressive payroll numbers for January. Despite this impressive showing, there are still some cracks emerging which we cover in one of our articles below.

- U.S. nonfarm payrolls grew more than expected adding 353,000 jobs in January; almost double that of expectations. This includes hourly earnings increasing by 4.5% from a year earlier. The unemployment rate held at 3.7% from the previous month but initial jobless claims rose by 9,000 to 224,000, outpacing expectations. This is the highest since mid-November 2023.

- U.S. labor costs rose less than expected in the fourth quarter and the annual increase was the smallest in two years, signs of moderating wage inflation that could give the Federal Reserve room to start cutting interest rates by June.

- Job cut announcements in January increased to its highest level in 10 months as employers in the financial and technology sectors launched restructuring efforts. Announced layoffs surged by 136% in January which was the highest monthly total since March 2023. On a yearly basis, announced job cuts overall fell 20% from January 2023.

Eurozone and U.K. Economy

Signs of stabilization in the U.K. and Eurozone are showing as new orders data recovered, while inflation continued to slowly cool in the Eurozone. Geopolitical tensions add some uncertainty to the next steps regarding inflation as policy makers have differing opinions on interest rates in the U.K.

- The Bank of England kept interest rates steady on Thursday, with officials split three ways on the right course for policy. It marked the first time since August 2008 that different policymakers have voted to move interest rates up and down at the same meeting.

- British services businesses started 2024 on a robust footing, with a solid inflow of new orders and the fastest hiring in six months, as the prospect of lower interest rates made customers more willing to spend. The S&P Global services PMI for Britain rose to 54.3 in January from 53.4 in December, its highest reading since May 2023 and stronger than an initial estimate of 53.8.

- The euro zone economy showed tentative signs of recovery at the start of the year, bolstering the European Central Bank's case for keeping interest rates at record highs. S&P Global HCOB's composite PMI rose to 47.9 in January from December's 47.6, matching a preliminary estimate. That was its best reading since July despite remaining below the 50 mark.

- Euro zone inflation eased as expected last month but underlying price pressures fell less than forecasted, likely boosting the European Central Bank's argument that rate cuts should not be rushed. Consumer inflation dipped to 2.8% in January from 2.9% in December, in line with expectations and inching towards the ECB's own 2% target.

Canadian Economy

Canadia appears to have avoided a recession in Q4 though signs of weakness are prevalent within the economy. While recent inflation figures, particularly in housing add some uncertainty, it is likely that the Bank of Canada can cut rates mid-year.

- Canada’s job market was hotter than expected in January, with 37,000 new jobs added during the month. Most of the gains were in part-time work, but nonetheless the strong jobs print was more than twice what economists were expecting.

- Canada’s Gross Domestic Product (GDP) rose in November by 0.2% vs. the 0.1% expected from October. Canada's economy was expected to have grown by 0.3% in December 2023. This would mean annualized growth of 1.2% in the fourth quarter. In the third quarter, Canada's GDP contracted by 1.1%.

- Canadian service sector activity slowed for an eighth straight month in January as new business ebbed and cost pressures intensified. The headline business activity index rose to 45.8 in January from 44.6 in December. In November, the index posted a near three-and-a-half-year low of 44.5, while it has been below the 50 threshold that marks contraction in the sector since June.

- Canadian manufacturing activity declined for a ninth straight month in January but there was a slowdown in the pace of contraction as inflation pressures eased and firms grew more confident about the outlook. The S&P Global Canada Manufacturing PMI rose to a seasonally adjusted 48.3 in January after slumping to 45.4 in December, its lowest level since May 2020. This is the longest stretch of results below 50 since October 2010.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | -0.2% | 1.4% | 1.4% | 1.1% | 0.3% | -7.3% | 1.8% |

| Last Week | -0.4% | 1.4% | 0.0% | 2.3% | 0.2% | 6.0% | -0.7% |

Market data taken from https://www.marketwatch.com/

CIBC Economics Economic Flash CA - GDP Monthly by Andrew Grantham Link to Article

Canadian GDP (Nov, Dec/Q4 adv.): A somewhat better-than-expected rebound (Econ Flash)

The growth of the Canadian economy exceeded expectations in the fourth quarter of 2023. The early estimate suggests an annualized growth rate of 1.2%, surpassing the Bank of Canada's forecast of no growth.

CIBC Economics maintains its prediction of a rate cut in June. November GDP showed a 0.2% increase, slightly better than expected, and December's advance estimate indicated a further 0.3% gain. Sectors such as manufacturing and transportation rebounded, while education services were affected by strikes. Sectors related to domestic demand, such as retailing and finance & insurance, remained sluggish.

Overall, the economy is expected to grow by around 1.2% in the fourth quarter, but this could be revised when expenditure figures are released in February.

Note — The Q4 2023 momentum suggests that Q1 GDP may be a little stronger despite signposts of domestic demand looking weaker than the headline GDP data, we still suspect that any growth in activity during the first half of this year will be marginal. Bond yields and the Canadian dollar rose following the release, as market pricing for the first Bank of Canada interest rate cut shifted from April to June.

MacroMemo - February 6 - 26, 2024 by Eric Lascelles Link to Article

U.S. Business cycle update

RBC Economics business cycle scorecard has been updated with the simplest interpretation is that the U.S. business cycle is now in the ‘late cycle’ stage, which has retreated from ‘end of cycle’ in the previous quarter.

But that arguably misses two rather larger points:

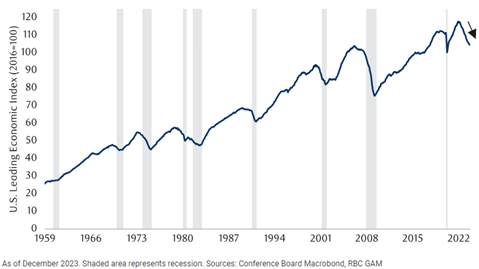

- There’s still a cluster of indicators ‘late cycle’ to ‘recession.’ Most variables suggest the business cycle is quite advanced – highlighting the elevated risk of a downturn.

- There’s been a jump in indicators referring to ‘start of cycle.’ This argues for the beginning of a new cycle, and thus that a recession may have been avoided. The scorecard still indicates that it is materially less likely that a new cycle is beginning (~20% vote) than that an old one is nearing an end (~66% vote).

U.S. leading economic indicator has continued to fall

Soft landing odds rising

While RBC Economics still puts recession is a higher likelihood than a soft landing, the odds of a soft landing have risen further to start 2024.

Some recent good news includes:

- U.S. economic data has continued to remain robust. January payrolls revealed the addition of 353,000 more workers, nearly double the consensus expectation.

- The ISM Manufacturing Index remains weak, with a sub-50 reading, but has continued to rise, leaping from 47.1 to 49.1 in January the highest since November 2022.

- The new orders sub-component rose even further, into expansion territory and the highest reading in 17 months. This is theoretically a leading indicator for the overall index.

The Inflation Story

Inflation numbers across the developed world and dropped drastically though still haven’t reached targets set by many Central Banks.

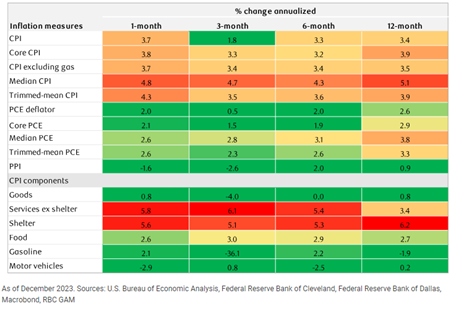

Inflation estimates vary widely

While further inflation progress to be slow and inconsistent compared to the last 18 months, there is still room for improvement. For example in the U.S. over half of the latest monthly CPI price increase was the direct result of shelter costs, which could ease from here. Real-time inflation metrics have also begun to decline as they took a slight sideways step in recent months.

There does remain the challenge of rising inflation in shipping costs and oil as tensions continue in the Suez Canal.

Magnificent Seven: What do you need to believe? by David Polak, Equity Investment Director, Capital Group Link to Article

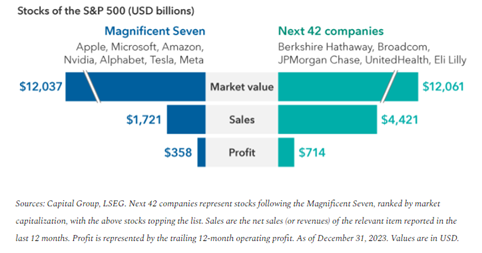

The Magnificent Seven stocks — Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla — now sport a market cap of around $12 trillion (in USD). The next $12 trillion in market cap are represented by 42 companies from a broad set of industries ranging from tech and health care to financials and consumer companies.

According to data from the London Stock Exchange Group, the 12-month forward sales and earnings for these companies, which make up a $12 trillion market cap, are higher compared to other companies. This suggests that the performance of the U.S. stock market could potentially broaden in the coming years based on earnings outlooks. This emphasizes the need to diversify investments due to the rise in share prices for the top 7 companies.

Can the Magnificent Seven maintain their dominance?

The Magnificent Seven does however boast positive fundamentals, including earnings growth exceeding the other 493 companies, strong cash generation, investments in research and development, particularly in AI.

With this comes a premium for their earnings, and a higher price-to-earnings ratio compared to the broader S&P 500 Index. This also comes with a higher expectation for these companies to continue to achieve exceptional results, as well as the regulatory uncertainty that comes with having such a large market share.

In conclusion, investors may want to consider some exposure to the Magnificent Seven and also a broader set of stocks within the S&P 500. Additionally, consider exposures to non-U.S. markets where in some cases valuations are reasonable, and prospects for both top-line and bottom-line growth look promising.

Labor Market Not Adding Up by Brian S. Wesbury First Trust Chief Economist Link to Article

On the surface, there’s much to like about the job market. But when you get into the details, it’s not quite as strong and some things don’t add up.

On the positive side nonfarm payrolls increased in January, surpassing expectations and marking the largest gain in a year. Payroll gains for November and December were also revised up. Using a "core” measure of payrolls that excludes government, education & health, and leisure & hospitality sectors, the increase was 194,000 in January, the highest monthly increase since mid-2022.

The challenging details are there has been a decline in the number of hours worked per worker, reaching levels not seen since the onset of the COVID-19 pandemic. This means that although total jobs have increased, total hours worked have only seen a minimal increase. Secondly, the household survey measure of employment has not been rising as fast as payrolls, which has been observed prior to previous recessions.

Additionally, the unusual combination of high payroll growth and a low unemployment rate must be questioned, with this possibly being a temporary effect of government policies and budget deficits. Once these artificial boosts end, job growth is expected to slow significantly. Payrolls have risen 1.9% in the past year which was also the case in 1990 when there was a recession mid-year and up 1.3% in the year ending January 2001 when there was a recession in the Fall.

NOTABLE NEWS

Germany's government has agreed plans to subsidize gas power plants that can be switched to hydrogen, the economy ministry said on Monday, with a price tag of $17 billion in subsidies as part of efforts to supplement intermittent renewable energy and speed up the transition to low carbon generation.

The U.S. Treasury Department said on Thursday it had put sanctions on three entities based in the United Arab Emirates (UAE), and one tanker registered by Liberia for violating a cap placed on the price of Russian oil by a coalition of Western nations.

The Treasury also said it had taken steps to bar the import of certain categories of diamonds mined in Russia, another step designed to deprive Moscow of revenues following the 2022 invasion of Ukraine.

Aurie Wicks, CA, CPA, CFP Bram Houghton, CFA, CFP

Wealth Advisor Wealth Advisor

(403) 835 – 4785 (403) 690 – 9376

aurie.wicks@cibc.com bram.houghton@cibc.com

Wicks Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2024.