Bram Houghton

March 11, 2024

Economy CommentaryMarket Update - March 8, 2024

MARKET UPDATE – February 26th - March 8th, 2024

In a Nutshell: Markets continued on a bullish trend unphased by the mixed economic indicators and early warning signs that rate cuts may not be feasible in accordance with the U.S. Fed’s dot plot. Canada showed signs of resilience while the U.K., Eurozone and Japan saw early signs of recovery.

U.S. Labour Markets

Mixed signals continue from the U.S. labour market. A key area to monitor area downward revisions to employment figures over the coming months, as December and January have now been downgraded. The U.S. labour market is still the primary focus for understanding the direction of rates and economic strength over the next 12 months.

The number of Americans filing new claims for unemployment benefits unexpectedly fell two weeks ago and remained unchanged last week, suggesting that job growth likely remained solid in February.

The U.S. economy added more jobs than expected last month, but December and January's figures were revised sharply lower. This points to an easing labor market picture that could impact how the Federal Reserve approaches potential interest rate cuts this year. Non-farm payrolls rose by 275,000 in February, increasing from a downwardly revised total of 229,000 in January, and above the expected reading of 198,000.

U.S. layoff announcements rose 3% last month to the highest level in 11 months as automation-related restructuring continues to take a toll. Despite this, cuts are down almost 8% from the same period last year

U.S. Economy

The U.S. economy continues to surprise in resilience, though it is important to note that the manufacturing industry is still in contraction territory. While on the plus side the service industry continues to expand, and makes up 2/3rds of the U.S. economy, durable household goods sales (a reliable leading economic indicator) also fell a material amount.

U.S. manufacturing slumped further in February, with factory employment falling to a seven-month low amid layoffs. The ISM manufacturing PMI fell to 47.8 last month from 49.1 in January. It was the 16th straight month the PMI remained below 50, which indicates a contraction in manufacturing.

The growth in the U.S. services industry slowed some in February amid a decline in employment, but a measure of new orders increased to a six-month high which points to underlying strength in the sector. The ISM non-manufacturing PMI slipped to 52.6 last month from 53.4 in January.

U.S. durable goods orders for January fell by 6.1% month on month – greater than the expectations.

Canadian Economy

The Canadian economy showed modest signs of life as GDP expanded year on year while adding jobs in February. If inflation remains in check, Canada is still on track for rate cuts in the middle of the year.

Canada's economy added a net 40,700 jobs in February, double the expected gain, though wage growth slowed for a second consecutive month and the jobless rate ticked up to 5.8%, Statistics Canada said. The central bank continued to hold interest rates at a 22-year high.

Canada recorded a bigger-than-expected trade surplus in January, as imports plunged to a nearly 2-year low while exports fell at a slower pace. A senior economist with Export Development Canada indicated that if interest rates stay high, it could continue to impact import numbers this year.

Canadian manufacturing activity moved closer to stabilizing in February as employment rose alongside a slower downturn in output and new orders. The S&P Global Purchasing Managers' Index (PMI) for manufacturing rose to a seasonally adjusted 49.7 in February (still a contractionary sub-50 measure) from 48.3 in January, posting its highest level since April.

Eurozone and U.K. Economy

Eurozone and U.K. have shown signs of recovery from technical recessions, while the labour markets continue to remain resilient, highlighting the same global disconnect. While inflation remains a risk, rate cuts are looking like a reality in the very near future.

British employers advertised the fewest jobs in nearly three years last month, with numbers down 15% from a year ago. Falling job vacancies offer a potential sign that employers are finding it easier to recruit than in the immediate aftermath of the COVID-19 pandemic, when job vacancies peaked.

British companies had their strongest month in 9 months, suggesting the economy emerging from a short recession. The S&P Global composite Purchasing Managers Index, spanning Britain's services and manufacturing sectors, edged up to 53.0 from 52.9 in January. It was still its second-highest reading since May 2023.

Business activity in the Eurozone showed signs of recovery last month as the bloc's dominant services industry expanded for the first time since July, offsetting a deeper contraction in manufacturing. The HCOB Composite Purchasing Managers' Index (PMI) for the bloc jumped to 49.2 in February from January's 47.9.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | 0.7% | 1.0% | -0.1% | 1.7% | -0.2% | 4.5% | 2.3% |

| Last Week | 0.9% | -0.3% | -0.9% | -1.2% | 1.4% | -2.6% | 4.3% |

Market data taken from https://www.marketwatch.com/

CIBC Economics: Quick Take: BoC Announcement by Avery Shenfeld

The Bank of Canada kept rates unchanged, and also refrained from signaling an impending rate cut as well. Its statement gave a nod to some signs that wage pressures are easing, but balanced that by saying that while growth was still weak, it was a bit better than expected.

On inflation, it stated that while the overall pace had slowed, it judged that that underlying inflation pressures still persist (led by housing and rent) and maintained its message that it’s is still “concerned” and wants to see more progress. It seemed to stick to its two official core inflation measures, with no mention of the better progress seen in measures like CPIX that strip out mortgage interest costs.

There should be greater clarity to come in April’s Monetary Policy Report, which in addition to a fresh forecast, may show enough optimism in the battle against inflation to set markets up for a rate cut in June. For now, the overall message is that its too early to cut, and that they need to see more progress on inflation.

MacroMemo - February 27 – March 24, 2024 by Eric Lascelles Link to Article

Soft landing in the spotlight

RBC Economics has shifted the likelihood of a soft landing from 40% to 60%, which is significant. This means a recession is no longer the base case. However, the U.S. remains the most resilient of the major economies and there remains a higher likelihood that Canada, the U.K. or Eurozone experience a recession.

Why is a soft landing in the U.S. more likely?

- The U.S. economy remains surprisingly resilient, continually exceeding expectations despite high interest rates, with arguably modest economic acceleration in recent months.

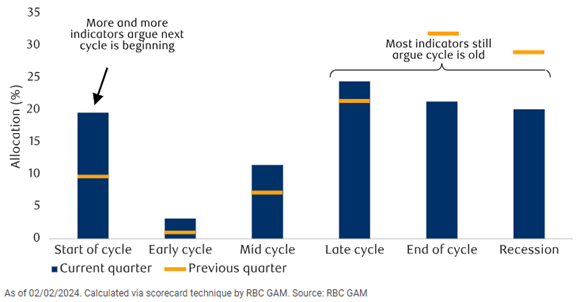

- RBC’s business cycle scorecard is showing mixed signals, with a growing number of indicators pointing to start of cycle. This suggests a recession may have been already experienced (remember the technical recession largely ignored in 2022) or avoided and maybe a new cycle has begun.

- A number of historically powerful recession signals are now reversing – these include: U.S. Manufacturing New Orders, an increase in purchases of recreational vehicles, and the profit margins of S&P 500 companies have begun to stabilize.

U.S. business cycle scorecard is getting confused…

Puzzling economic disconnect

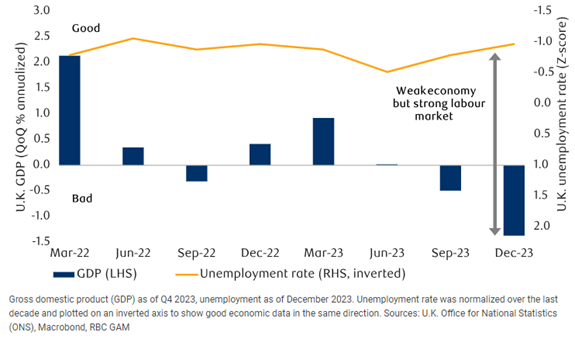

On the other hand, we have seen economic weakness in the U.K., Japan, and Germany, where each country has experienced two consecutive quarters of declining GDP, leading to a 'technical recession'.

However, typically a recession involves more than just GDP decline, such as labor market distress, significant company losses, and a retreat in risk assets, which have not been observed at a large scale.

Despite the economic contraction, the labor markets in the U.K., Japan, and Germany have shown resilience, with improving unemployment rates below normal levels. As previously observed, this is likely a knock on effect from widespread global COVID lock downs disrupting normal economic patterns.

This disconnect is also potentially explained by declining productivity, but this is unlikely to be a permanent trend due to ongoing advancements in technology and stable education levels. The concept of labour hoarding, where businesses retain workers during economic downturns is a consideration, but the current scenario does not align with this theory as many companies are actively hiring, indicating minimal distress.

U.K. Economy vs Employment Disconnect

Commodities in 2024: An Opportunity for Growth by Frank Holmes, CEO, CIO, U.S. Global Investors Link to Article

In a new report, Goldman Sachs makes the case that natural resources are poised for success over the next year with the potential end to rate hikes, shrinking recession fears, and demand for “green energy metals”, among other drivers.

Firstly, the Federal Reserve had been increasing rates at an unprecedented rate to slow down the U.S. economy and control consumer prices. These efforts appear to have been effective on inflation and makes it very likely that the rate hiking cycle is done for now, which will likely boost demand for commodities.

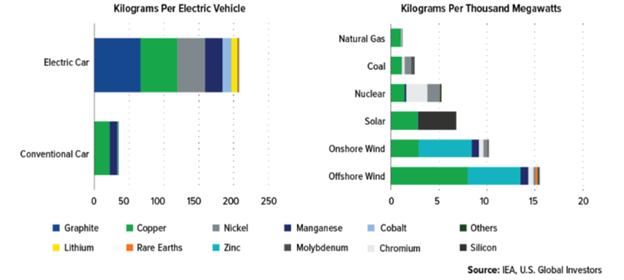

Clean energy production could also contribute to potentially higher commodity prices in 2024. Electric Vehicles (EVs) require significantly more metals and minerals compared to conventional gas-powered cars, with an EV needing six to seven times more materials. Similarly, constructing an offshore wind plant requires 13 times more minerals than building a gas-fired power plant of similar size.

“Green Metals” used in Electric Vehicles and Clean Energy technology (as at May 2021)

Clean energy projects are highly resource intensive, with both quantity and variety of materials required being important. While metals like cobalt, lithium, and nickel are well-known, lesser-known minerals like graphite also play a crucial role in clean energy production. Graphite for example accounts for about half of a lithium-ion battery's weight, while lithium makes up only 8% to 10%.

NOTABLE NEWS

A new report says by 2030, Canada's agriculture industry will have a domestic labour gap of more than 100,000 jobs. The Canadian Agricultural Human Resource Council says the forecast represents a 15 per cent increase compared with the number of jobs in 2023 that couldn't be filled by Canadian residents.

The council says that this growing gap is due in part to Canada's aging population. More than 30% of the agriculture workforce is expected to retire over the same period. The report says temporary foreign workers will play an important role in narrowing the gap, with about four in five of those 100,000 jobs to be filled by a foreign worker.

Novo Nordisk surpassed Tesla Inc in market valuation after the maker of the popular weight-loss drug Wegovy announced positive early trial data for a highly anticipated new obesity drug.

Novo Nordisk shot up in global rankings to the 12th most valuable company from 14 previously, after it told investors a Phase I trial of the pill version of experimental drug amycretin showed participants lost 13.1% of their weight after 12 weeks.

A new study suggests that while EVs produce fewer Co2 emissions, they appear to emit a higher rate of other emissions such as particulate pollution that could impact human heath, when compared with Internal Combustion Engine (ICE) vehicles. This is largely due to faster wear on brakes and tires that result from the increased weight of EVs vs ICEs.

When you read the content we share and it causes you to think of others in your life who would benefit from seeing it, please don’t hesitate to share it with them.

Wicks Quinn Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Quinn Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2023.